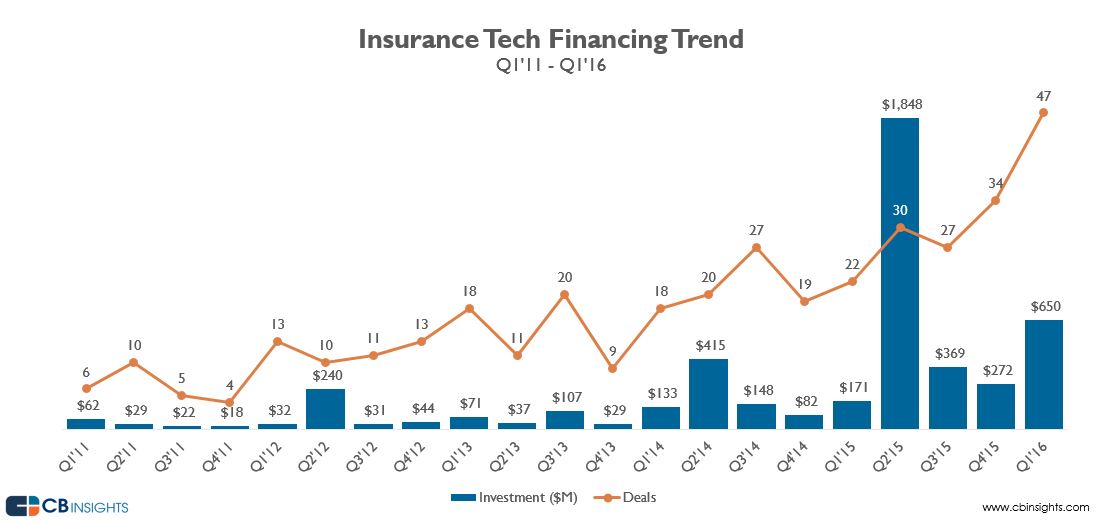

What is Insurance Technology (InsurTech) all about? It’s a sub-sector of Fintech that is growing fast and vigorously, with annual investments that increased fivefold in the past three years, totaling $3.4bn of funding poured into the sector since 2010. Insurance behemoths are paying attention like never before.

PwC just published a new report on fintech, showing that about 90% of the insurers surveyed are fearing the loss of business to startups, with about 70% of insurance companies that said to have already taken action to face the new challenges and opportunities presented by fintech.

While the insurtech industry is still in its infancy, there are already a number of companies that have partnered with global leading insurance companies and raised several millions in funding from top venture capital firms. According to CB Insights data, the first quarter of 2016 was the strongest ever, for insurance tech, in term of quantity, with 47 deals closed and $650M in funding. However 60% of the funding total was due to the $400M mega round led by Fidelity Investments for a health insurance carrier called Oscar.

While the insurtech industry is still in its infancy, there are already a number of companies that have partnered with global leading insurance companies and raised several millions in funding from top venture capital firms. According to CB Insights data, the first quarter of 2016 was the strongest ever, for insurance tech, in term of quantity, with 47 deals closed and $650M in funding. However 60% of the funding total was due to the $400M mega round led by Fidelity Investments for a health insurance carrier called Oscar.

The necessity to act now

“There is a risk of missing an opportunity to deliver customers a similar experience to one they already receive from retail and technology companies. One size simply does not fit all in insurance anymore and, by working alongside InsurTech companies, companies can begin to reposition themselves at the cutting edge of customer interaction. [...] InsurTech will be a game changer for those who choose to embrace it. Insurers have unrivalled access to consumer data and using cutting edge technology to thoroughly analyse it could result in significant benefits for both the company and the man on the street. [...] Only by acting today and embracing both the challenges and opportunities presented by InsurTech will the industry be ready to tackle tomorrow’s challenges. Those who are savvy enough to address the ongoing disruption sooner rather than later will reap the benefits and emerge as market leaders” said Stephen O’Hearn, global insurance leader at PwC.

Lemonade, an insurtech startup backed by Sequoia Capital and with Warren Buffett and Berkshire Hathaway as one of the reinsurance partners, was the first to launch as an online peer-to-peer insurance carrier, but there are now a good number of companies that joined the market, including Guevara, Uvamo and Friendsurance, that are basically acting as brokers with the objective to cut down insurance fees for consumers by pooling policyholders together online in small groups.

Threat and Opportunities for Insurance Incumbents

Pressure on margins and loss of market share seem to be top concerns that insurance executives think the fintech wave could bring, while they see cost reduction and differentiation as possible positive outcomes. While the need to refine the range of products offered by listening to and by forming strategic partnerships with insurtech startups seems to be recognized by insurance incumbents, they seem concerned with IT security issues emerging from working with technology companies.

As Jonathan Howe, UK insurance leader at PwC, said, “the differences between startups and incumbents should be embraced as both are vital to the future of the industry. If the long-term mindset and experience of insurance companies can successfully be partnered with the creativity and agility of startup companies, the industry as a whole will make progress in solving problems and bringing truly innovative products to market.”

We can’t agree more with his statement. It’s always more clear that there is no sector in the financial industry, even the most stagnant, that will remain the same, with huge opportunities in sight for those ready to take advantage of them.

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed