| The Internet’s impact on financial services has been limited so far. While we do have services with online distribution and information capabilities like online banking, efficient payments and brokerage, true disruptions to financial services, particularly investment markets, have been vague. That is until now. |

New online securities models have started to challenge and disrupt established value chains in financial services, in the form of peer-to-peer investment networks (peer-to-peerlending, peer-to-business lending, crowd investing, etc). While these networks create many opportunities in the financial services market, they also makes some traditional business models redundant. Changes are vast and global, and their impact is becoming undeniable cross the market.

Various countries and financial regulators from the United States, the UK and other European countries, as well as countries in Asia Pacific, have adopted new measures to set a framework in place for online investment markets to emerge with the right investor protections in place. In this article, we will examine these regulatory changes with a few case examples, their implications and the opportunities they present in the nascent but ultimately vastly disruptive marketplace.

Regulatory Developments, New Rules for Peer-to-Peer

Networks

The call for new marketplaces has been echoed globally and certain frameworks have been erected to set in place initial rules of engagement in the market. However, it is important to note that while there are certain regulations already in place, most are still in development, unfinished or still being written. The discussions are

most vocal in North America and Europe, but there are also new rules emerging in Asia Pacific and increasing activity around the world.

The “JOBS Act” in the United States

The most notable regulatory development has undoubtedly come in the shape of the JOBS Act in the United States, consisting of different provisions (“Titles”) aimed at accelerating capital formation and employment in the shape of updating certain securities laws. It is important to note, that while the JOBS Act is often associated to

“equity crowdfunding”, it is a broad set of provisions which have an impact on a variety of provisions governing the marketing and sale of securities offerings. In fact, the regulation includes a total of six Titles, which we will summarize as an introduction to the topic below.

Title I attempts to streamline the process of going public for certain companies (i.e. pursuing an initial public offering) and creates a new reporting regime for certain young or growing companies (emerging growth companies or EGCs).

Title II concerns how private offerings are marketed (i.e. the removal of the prohibition on general solicitation and general advertising, creating the new “506c” rule allowing general solicitation of securities offerings) and creates a new exemption from registration for entities (or people) engaged in certain broker dealer activities for “accredited investor only” offerings.

Title III is the “crowdfunding exemption” that everyone is talking about but which is not available yet. Basically, Title III allows companies to raise small amounts of money from a large number of non-accredited investors without registering the securities with the SEC.

Title IV directs the SEC to exempt certain offerings of up to $50 million per issuer, per year from registration under the Securities Act. It is known as Regulation A+ (because Regulation A currently exempts similar offerings but with a cap at $5 million).

Title V and Title VI are less revolutionary than the other sections, but still important. Together they will essentially give certain companies more time before they are required to register their securities with the

SEC (i.e. stay private).

Title I is already in effect, as is Title II. Title III is much anticipated but not yet in effect. The timing for Title IV, pertaining to modifications on Regulation A rules, is unknown.

OK, So the US Has the JOBS Act. What Is Happening There?

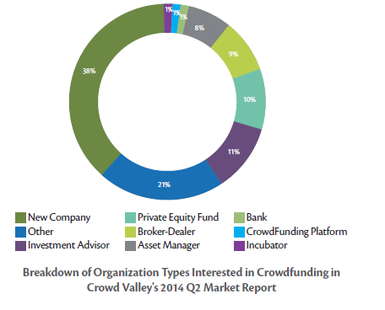

The breadth of the new regulatory development with the JOBS Act has implications for capital structure, IPO on-ramp process, fund structures and investment vehicle designs. The JOBS Act also enables existing broken dealers and investment advisors to engage in crowdfunding activities largely under existing rules and regulations (see the figure above for operator profiles).

For instance, Title II, that is the public marketing and solicitation of securities offerings (i.e. the new Regulation D, rule 506C), may be applicable to crowdfunding marketplace, allowing a broader use of advertising in securities offerings.

First Movers in South East Asia

The Malaysian Securities Commission (MSC) drafted regulation for securities crowdfunding, looking closely at what countries like Australia, New Zealand and the US have done in this regard. The rules have ended a period of public consultation on the 5th of September 2014, which means the development of the rules is still in nascent stage. There is clear interest in these initial frameworks, from the broad investor community as well as the general public, and surely they will play an important reference template for the region. The MSC has already reviewed these initial guidelines and proposed amendments to the new rules.

While countries like Malaysia, New Zealand and Australia have been getting active in the regulatory debate, the absence of professional investment companies in the marketplace is still apparent. Like we mentioned in the United States, where licensed and regulated broker dealers and investment advisors conduct the majority of activity under existing regulatory frameworks in the marketplace, it seems there is a lot of untapped potential and opportunity in geographies with a strong investment culture and track record.

