Considering the U.S. has 52 sets of securities laws (federal + the 50 states + D.C), it is no wonder that thousands of lawyers across the country have made comfortable (if paper heavy and, let’s be honest with ourselves, fairly mind-numbing) lives off of this portion of the legal world. U.S. federal and state securities laws are extraordinarily complicated.

The SEC recently released its proposed rules for Title III of the JOBS Act (i.e. “crowdfunding”) which, while a major step in the opening of this market, does not mean that issuers are now able to pursue crowdfunding transactions. The rules that were proposed by the SEC will be subject to a comment period and the release and adoption of final rules.

As a result, we continue to receive a lot of questions on the JOBS Act: what can and can’t be done with respect to marketing securities transactions now (general solicitation?), the types of investors that can invest (accredited investors only?), the types of transactions issuers can pursue (Title II vs. Title III?), the timing of any upcoming changes, whether new investor networks can be started now by Joe Public and pretty much everything else.

We will release a summary of the rules as proposed by the SEC and the registration process proposed by FINRA in short order. However, as the proposed rules generally follow the requirements of the JOBS Act, the discussion below provides a good snapshot of where things stand at the moment.

I have run through some of the most frequently asked questions that we receive, attempted to put things into language that makes sense, given an idea of where things currently stand and maybe shed some light on where things (might) go in the near future.

But before any of that, please consult legal counsel before entering this market in any way. The information below is not legal advice: it is only provided as an introduction. A little knowledge is a dangerous thing and if you make a mistake, even if it is inadvertent, there may be serious legal consequences. Go talk to a lawyer.

Why does ANY of this matter? Why can’t I just offer and sell shares of my company to anyone and any point?

Ok, if you know this already, skip ahead as this is starting from scratch, but it’s important because I don’t think people usually lay out the fundamentals before they start talking about “exemptions from registration”.

Section 5 of the U.S. Securities Act of 1933, as amended (the Securities Act) mandates that every time a security is sold, it either must be (1) registered with the SEC, or (2) exempt from registration with the SEC. Securities that are registered with the SEC are often referred to as being publicly offered (think the Facebook IPO). Securities that are sold pursuant to an exemption from registration (#2 above) are often referred to as being privately offered or placed (think the Facebook shares that were sold by Facebook prior to their IPO).

In addition, nearly every sale of a security (whether registered or privately offered) will need another party to handle the money and the securities, find the investors and communicate with them throughout the transaction and give advice to the company as to how to execute the transaction. This person or company is a broker dealer and will be required to register as such unless there is an exemption from registration available. This requirement often implicates people that have no idea it even exists.

Ok, but what if I just ignore the requirements to register an offer of shares or to register as a broker dealer?

This one is easy: you might have to give all the money back to the investors and you might have to pay large fines.

Ok, let’s get to some of the specifics. What are some of the key provisions of the JOBS Act?

Before we set out where we are now and where we (hopefully) will be sometime soon, we need to set out what the various provisions of the JOBS Act are. You may already know this and, if so, skip ahead.

Key provisions of the JOBS Act include:

What parts of the JOBS Act have been implemented and which are outstanding?

The SEC is writing rules for and implementing the various provisions of the JOBS Act on rolling basis. Given the breadth of the changes and the intricacies of the laws, it makes sense that they are taking their time. That said, it has led to some confusion as to what is currently on the table and what is to come.

