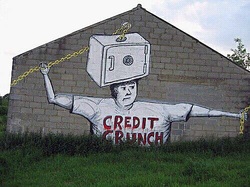

“Economic Crisis”. A term we heard a lot in recent years and, unfortunately, we still hear today in Europe and in the US. Yes, because the economic crisis is still a reality in many cases, especially among small businesses, one of the backbones of western economies.

Heavily hit by the credit crunch, SMEs still find it difficult to receive loans from banks, which until a few years ago was instead one of the major financing sources for them. With the explosion of the crisis, SMEs saw their sales dropping off, the value of their collaterals diminishing and the lenders’ risk aversion increasing. This situation was a “perfect storm” - like a working paper from Harvard Business School defined it- for SMEs, which understandably still have troubles recovering completely from the crisis.

For large business was instead another story. They also suffered from the crisis, but not so much from the credit crunch: banks continued to lend to big corporate clients. The above mentioned report from Harvard Business School identified several factors that may still have an impact on bank lending to SMEs, including high search costs and transaction costs for both borrowers and lenders. In the US, SMEs are estimated to spend on average 25 hours on paperwork for a loan, after having spent already considerable time in searching for the bank that would agree to their request.

However there are also some positive trends. The SMEs financing gap that has been expanding during the present economic crisis could be partially covered by innovative, alternative lending mechanisms. Peer-to-peer lending firms, which appeared for the first time on the market a few years before the crisis busted, are growing at an increasingly fast speed (see our article) and their growth is mainly driven by business lending.

Characterized by a higher risk appetite, P2P portals lend to many small business which have trouble accessing finance through the traditional banking circuit. Their business model is often more efficient and sometimes even more transparent than banks’: on a P2P portal, an SME can complete a loan application in about 30 minutes and, if approved, it could receive a loan the following day. Like crowdfunding in general, P2P platforms have the potential to disrupt the traditional finance sector.

However, in many countries -for example in the USA- P2P lending is still largely unregulated and thus it carries a good dose of risk. It will be regulators’ task to take this challenge and transform it in an opportunity for SMEs to be fueled again.

References

Gordon Mills, K., McCarthy, B. (2014). The State of Small Business Lending: Credit Access during the Recovery and How Technology May Change the Game. Harvard Business School.

Image Credit to: Lillian Cameron. http://bit.ly/1q9FUgH

For large business was instead another story. They also suffered from the crisis, but not so much from the credit crunch: banks continued to lend to big corporate clients. The above mentioned report from Harvard Business School identified several factors that may still have an impact on bank lending to SMEs, including high search costs and transaction costs for both borrowers and lenders. In the US, SMEs are estimated to spend on average 25 hours on paperwork for a loan, after having spent already considerable time in searching for the bank that would agree to their request.

However there are also some positive trends. The SMEs financing gap that has been expanding during the present economic crisis could be partially covered by innovative, alternative lending mechanisms. Peer-to-peer lending firms, which appeared for the first time on the market a few years before the crisis busted, are growing at an increasingly fast speed (see our article) and their growth is mainly driven by business lending.

Characterized by a higher risk appetite, P2P portals lend to many small business which have trouble accessing finance through the traditional banking circuit. Their business model is often more efficient and sometimes even more transparent than banks’: on a P2P portal, an SME can complete a loan application in about 30 minutes and, if approved, it could receive a loan the following day. Like crowdfunding in general, P2P platforms have the potential to disrupt the traditional finance sector.

However, in many countries -for example in the USA- P2P lending is still largely unregulated and thus it carries a good dose of risk. It will be regulators’ task to take this challenge and transform it in an opportunity for SMEs to be fueled again.

References

Gordon Mills, K., McCarthy, B. (2014). The State of Small Business Lending: Credit Access during the Recovery and How Technology May Change the Game. Harvard Business School.

Image Credit to: Lillian Cameron. http://bit.ly/1q9FUgH

About the author - Irene Tordera

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

RSS Feed

RSS Feed