Despite the fact that there are heaps of articles being published, suggesting that a crowd investing sector or geography is dominating the rests. While appealing as a thought, the market is still nascent and any domination, may simply suggest that growth is uneven cross the various dimensions. However, there are observations that can be made in how the market is evolving, at various stages across the world.

The first movers; idealogical and well-intended applications

New markets and new models are unpredictable in their applications as well as their effects. Many attempt to model them ahead of time, but a true, disruptive force can rarely be analyzed without the luxury of hindsight. This is true for all analyst predictions, but particularly in those that can have ripple effects and cause changes of behavior, can the implications be much broader than imagined ahead of time.

An important servant in the global crowd funding economy’s development, is the implementation of an initial framework or model, that is tested out in the market. In many cases this is a private sector contribution, where a new business emerges pioneering a new market. These cases raise the need for a discussion and they set in motion the ecosystems development

The initial frameworks

As the private market raises the need for a discourse on these new models, its only natural that regulatory and supporting functions emerge around them. Regulators often have their limitations and a certain aversion to incremental evolution, which can be understood through considering their interests. However, the initial framework, is just that - the first attempt at setting boundaries and guidance for a new set of operational models.

Initial frameworks, whether they are state level regulations or even federal or national, start emerging one by one, in a discussion that transcends state borders as benchmarks are developed in an iterative setting. While we should not dismiss the importance of the initial frameworks in and of themselves, they may serve a larger role in guiding the market and starting the practical discourse.

The future

Broadly speaking, we are not yet at the stage of having more structured establishment around the ecosystem to talk of a fixed framework or model. Surely there are countries who have successful models already implemented, such as the FCAs rules in the UK, as well as some state regulatory frameworks in the US, but a real liquid and active use of these regulations is still rather elusive and narrow.

There's also an interesting note to be made about countries which might lack established investment activities and structures in areas such as private securities. Given the need for new solutions may create a strong demand, as well as the absence of strong, existing frameworks standing in the way, some countries with a high growth rate and entrepreneurial drive, may simply leapfrog ahead. Consider for example the potential of peer to peer lending or business loans in countries like Malaysia, Indonesia, Thailand, the Philippines (and various others in South East Asia, South and Central America, Africa, the Middle East etc..). There are several opportunities, we will undoubtedly see realized.

Practical applications help guide the market

A data point our team has observed over their hundreds of conversations with operators in various markets world wide, is that the conversations in countries where the market is still widely undeveloped and unstructured, are highly - well, undeveloped and unstructured. In practical terms this means that those who have data points to compare to in the market, when considering a new application, extension or utilizing existing services in a crowd investment market, they will have something real to compare against. This is in stark contrast to countries where data points are limited and obscure, which translates to a lot of misinformation, which despite good intentions, can be a dangerous thing.

How to get from obscure to practical?

We’ve encouraged an active dialog since day one in this market (which, in the case of yours truly, has been some time ago), in order to benchmark, share experiences and develop best practices in an emerging market. This is not always easy, as the dialog should emerge between the private sector, but also regulatory bodies and those that have a vested interests in creating a robust infrastructure for the economy. Based on our conversations, due to several factors (territory, jurisdiction, various legal dimensions etc), these discussions are hard to make practically valuable.

Our team has spent thousands of hours working with various proposed applications in various regions of the world, with some of the worlds most talented and credible industry actors. Yet the observation is quite universal: there is a need to get to a practical stage in the market, for the market to truly start benefiting the regional economies and the broader integration into the capital markets. And the fact remains, we are still far from such a data driven market foundation, which we could leverage to build the futures capital marketplace.

Undeniably, there is a lot going on in the global market and no doubt, its an unprecedented development that will have a fundamental impact. Yet, there’s a clear need for a tangible dialog cross countries and cross operators, for that market to really take hold. After all, it is and will be a globally connected development.

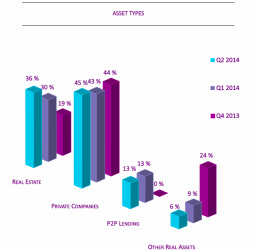

Chart: Crowd Valley market data from online investing platforms.