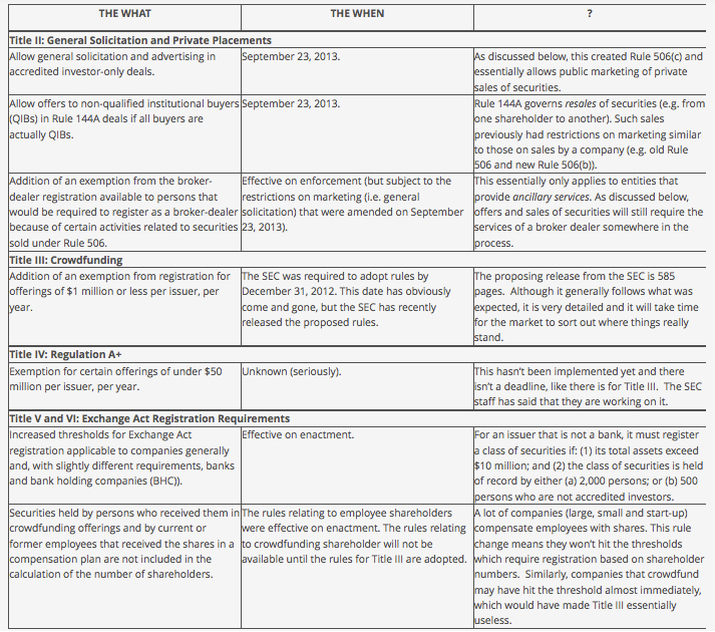

I have set out the implementation dates or status of some of the provisions below. The “?” column is just a quick reference and tries to give a bit of context. Please read further below as I attempt to clarify these points in more detail.

When is an intermediary considered to be a funding portal?

According to the SEC, a funding portal is any person acting as an intermediary in a transaction involving the offer or sale of securities for the account of others pursuant to the new crowdfunding exemption under the Securities Act (upon implementation of the rules for that exemption), that does not do any of the following:

What are the responsibilities and obligations of a funding portal?

Subject to the SEC and FINRA finalizing the rules, funding portals will have a number of ongoing obligations. These obligations will include:

OK, when will an intermediary be considered a broker-dealer and be required to register as such?

Before getting into this question, it is worth stressing again that this is a very complicated part of the legal world. Advising broker-dealers, or entities that may be engaging in broker-dealer activity, is very fact sensitive and rarely black and white. You absolutely need to engage trusted legal counsel if these are live issues for you.

With that said, here are a few questions that may be helpful. Note that this list is in no way exhaustive, it’s just provided as a rudimentary starting point. Also, while I have used “entity” below, a person can (and is often required to) register as a broker-dealer. A “yes” to any of them likely means registration with the SEC as a broker-dealer:

I included this question just for the sake of completeness, but I am not even going to attempt to summarize the answer or put it into easily understood language. The obligations are complicated and voluminous. Contact a lawyer.

What information will be required to be provided by crowdfunding issuers to the funding portals and the potential investors (at least as far as we know at this stage)?

At this point (subject to the rules being finalized and adopted by the SEC), each crowdfunding issuer will be required to file with the SEC, provide to investors and the broker or funding portal and make available to the potential investors:

So, after all of that, I still want to launch my own crowdfunding site, can I do it?

Here are some of the fundamental questions that you might want to consider:

(1) What types of deals are you going to host/market: crowdfunding deals (e.g. pursuant to Title III) or accredited investor only deals (e.g. pursuant to Title II)?

(2) How will you market your deals or offerings?

(3) How will you verify the status of your potential investors?

(4) What is your compensation structure (i.e. how are you going to make money)?

(5) Are you planning to register as a broker-dealer or a funding portal?

Let’s go through these one at a time.

(1) What types of deals are you going to host/market: crowdfunding deals (e.g. pursuant to Title III) or accredited investor only deals (e.g. pursuant to Title II)?

Just like every securities offering that won’t be registered with the SEC, a crowdfunding transaction must be made pursuant to an exemption (i.e. Title III) must be conducted through either a registered broker-dealer or a registered funding portal. Now, because the Title III rules have not yet been adopted, exempt crowdfunding transactions are still prohibited. Furthermore, there is no way to register with the SEC or FINRA as a funding portal, so that part is currently impossible as well. However, as discussed below, although you cannot facilitate crowdfunding transactions (or act as a funding portal) at this time, you may be able facilitate accredited investor-only deals online (subject to complex restrictions).

