Innovation in the financial sector has arrived late compared to other industries, for example telecommunications, but it eventually happened, mainly driven by small, external actors - the so called fintech startups - which are today posing a serious threat (or a huge opportunity) to incumbents.

The factors behind the uprising of fintech

The uprising of fintech and finance 2.0, which took place only recently, was favored by a magical mix of a few major ingredients, among which:

- The financial crisis. The big crisis of the financial sector back in 2008 brought to the surface the in-transparency and bad practices of some of the most prominent players, hitting hard on the general trust level that consumers had had until then towards banks and other actors in finance.

- New generations and the use of internet. Millennials have born and grown up with the internet. Any Information can be found within a few seconds and any purchase can be made with just one click. Everything is accelerated and more accessible. It is natural that these customers look for and demand the same characteristics also from common financial services like, payments, banking and saving management.

- Increased adoption of mobile. The diffusion of smartphones has increased tremendously in the last five years, providing easy access to the internet to a great variety of people of different social extractions, no matter where they live. Think of countries like Nigeria, where most of the population can use the Internet thanks to mobiles. Reaching a bank office, for some, may involve quite a long trip. What if the bank account could be reached by simply swiping on the smartphone’s screen instead?

People, numbers & money

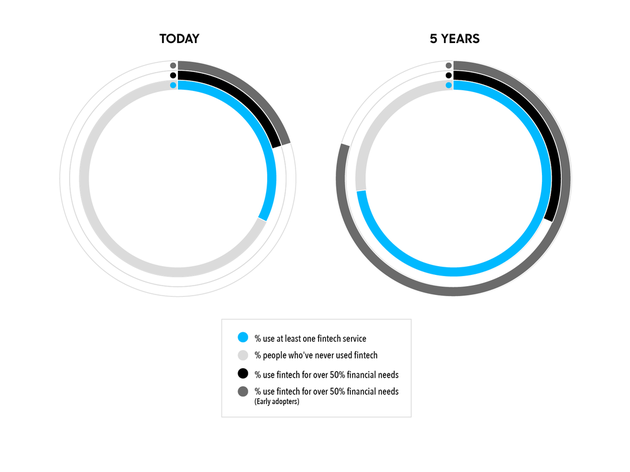

From a few reports on the fintech industry, conducted in 2015, emerges clearly that the growth of the sector is just at the beginning. According to Transferwise’s report, in five years’ time the number of consumers using fintech at least for one financial service is expected to double.

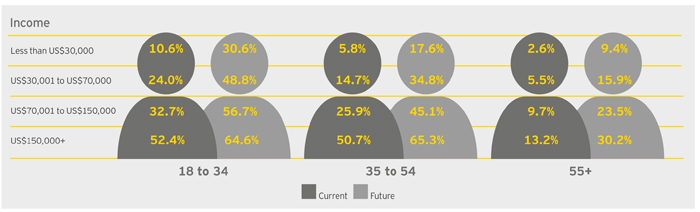

Maybe not that surprisingly, early adopters of fintech services are aged mostly between 18 and 34, live in urban areas and their usage of fintech products increases with the income, as clearly shown by the following graph taken from the EY report.