New markets and new models are unpredictable in their applications as well as their effects. Many attempt to model them ahead of time, but a true, disruptive force can rarely be analyzed without the luxury of hindsight. This is true for all analyst predictions, but particularly in those that can have ripple effects and cause changes of behavior, can the implications be much broader than imagined ahead of time.

An important servant in the global crowd funding economy’s development, is the implementation of an initial framework or model, that is tested out in the market. In many cases this is a private sector contribution, where a new business emerges pioneering a new market. These cases raise the need for a discussion and they set in motion the ecosystems development

The initial frameworks

As the private market raises the need for a discourse on these new models, its only natural that regulatory and supporting functions emerge around them. Regulators often have their limitations and a certain aversion to incremental evolution, which can be understood through considering their interests. However, the initial framework, is just that - the first attempt at setting boundaries and guidance for a new set of operational models.

Initial frameworks, whether they are state level regulations or even federal or national, start emerging one by one, in a discussion that transcends state borders as benchmarks are developed in an iterative setting. While we should not dismiss the importance of the initial frameworks in and of themselves, they may serve a larger role in guiding the market and starting the practical discourse.

The future

Broadly speaking, we are not yet at the stage of having more structured establishment around the ecosystem to talk of a fixed framework or model. Surely there are countries who have successful models already implemented, such as the FCAs rules in the UK, as well as some state regulatory frameworks in the US, but a real liquid and active use of these regulations is still rather elusive and narrow.

There's also an interesting note to be made about countries which might lack established investment activities and structures in areas such as private securities. Given the need for new solutions may create a strong demand, as well as the absence of strong, existing frameworks standing in the way, some countries with a high growth rate and entrepreneurial drive, may simply leapfrog ahead. Consider for example the potential of peer to peer lending or business loans in countries like Malaysia, Indonesia, Thailand, the Philippines (and various others in South East Asia, South and Central America, Africa, the Middle East etc..). There are several opportunities, we will undoubtedly see realized.

Practical applications help guide the market

A data point our team has observed over their hundreds of conversations with operators in various markets world wide, is that the conversations in countries where the market is still widely undeveloped and unstructured, are highly - well, undeveloped and unstructured. In practical terms this means that those who have data points to compare to in the market, when considering a new application, extension or utilizing existing services in a crowd investment market, they will have something real to compare against. This is in stark contrast to countries where data points are limited and obscure, which translates to a lot of misinformation, which despite good intentions, can be a dangerous thing.

How to get from obscure to practical?

We’ve encouraged an active dialog since day one in this market (which, in the case of yours truly, has been some time ago), in order to benchmark, share experiences and develop best practices in an emerging market. This is not always easy, as the dialog should emerge between the private sector, but also regulatory bodies and those that have a vested interests in creating a robust infrastructure for the economy. Based on our conversations, due to several factors (territory, jurisdiction, various legal dimensions etc), these discussions are hard to make practically valuable.

Our team has spent thousands of hours working with various proposed applications in various regions of the world, with some of the worlds most talented and credible industry actors. Yet the observation is quite universal: there is a need to get to a practical stage in the market, for the market to truly start benefiting the regional economies and the broader integration into the capital markets. And the fact remains, we are still far from such a data driven market foundation, which we could leverage to build the futures capital marketplace.

Undeniably, there is a lot going on in the global market and no doubt, its an unprecedented development that will have a fundamental impact. Yet, there’s a clear need for a tangible dialog cross countries and cross operators, for that market to really take hold. After all, it is and will be a globally connected development.

Chart: Crowd Valley market data from online investing platforms.

About the author - Markus Lampinen

Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets.

Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and a spinoff from the Grow VC Group. He is also a global investor and Senior Partner at the Grow VC Group. During his tenure as COO of Grow VC, he recruited over 120 individuals, built up a global team on six continents and expanded operations to over 150 countries. In his earlier businesses, he served in diverse roles, taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus holds an M.S. and a B.A. in Economics.

Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children.

Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets.

Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and a spinoff from the Grow VC Group. He is also a global investor and Senior Partner at the Grow VC Group. During his tenure as COO of Grow VC, he recruited over 120 individuals, built up a global team on six continents and expanded operations to over 150 countries. In his earlier businesses, he served in diverse roles, taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus holds an M.S. and a B.A. in Economics.

Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children.

RSS Feed

RSS Feed