Ok, so, maybe your plan is to facilitate or host offerings that are not crowdfunding transactions (Title III) but are offerings to sophisticated investors only pursuant to Rule 506(c) and/or Rule 144A (i.e. the rules that were changed by Title II).

Can you just set up a site, post offerings from issuers, solicit potential accredited investors, hit the ground running and start pushing securities and money? The answer is: “not really”.

As discussed here http://www.crowdvalley.com/2013/05/06/the-secs-recent-no-action-letters/ , the SEC has recently issued two “no action letters” in relation to accredited investor only online networks. However, each company explained in (almost painstaking) detail how they were not engaging in broker-dealer activity and therefore should not be required to register as such. Furthermore, each company will need to engage the services of a broker-dealer if they want to actually execute any transactions. Otherwise, the site would simply be a list of offerings and potential investors and companies would be required to find ways to execute the deals themselves.

Finally, marketing and facilitating accredited investor-only deals is not straightforward. Even if you do have a broker-dealer lined up to provide all broker-dealer-related services, things get complicated very quickly. Some of this will be discussed below but, as always, it is vital that you consult legal counsel.

It should also be noted that the two “no action letters” went into some detail regarding registration as an “investment advisor” under the Investment Advisors Act of 1940. I won’t get into this here, but this is yet another complication, as certain activities related to these online offerings may require parties to register as an investment advisor.

(2) How will you market your deals or offerings?

This question is included in order to draw the distinction again between Rule 506(b) (i.e. the old Rule 506) and Rule 506(c). The former still prohibits general solicitation and general advertising. The latter allows for it, but with additional requirements in relation to verifying the status of the investor as discussed below.

If you are providing details of deals and offerings on a website that can be accessed by the general public, it is very likely that you would be pursuing the Rule 506(c) exemption. If you are providing details of deals and offerings on a website that can be accessed only by accredited investors that you have had a substantial and pre-existing relationship with, it may be possible that you could pursue the Rule 506(b) exemption, but this is not clear. You should consult with legal counsel in either case.

(3) How will you verify the status of your potential investors?

If you are generally advertising offers on your website and generally soliciting investors, you will need to meet the requirements of Rule 506(c). Rule 506(c) states that the issuer must take reasonable steps to verify that each purchaser is an accredited investor. Rule 506(c) does not require specific verification procedures. However, it does specify non-exclusive and non-mandatory methods of verifying that a natural person is an accredited investor, such as:

(4) What is your compensation structure (i.e. how are you going to make money)?

Although I noted this above, it is worth repeating: if you anticipate transaction-related compensation (either based on the amount raised, the number of investors that ultimately invest or a “success fee”), you will almost certainly need to register as a broker-dealer. This means that you cannot simply set up a site and start offering deals to investors. Broker-dealer registration can be a long and expensive process.

(5) Are you planning to register as a broker-dealer or a funding portal?

See above. If you are planning to register as a funding portal, you’re going to have to wait until the SEC and FINRA tells us what that means. If you are going to register as a broker-dealer, that’s another story altogether. If you don’t plan on registering as either, you need to restrict your activities that will not require you to register, which won’t be that easy (or likely remunerative) either.

Image credit to: USDAgov. http://bit.ly/1mFjiIY

As a result, we continue to receive a lot of questions on the JOBS Act: what can and can’t be done with respect to marketing securities transactions now (general solicitation?), the types of investors that can invest (accredited investors only?), the types of transactions issuers can pursue (Title II vs. Title III?), the timing of any upcoming changes, whether new investor networks can be started now by Joe Public and pretty much everything else.

We will release a summary of the rules as proposed by the SEC and the registration process proposed by FINRA in short order. However, as the proposed rules generally follow the requirements of the JOBS Act, the discussion below provides a good snapshot of where things stand at the moment.

I have run through some of the most frequently asked questions that we receive, attempted to put things into language that makes sense, given an idea of where things currently stand and maybe shed some light on where things (might) go in the near future.