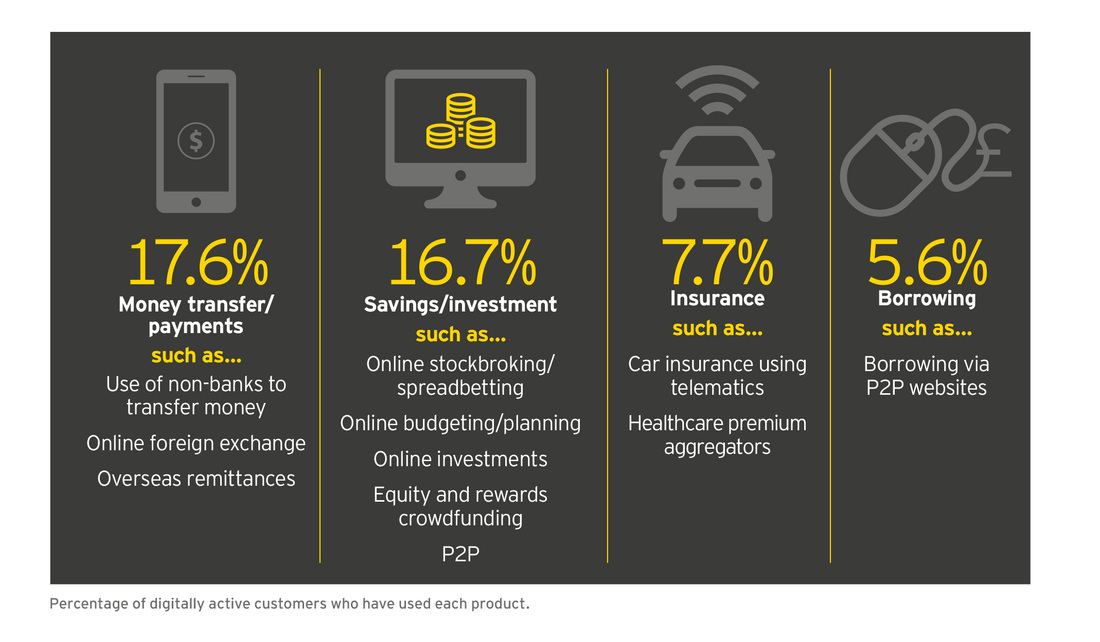

When looking at the types of fintech services that are currently mostly diffused, those offering mobile transfers and payments are heading the ranking, followed by companies offering online investments or saving management's, like Crowd Valley’s customers.

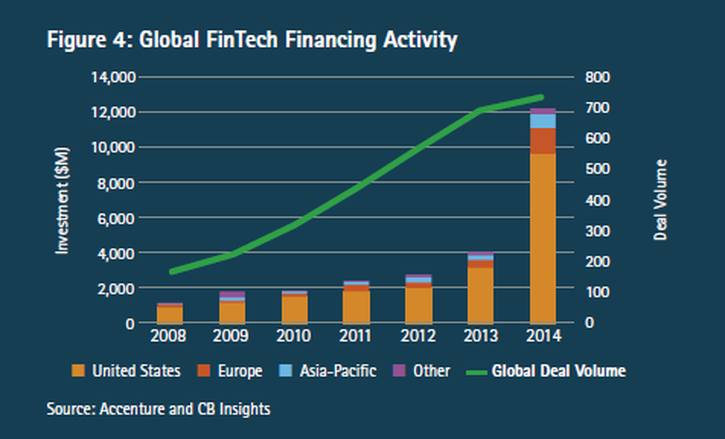

This level of growth is backed by a consistent amount of investments that are increasingly flowing into the sector (over $12 billion in 2014, according to Accenture), not only by professional and institutional investors, but also by corporate venturing departments of large banks.

A crossroad ahead

The innovative power of fintech has posed banks and other traditional finance actors in front of a crossroad: innovating and re-inventing the way they operate or keeping doing business as they did it the until now? Certainly, looking at data and at experts’ analysis, it seems like fintech will go more and more mainstream, as new players will enter the market and existing fintech companies will conquer larger shares of the market. Some traditional actors have already seen this as a great opportunity to offer an improved, multi-channel and efficient service to their customers and, as a consequence, have invested large sums into fintech startups or have initiated strategic partnerships with them. Crowd Valley itself has among its clients various traditional finance actors that have taken the chance to bring their operations online for an enhanced customer service and experience. Choosing not to innovate seems to be like a counterproductive choice in the long term, especially given that in 25 years from now, Millennials, who currently are the biggest fintech users, will probably be the biggest savers.

Whatever the way chosen by finance incumbents, it is clear that the level of competition in the financial sector will increase, with new, more agile players bringing to the market a more transparent, convenient and efficient service. The consumer will then be the ultimate winner, gaining a diversified offer for better prices.

References & Sources

The Future of Fintech and Banking. Accenture (2015)

EY Fintech Adoption Index. EY (2016)

The Future of Fintech. Transferwise (2016)

| About the author - Irene Tordera Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives. During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem and she works also for the European Crowdfunding Network. |

RSS Feed

RSS Feed