Peer-to-peer lending in the UK is growing at an incredibly fast speed. Favored by FCA’s rules that treat peer-to-peer lending in a different way than equity crowdfunding, which is considered riskier, and by the tax discount (New ISA) which has been available since beginning of July, this new mechanism for borrowing capital is becoming more and more popular.

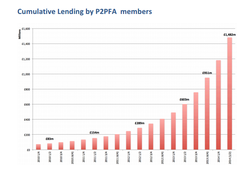

The outstanding growth of peer-to-peer lending in the UK was well framed in the last report published by the British P2P Finance association (P2PFA), which reported that the rate of flow of capital through P2P has doubled in the past 6 months and this year is probably going to hit £1 billion compared with the £950 million in the past three years combined. Also Crowd Valley observed a significant growth in the international demand for P2P platforms, as the company reported in the past two Global Crowdfunding Reports.

P2P lending growth in the UK is mainly driven by peer-to-business lending, but also more and more consumers are turning to this solution to receive a loan. The increasing popularity of this financial source says it all: P2P lending has consolidated its position in the British market and it is starting to be considered a valid financial source, winning the trust of a larger and larger audiance. This fact recently pushed a British bank to propose partnerships to several P2P platforms, in order to join forces and channel more capital to UK small and medium businesses.

The UK, at the moment, offers probably one of the best grounds for crowdfunding to flourish, as the numbers above testify and as it is also evident looking at the last local statistics for equity crowdfunding discussed on our blog. Hopefully the British case will serve as an example for other countries too, which are still working to help crowdfunding to take off.

References

Alois, J.D. (2014).UK P2PFA: Peer to Peer Lending Goes to Over £1 Billion in 2014. CrowdfundInsider

P2PFA (2014).Peer-to-Peer Finance Market Data

Image credit to: P2PFA http://bit.ly/WUnoC2

P2P lending growth in the UK is mainly driven by peer-to-business lending, but also more and more consumers are turning to this solution to receive a loan. The increasing popularity of this financial source says it all: P2P lending has consolidated its position in the British market and it is starting to be considered a valid financial source, winning the trust of a larger and larger audiance. This fact recently pushed a British bank to propose partnerships to several P2P platforms, in order to join forces and channel more capital to UK small and medium businesses.

The UK, at the moment, offers probably one of the best grounds for crowdfunding to flourish, as the numbers above testify and as it is also evident looking at the last local statistics for equity crowdfunding discussed on our blog. Hopefully the British case will serve as an example for other countries too, which are still working to help crowdfunding to take off.

References

Alois, J.D. (2014).UK P2PFA: Peer to Peer Lending Goes to Over £1 Billion in 2014. CrowdfundInsider

P2PFA (2014).Peer-to-Peer Finance Market Data

Image credit to: P2PFA http://bit.ly/WUnoC2

About the author - Irene Tordera

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

RSS Feed

RSS Feed