But before any of that, please consult legal counsel before entering this market in any way. The information below is not legal advice: it is only provided as an introduction. A little knowledge is a dangerous thing and if you make a mistake, even if it is inadvertent, there may be serious legal consequences. Go talk to a lawyer.

Why does ANY of this matter? Why can’t I just offer and sell shares of my company to anyone and any point?

Ok, if you know this already, skip ahead as this is starting from scratch, but it’s important because I don’t think people usually lay out the fundamentals before they start talking about “exemptions from registration”.

Section 5 of the U.S. Securities Act of 1933, as amended (the Securities Act) mandates that every time a security is sold, it either must be (1) registered with the SEC, or (2) exempt from registration with the SEC. Securities that are registered with the SEC are often referred to as being publicly offered (think the Facebook IPO). Securities that are sold pursuant to an exemption from registration (#2 above) are often referred to as being privately offered or placed (think the Facebook shares that were sold by Facebook prior to their IPO).

In addition, nearly every sale of a security (whether registered or privately offered) will need another party to handle the money and the securities, find the investors and communicate with them throughout the transaction and give advice to the company as to how to execute the transaction. This person or company is a broker dealer and will be required to register as such unless there is an exemption from registration available. This requirement often implicates people that have no idea it even exists.

Ok, but what if I just ignore the requirements to register an offer of shares or to register as a broker dealer?

This one is easy: you might have to give all the money back to the investors and you might have to pay large fines.

Ok, let’s get to some of the specifics. What are some of the key provisions of the JOBS Act?

Before we set out where we are now and where we (hopefully) will be sometime soon, we need to set out what the various provisions of the JOBS Act are. You may already know this and, if so, skip ahead.

Key provisions of the JOBS Act include:

- We won’t discuss Title I in any detail here because it’s probably beyond the scope of what you’re interested in. In brief, Title I attempts to streamline the process of going public for certain companies (i.e. pursuing an initial public offering) and creates a new reporting regime for certain young or growing companies (emerging growth companies or EGCs).

- Title II concerns how private offerings are marketed (i.e. the removal of the prohibition on general solicitation and general advertising) and creates a new exemption from registration for entities (or people) engaged in certain broker dealer activities for “accredited investor only” offerings (more on all of this below).

- Title III is the “crowdfunding exemption” that everyone is talking about but which isn’t available yet. Basically, Title III allows companies to raise small amounts of money from a large number of unsophisticated investors without registering the securities with the SEC.

- Title IV directs the SEC to exempt certain offerings of up to $50 million per issuer, per year from registration under the Securities Act. It’s known as Regulation A+ (because Regulation A currently exempts similar offerings but with a cap at $5 million).

- Title V and Title VI are somehow more tedious than the other sections, but are actually pretty important. Together they will essentially give certain companies more time before they are required to register their securities with the SEC (i.e. stay private). From a crowdfunding perspective, this is particularly important because one of the triggers for the requirement to register is the number of shareholders a company has (and crowdfunding might mean a lot of shareholders).

What parts of the JOBS Act have been implemented and which are outstanding?

The SEC is writing rules for and implementing the various provisions of the JOBS Act on rolling basis. Given the breadth of the changes and the intricacies of the laws, it makes sense that they are taking their time. That said, it has led to some confusion as to what is currently on the table and what is to come.

I have set out the implementation dates or status of some of the provisions below. The “?” column is just a quick reference and tries to give a bit of context. Please read further below as I attempt to clarify these points in more detail.

When is an intermediary considered to be a funding portal?

According to the SEC, a funding portal is any person acting as an intermediary in a transaction involving the offer or sale of securities for the account of others pursuant to the new crowdfunding exemption under the Securities Act (upon implementation of the rules for that exemption), that does not do any of the following:

- Sell or offer the securities displayed on its website or portal, other than simply having them displayed (e.g. calling potential investors and marketing a transaction).

