“Crowdfunding platforms could naturally evolve to become the primary source of financial services for young generations” Nathaniel Karp, chief economist for BBVA Research, US Economic Outlook, 2nd Quarter 2013

There is a growing sense that our industrial age capitalism has reached a pivotal point in its evolution. Even people who have long and deep experience of working in the financial system believe it needs change.

There is a big mismatch between the financial support today's real economy needs and what financial markets are able to deliver. The banking industry is run by a select few large organisations, which are allowed to create money effectively out of nothing, and which are big lenders to unsustainable sectors such as the coal industry.

There is a growing sense that our industrial age capitalism has reached a pivotal point in its evolution. Even people who have long and deep experience of working in the financial system believe it needs change.

There is a big mismatch between the financial support today's real economy needs and what financial markets are able to deliver. The banking industry is run by a select few large organisations, which are allowed to create money effectively out of nothing, and which are big lenders to unsustainable sectors such as the coal industry.

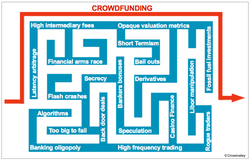

Capital is allocated in long and opaque supply chains which are crammed with intermediaries charging high fees. Financial markets follow the imperative of continuous growths and the valuation of companies is determined by questionable metrics rather than added value for society. The vast majority of what goes by the name of 'investing' is really a secondary market activity, to a large extend conducted by programmed trading algorithms, running on autopilot causing irrational price movements.

Trust, which is one of the core principles of banking, has been lost due to consistent scandals and the unreasonable bonus culture. There is very little connection between the decisions of banking executives and their impact on ordinary peoples' lives. Such a system which allows one group to dominate and benefit to the detriment of the whole is suboptimal and prone to instability. Therefore, it was inevitable that various crowdfunding models (e.g peer-to-peer lending, community renewables, real estate investments) begin severely to disrupt the traditional finance system and replace it gradually with a democratized finance system which returns financial influence and decision-making to everyday people.

One rising force behind crowdfunding is that it dis-intermediates the financial supply chain and makes the investment process transparent. It gives investors control over their investments, in a way that has never before been possible, and enables them to make direct investments in companies or projects that resonate with their values.

It empowers people to re-embed ownership in their local community by supporting small and medium sized companies which do not have access to traditional forms of finance. Such ownership architectures acknowledge that businesses do not just exist to generate profits but also to serve a higher purpose, and that companies have a dual entity as living system and as a property. These investments don't need to follow the growth dictated by - and price movements of - financial markets. By creating living relationships with local investors, socially responsible investors, or others with a stake in a company's mission, financial capital is becoming a friend to the investee.

In addition, a decentralised finance system can provide higher resilience and system stability as problems can not so easily cascade in the same way as in a centralised mono-banking system. A growing number of private households are losing interest in stock-ownership and beginning to divest from fossil fuel assets. They turn to crowdfunding as they realise that the current system is destroying our planet, undermining social coherence and putting us in danger of completely losing the confidence of future generations. Over time we will see a complete flip in the investor demographic with people genuinely concerned with 'doing well while doing good', with the largest body of investors and crowdfunding as the dominant investment vehicle. Eventually the collective financial power of the crowd will give birth to a new global economy enabling the long-term prosperity of everyone in our interconnected global village.

Trust, which is one of the core principles of banking, has been lost due to consistent scandals and the unreasonable bonus culture. There is very little connection between the decisions of banking executives and their impact on ordinary peoples' lives. Such a system which allows one group to dominate and benefit to the detriment of the whole is suboptimal and prone to instability. Therefore, it was inevitable that various crowdfunding models (e.g peer-to-peer lending, community renewables, real estate investments) begin severely to disrupt the traditional finance system and replace it gradually with a democratized finance system which returns financial influence and decision-making to everyday people.

One rising force behind crowdfunding is that it dis-intermediates the financial supply chain and makes the investment process transparent. It gives investors control over their investments, in a way that has never before been possible, and enables them to make direct investments in companies or projects that resonate with their values.

It empowers people to re-embed ownership in their local community by supporting small and medium sized companies which do not have access to traditional forms of finance. Such ownership architectures acknowledge that businesses do not just exist to generate profits but also to serve a higher purpose, and that companies have a dual entity as living system and as a property. These investments don't need to follow the growth dictated by - and price movements of - financial markets. By creating living relationships with local investors, socially responsible investors, or others with a stake in a company's mission, financial capital is becoming a friend to the investee.

In addition, a decentralised finance system can provide higher resilience and system stability as problems can not so easily cascade in the same way as in a centralised mono-banking system. A growing number of private households are losing interest in stock-ownership and beginning to divest from fossil fuel assets. They turn to crowdfunding as they realise that the current system is destroying our planet, undermining social coherence and putting us in danger of completely losing the confidence of future generations. Over time we will see a complete flip in the investor demographic with people genuinely concerned with 'doing well while doing good', with the largest body of investors and crowdfunding as the dominant investment vehicle. Eventually the collective financial power of the crowd will give birth to a new global economy enabling the long-term prosperity of everyone in our interconnected global village.

About the author - Rex Kempcke

Rex is an innovative banker with more than 15 years experience in retail banking, treasury and commodity trading at Commerzbank, J.P. Morgan and ABB Financial Services. Through his passion for entrepreneurship and new markets he got involved during the dot-com era in building up a business incubation unit for ABB, subsequently spinning off a company which pioneered the implementation of the European emissions trading scheme. He continued his career in the climate change sector first by joining EcoSecurties, a leading startup company in developing carbon reduction projects worldwide, and more recently as director in the environmental markets team of BNP Paribas.

Rex strongly believes that crowdfunding will cause a paradigm shift in the financial service industry and that it will make a significant contribution to the transition towards a sustainable economy.

Rex is an innovative banker with more than 15 years experience in retail banking, treasury and commodity trading at Commerzbank, J.P. Morgan and ABB Financial Services. Through his passion for entrepreneurship and new markets he got involved during the dot-com era in building up a business incubation unit for ABB, subsequently spinning off a company which pioneered the implementation of the European emissions trading scheme. He continued his career in the climate change sector first by joining EcoSecurties, a leading startup company in developing carbon reduction projects worldwide, and more recently as director in the environmental markets team of BNP Paribas.

Rex strongly believes that crowdfunding will cause a paradigm shift in the financial service industry and that it will make a significant contribution to the transition towards a sustainable economy.

RSS Feed

RSS Feed