| In July 2014 a crowdinvesting bill (named the North Carolina Jobs Act) was given to the North Carolina General Assembly for approval. Unfortunately the bill was caught up in end-of-session political debate and eventually defeated. In 2015, a further General Assembly session has been scheduled to revisit the Jobs Act along with a further proposed crowdfunding bills competing for North Carolina’s government approval. The first bill is titled North Carolina Jobs Act, while the second is called North Carolina Intrastate Private Capital Act which has been revered as more liberal and less restrictive. |

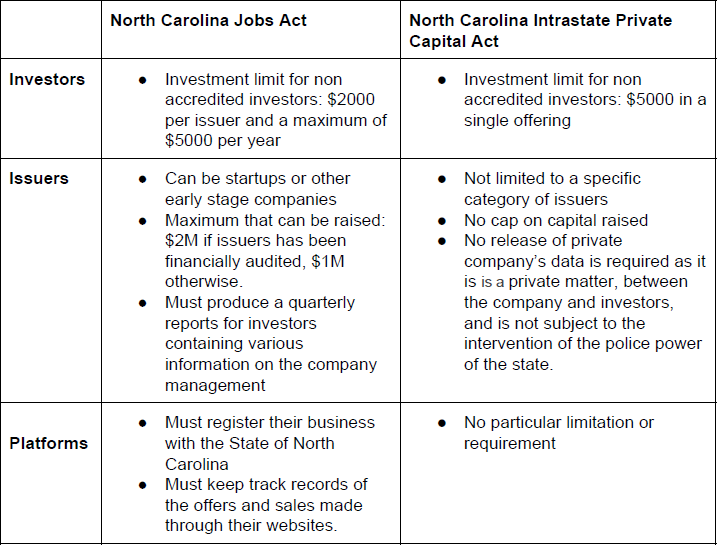

In fact, the original bill largely follows the online investing template that has been put into effect in other 14 US counties, the latter represents a more lax approach, reducing minimum requirements and limitations for issuers and investors. In particular, while both drafted bills refer to North Carolina residents and companies. They pose no limits on accredited investors, there main differences are summarized below:

As the table shows, the two proposed intrastate crowdfunding bills differ in many ways between each other. Most likely the final bill will fall somewhere between the two approaches. It will be interesting to see if North Carolina’s case will lead other States to consider more liberal appraches for their own intrastate online investing bills.

References

Vass, T. (2015). Analysis and Commentary on the Two Competing North Carolina Crowdfunding Bills. Crowdsourcing.org

Image credit to: Jimmy Emerson, http://bit.ly/1LtDswq

References

Vass, T. (2015). Analysis and Commentary on the Two Competing North Carolina Crowdfunding Bills. Crowdsourcing.org

Image credit to: Jimmy Emerson, http://bit.ly/1LtDswq

| About the author - Irene Tordera Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives. During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem. |

RSS Feed

RSS Feed