- Hold, manage, possess or otherwise handle investor money or securities.

- Compensate employees, agents or others based on the sale of securities that are for sale on its website or portal.

- Offer investment recommendations or advice.

- Engage in such other activities as the SEC determines appropriate.

What are the responsibilities and obligations of a funding portal?

Subject to the SEC and FINRA finalizing the rules, funding portals will have a number of ongoing obligations. These obligations will include:

- Register with the SEC as a broker-dealer or a funding portal and register with any applicable self-regulatory organization.

- Provide any disclosure as the SEC requires.

- Ensure that each investor:

- reviews investor education information;

- confirms it understands that it is risking the loss of its entire investment and that it can bear such a loss; and

- answers questions demonstrating an understanding of the level of risk generally applicable to investments in startups and small issuers, the risk of illiquidity and any other matters that the SEC requires by rule.

- Take measures to reduce the risk of fraud, including background and securities enforcement regulatory checks on the officers, directors and 20% shareholders of each issuer whose securities it offers.

- Not compensate promoters, finders, or lead generators for providing the broker or funding portal with personal identifying information for any potential investor.

- No later than 21 days before the first day on which securities are sold to any investor, make available to the SEC and to potential investors any information that is required to be provided by (and is in fact provided by) the issuer (see below for what we know about what these requirements will be).

- Comply with any privacy or protection of information requirements the SEC adopts.

- Undertake any efforts the SEC requires to ensure that no investor purchases an amount of crowdfunding securities during any 12-month period that, in the aggregate, from all issuers, exceeds the per-investor limit as set out in the exemption.

- Ensure that the issuer may only receive the offering proceeds when the aggregate capital raised from all investors equals or exceeds a targeted offering amount, and permit all investors to cancel their commitments to invest.

- Prohibit its directors, officers, or partners (or any similar person) from having any financial interest in an issuer that uses its services.

OK, when will an intermediary be considered a broker-dealer and be required to register as such?

Before getting into this question, it is worth stressing again that this is a very complicated part of the legal world. Advising broker-dealers, or entities that may be engaging in broker-dealer activity, is very fact sensitive and rarely black and white. You absolutely need to engage trusted legal counsel if these are live issues for you.

With that said, here are a few questions that may be helpful. Note that this list is in no way exhaustive, it’s just provided as a rudimentary starting point. Also, while I have used “entity” below, a person can (and is often required to) register as a broker-dealer. A “yes” to any of them likely means registration with the SEC as a broker-dealer:

- Does the entity engage in solicitation, negotiation or execution of securities transactions?

- Does the entity handle someone else’s money or securities?

- Does the entity receive transaction related compensation?

- Does the entity extend credit in relation to the purchase of securities?

- Does the entity give investment advice to investors (note that this also implicates registration as an investment advisor)?

- Does the entity hold itself out as a broker-dealer and/or advertise itself engaging in the business of buying and selling securities?

I included this question just for the sake of completeness, but I am not even going to attempt to summarize the answer or put it into easily understood language. The obligations are complicated and voluminous. Contact a lawyer.

What information will be required to be provided by crowdfunding issuers to the funding portals and the potential investors (at least as far as we know at this stage)?

At this point (subject to the rules being finalized and adopted by the SEC), each crowdfunding issuer will be required to file with the SEC, provide to investors and the broker or funding portal and make available to the potential investors:

- Its name, legal status, physical address and website address.

- The names of its directors, officers and 20% stockholders.

- A description of its business and anticipated business plan.

- A description of its financial condition. The level of disclosure required will depend on the crowdfunding activity undertaken by the issuer during the preceding 12 months. If the offering in question plus all other crowdfunding offerings by the issuer in the past 12 months, have, target offering amounts of:

- $100,000 or less, then the issuer must provide income tax returns for its most recently completed year and financial statements certified by the principal executive officer (e.g, CFO or CEO);

- more than $100,00 but less than $500,000, then the issuer must provide financial statements reviewed by a public accountant that is independent of the issuer; and

- more than $500,000 (or such other amount as the SEC establishes by rule), then the issuer must provide audited financial statements.

