The adoption of open APIs by banks and financial institutions has been steadily growing, as has the ecosystem delivering these services. Companies providing KYC products rank among the most well established services to help financial institutions cut cost, increase scalability and help comply in a more scrupulous regulatory environment. A Thomson Reuters global survey reveals that banks are taking as long as 48 days to onboard a new customer. Also, the banks are spending in excess of $60 million per annum on KYC and client onboarding.

Source: Sound Principle. Complex Reality. Thomson Reuters’ independent survey discussing the real impact of global changes in KYC regulation on Financial Institutions.

Although newer more dynamic platforms process KYC in an automated fashion, most financial institutions still handle KYC verifications manually. Manual verification is cumbersome and error prone. This is more true as institutions scale, adding further compliance officers compounding the problem at hand. Outside of basic requirements, Booz Allen Hamilton estimated compliance failure costing firms $13.4 billion in 2014.

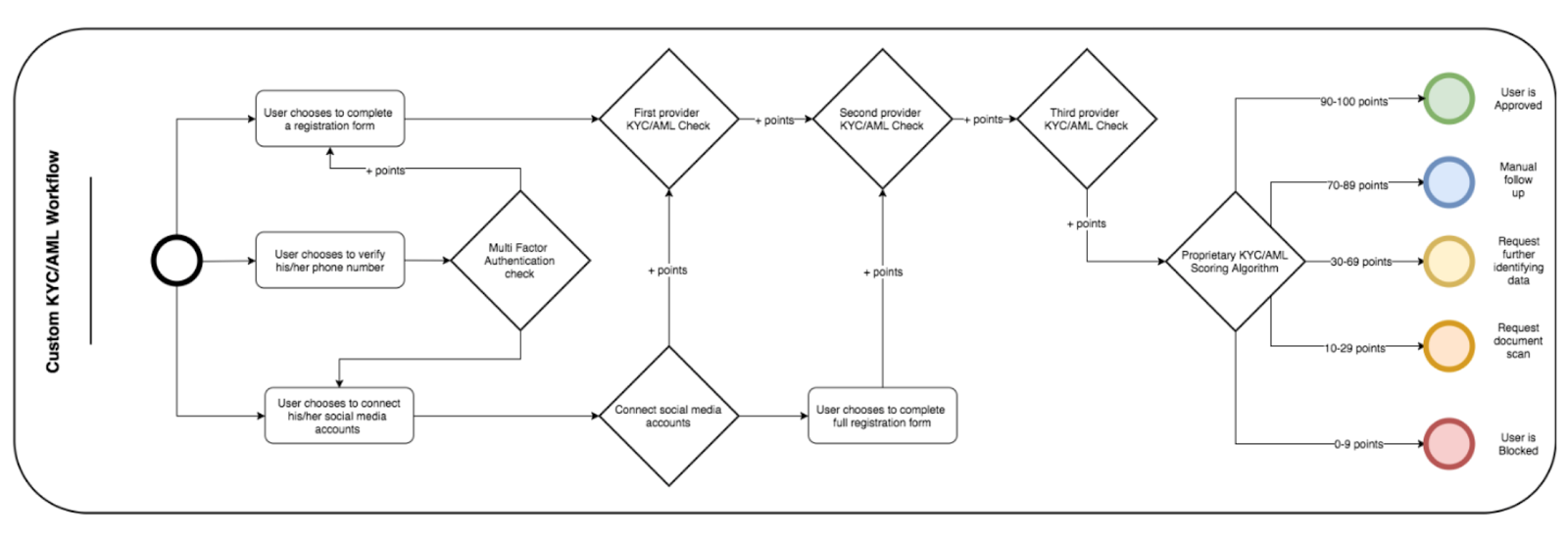

When taking a practical approach to deploying automated KYC workflows using open APIs into financial institutions, they need to support both technical and operation members.

When taking a practical approach to deploying automated KYC workflows using open APIs into financial institutions, they need to support both technical and operation members.

Technical teams are burdened with ancient core banking systems that are costly to service and as time passes, more difficult to do so. The cooperation between Fintech and financial institutions allow these technical teams to leverage cost effective solutions when compared to building and managing new infrastructure. They also vastly increase time to implement systems from an average of more than 36 months down to a period of 8 to 12 months. Making systems future proof, scalable and cost effective is a core concern being addressed by open APIs.

Operational teams are focused on workflow efficiencies and the bottom line. KYC APIs allow the compliance officers to be more productive while decreasing headcount. Officers are able to monitor rather than process, needing a light touch on most onboarding workflows. Better reporting, record-keeping and the near complete reduction of manual paper work can reduce compliance failure. Decoupling the rise in deal flow with the increase of headcount allow financial institutions to scale more efficiently while mitigating compliance failure.

We at Crowd Valley support both technical and operation teams migrate legacy systems into an open API environment. Technical teams can leverage our Bank grade Cloud Back Office connected to global KYC providers to efficiently launch compliance workflows into their core systems. Operational teams leverage our global reach where we have helped more than 130 institutions navigate the use of open APIs and industry best practise. If you are looking to capitalise on KYC efficiencies within the Fintech space and would like to discuss this further, please do not hesitate to get in touch with us.

Operational teams are focused on workflow efficiencies and the bottom line. KYC APIs allow the compliance officers to be more productive while decreasing headcount. Officers are able to monitor rather than process, needing a light touch on most onboarding workflows. Better reporting, record-keeping and the near complete reduction of manual paper work can reduce compliance failure. Decoupling the rise in deal flow with the increase of headcount allow financial institutions to scale more efficiently while mitigating compliance failure.

We at Crowd Valley support both technical and operation teams migrate legacy systems into an open API environment. Technical teams can leverage our Bank grade Cloud Back Office connected to global KYC providers to efficiently launch compliance workflows into their core systems. Operational teams leverage our global reach where we have helped more than 130 institutions navigate the use of open APIs and industry best practise. If you are looking to capitalise on KYC efficiencies within the Fintech space and would like to discuss this further, please do not hesitate to get in touch with us.

About the author - Pete Woodard

Pete has worked within FinTech since 2013 across a broad range of security applications serving multiple verticals. He has scaled Google Venture backed startups in the AdTech space before joining Crowd Valley. Originally from Canada with a education background in Mechanical Engineering and Marketing. Pete has helped to open up new global markets in the digital investing and lending space. When not firmly rooted in the London FinTech scene he enjoys travelling, always mixing business with pleasure. He has spoken to over 1000 digital investing entrepreneurs, which makes him a valuable resource for trends in new security models.

Pete has worked within FinTech since 2013 across a broad range of security applications serving multiple verticals. He has scaled Google Venture backed startups in the AdTech space before joining Crowd Valley. Originally from Canada with a education background in Mechanical Engineering and Marketing. Pete has helped to open up new global markets in the digital investing and lending space. When not firmly rooted in the London FinTech scene he enjoys travelling, always mixing business with pleasure. He has spoken to over 1000 digital investing entrepreneurs, which makes him a valuable resource for trends in new security models.

RSS Feed

RSS Feed