- A description of the intended use of the proceeds.

- The target offering amount, the deadline to reach the target offering amount and regular updates regarding the progress towards meeting the target offering amount.

- The price to the public of the securities or the method for determining the price. Before each sale, each investor must be provided in writing the final price and all required disclosure, with a reasonable opportunity to rescind its purchase commitment.

- A description of the ownership and capital structure of the issuer, including (among other items):

- a detailed description of the terms of the offered securities and each other class of the issuer’s securities; and

- the risks to purchasers of the securities relating to minority ownership in the issuer and future corporate actions, including additional share issuances, a sale of the issuer or transactions with related parties.

So, after all of that, I still want to launch my own crowdfunding site, can I do it?

Here are some of the fundamental questions that you might want to consider:

(1) What types of deals are you going to host/market: crowdfunding deals (e.g. pursuant to Title III) or accredited investor only deals (e.g. pursuant to Title II)?

(2) How will you market your deals or offerings?

(3) How will you verify the status of your potential investors?

(4) What is your compensation structure (i.e. how are you going to make money)?

(5) Are you planning to register as a broker-dealer or a funding portal?

Let’s go through these one at a time.

(1) What types of deals are you going to host/market: crowdfunding deals (e.g. pursuant to Title III) or accredited investor only deals (e.g. pursuant to Title II)?

Just like every securities offering that won’t be registered with the SEC, a crowdfunding transaction must be made pursuant to an exemption (i.e. Title III) must be conducted through either a registered broker-dealer or a registered funding portal. Now, because the Title III rules have not yet been adopted, exempt crowdfunding transactions are still prohibited. Furthermore, there is no way to register with the SEC or FINRA as a funding portal, so that part is currently impossible as well. However, as discussed below, although you cannot facilitate crowdfunding transactions (or act as a funding portal) at this time, you may be able facilitate accredited investor-only deals online (subject to complex restrictions).

Ok, so, maybe your plan is to facilitate or host offerings that are not crowdfunding transactions (Title III) but are offerings to sophisticated investors only pursuant to Rule 506(c) and/or Rule 144A (i.e. the rules that were changed by Title II).

Can you just set up a site, post offerings from issuers, solicit potential accredited investors, hit the ground running and start pushing securities and money? The answer is: “not really”.

As discussed here http://www.crowdvalley.com/2013/05/06/the-secs-recent-no-action-letters/ , the SEC has recently issued two “no action letters” in relation to accredited investor only online networks. However, each company explained in (almost painstaking) detail how they were not engaging in broker-dealer activity and therefore should not be required to register as such. Furthermore, each company will need to engage the services of a broker-dealer if they want to actually execute any transactions. Otherwise, the site would simply be a list of offerings and potential investors and companies would be required to find ways to execute the deals themselves.

Finally, marketing and facilitating accredited investor-only deals is not straightforward. Even if you do have a broker-dealer lined up to provide all broker-dealer-related services, things get complicated very quickly. Some of this will be discussed below but, as always, it is vital that you consult legal counsel.

It should also be noted that the two “no action letters” went into some detail regarding registration as an “investment advisor” under the Investment Advisors Act of 1940. I won’t get into this here, but this is yet another complication, as certain activities related to these online offerings may require parties to register as an investment advisor.

(2) How will you market your deals or offerings?

This question is included in order to draw the distinction again between Rule 506(b) (i.e. the old Rule 506) and Rule 506(c). The former still prohibits general solicitation and general advertising. The latter allows for it, but with additional requirements in relation to verifying the status of the investor as discussed below.

If you are providing details of deals and offerings on a website that can be accessed by the general public, it is very likely that you would be pursuing the Rule 506(c) exemption. If you are providing details of deals and offerings on a website that can be accessed only by accredited investors that you have had a substantial and pre-existing relationship with, it may be possible that you could pursue the Rule 506(b) exemption, but this is not clear. You should consult with legal counsel in either case.

(3) How will you verify the status of your potential investors?

If you are generally advertising offers on your website and generally soliciting investors, you will need to meet the requirements of Rule 506(c). Rule 506(c) states that the issuer must take reasonable steps to verify that each purchaser is an accredited investor. Rule 506(c) does not require specific verification procedures. However, it does specify non-exclusive and non-mandatory methods of verifying that a natural person is an accredited investor, such as:

- reviewing any IRS form that reports the person’s income for the two most recent years;

- obtaining a written representation that the person reasonably expects to reach the income level required to qualify as an accredited investor in the current year;

- reviewing one or more of certain documents (including bank statements, brokerage statements and tax assessments) dated within the past three months;

- reviewing a report from one of the national consumer reporting agencies and obtaining a written representation that the person has disclosed all liabilities necessary to make a net worth determination;

- obtaining a written confirmation from a certain type of third party (a registered broker-dealer or investment advisor, a licensed attorney in good standing or a CPA registered and in good standing) that the third party has taken reasonable steps to verify the person’s accredited investor status within the past three months and has determined that the person is an accredited investor.

- The nature of the purchaser and the type of accredited investor it claims to be (e.g. A natural person or an entity like a registered broker-dealer);

- The amount and type of information that the issuer has about the purchaser;

- The nature of the offering, such as the manner of the solicitation and the terms of the offering.

(4) What is your compensation structure (i.e. how are you going to make money)?

Although I noted this above, it is worth repeating: if you anticipate transaction-related compensation (either based on the amount raised, the number of investors that ultimately invest or a “success fee”), you will almost certainly need to register as a broker-dealer. This means that you cannot simply set up a site and start offering deals to investors. Broker-dealer registration can be a long and expensive process.

(5) Are you planning to register as a broker-dealer or a funding portal?

See above. If you are planning to register as a funding portal, you’re going to have to wait until the SEC and FINRA tells us what that means. If you are going to register as a broker-dealer, that’s another story altogether. If you don’t plan on registering as either, you need to restrict your activities that will not require you to register, which won’t be that easy (or likely remunerative) either.

Image credit to: USDAgov. http://bit.ly/1mFjiIY

About the author - Dan McNamee

Dan is a U.S. trained and qualified lawyer (New York) with extensive experience in capital markets and M&A transactions in the United States, Europe, Asia and Africa. This background has provided extensive exposure to rules, regulations and regulators (including the SEC and FINRA) governing many forms of capital raising in the United States. With this foundation in the traditional capital markets space, Dan is seeking to help grow the crowdfunding market in the United States in a manner that encourages capital formation, protects investors and meets the extensive requirements of the nation’s regulators.

Born and raised in Cleveland, Ohio, Dan has worked and lived throughout the United States, in London and elsewhere in Europe. In his spare time, Dan has contributed a significant amount of pro bono work to a number of organizations, including the Clinton Health Access Initiative, and enjoys suffering as he watches Cleveland’s consistently terrible sports teams lose.

Dan is a U.S. trained and qualified lawyer (New York) with extensive experience in capital markets and M&A transactions in the United States, Europe, Asia and Africa. This background has provided extensive exposure to rules, regulations and regulators (including the SEC and FINRA) governing many forms of capital raising in the United States. With this foundation in the traditional capital markets space, Dan is seeking to help grow the crowdfunding market in the United States in a manner that encourages capital formation, protects investors and meets the extensive requirements of the nation’s regulators.

Born and raised in Cleveland, Ohio, Dan has worked and lived throughout the United States, in London and elsewhere in Europe. In his spare time, Dan has contributed a significant amount of pro bono work to a number of organizations, including the Clinton Health Access Initiative, and enjoys suffering as he watches Cleveland’s consistently terrible sports teams lose.

RSS Feed

RSS Feed