Other Regulatory Developments

The JOBS Act has also served as a benchmark or case study in various countries, and even within the US, where intra-state crowdfunding exemptions have emerged as a way to operate new marketplaces and investment models within state borders. There are currently a dozen or so intrastate exemptions to allow for a crowd investment model of sorts, but similar to broader activity in the new market, activity within state borders has remained largely conducted by professional investment firms.

The FCA in the UK has possibly the most sophisticated framework for these new marketplaces, including peer-to-peer lending business loan and equity crowd investment marketplaces. The passage of these frameworks has been incremental, with parties learning about the markets successes and challenges side by side in healthy collaboration.

Similarly, many other European countries have adopted new frameworks that generally follow or mirror the aims and models of other countries. A general aim could be seen as to foster a vibrant and viable development of new capital formation, and limit intervention where it is not productive.

It should be noted, that regulatory updates in the United States securities regulation may have been more direly needed given the broad and strict prior provisions around for example the marketing of securities offerings in the United States, as compared to regulations in Europe. However, there are other challenges in Europe, such as the market fragmentation and lack of uniform regulatory frameworks within private securities markets.

Top Down Support Speeds up Market Penetration

The UK also offers other support for the ecosystem in order to create complementary funding mechanisms for needed causes. These include tax incentives (known as the enterprise investment scheme, EIS and seed enterprise investment scheme, SEIS) for investors in early private companies, as well as tax discounts to peer-to-peer lending, which was announced by Her Majesty’s Treasury on July 1st, 2014, as part of the Individual Savings Account (ISA) system.

These systems can be seen to speed up maturation of the nascent crowdfunding market, by providing supportive provisions and models for operators and participants alike. Their impact in the investment process is undeniable.

Market Implications

These new marketplaces can be seen as a source of capital for underrepresented asset classes such as early stage companies (startups), later stage private companies in need for expansion capital, renewable energy projects and so on (see the figure below on asset representation). On the other hand, these marketplaces often allow access to new investor demographics that previously did not have the access or ability to participate in such asset classes directly without going through their asset manager or through a fund structure.

Opportunity or Threat?

To date, we have observed a relatively even distribution of interest from established financial services companies, half of which represent an interest in private companies, a third in real estate and the rest in other real assets. Given that interest in assets such as properties accentuated in certain regions such as South East Asia (Singapore and other cities which have seen significant income rise), the rise of property marketplaces could be expected.

Another way to consider the progress in online investment markets would be to think of what investments are currently prominent in the existing marketplace and appealing to what investors and what geographies. The opportunities would likely give rise to new online investment marketplaces organized around certain hubs.

We already see the gears in motion, and despite often talked about developments looking far into the future, the opportunities are real today. There is a real opportunity in the market for professional financial operators; and more and more credible and well-established companies are building their instant marketplaces as well as their

expanded instant offerings as channel for the future.

Concluding Thoughts

The Grow VC Group works and collaborates with several companies in South East Asia, for example Singapore, Hong Kong, Mainland China and Malaysia. There are clearly still outstanding questions about fundamental changes to crowdfunding marketplaces in the longterm.

However, it is certain that these changes are making a shift in the fundraising landscape. There is no going back in the development, but seizing this opportunity presents a chance for financial services firms to put a stake in the ground and lay claim to new business opportunities.

This article was originally published in the HKVCA Journal. A New Leaf in Asia's Private Equity. Fall 2014.

Various countries and financial regulators from the United States, the UK and other European countries, as well as countries in Asia Pacific, have adopted new measures to set a framework in place for online investment markets to emerge with the right investor protections in place. In this article, we will examine these regulatory changes with a few case examples, their implications and the opportunities they present in the nascent but ultimately vastly disruptive marketplace.

Regulatory Developments, New Rules for Peer-to-Peer

Networks

The call for new marketplaces has been echoed globally and certain frameworks have been erected to set in place initial rules of engagement in the market. However, it is important to note that while there are certain regulations already in place, most are still in development, unfinished or still being written. The discussions are

most vocal in North America and Europe, but there are also new rules emerging in Asia Pacific and increasing activity around the world.

The “JOBS Act” in the United States

The most notable regulatory development has undoubtedly come in the shape of the JOBS Act in the United States, consisting of different provisions (“Titles”) aimed at accelerating capital formation and employment in the shape of updating certain securities laws. It is important to note, that while the JOBS Act is often associated to

“equity crowdfunding”, it is a broad set of provisions which have an impact on a variety of provisions governing the marketing and sale of securities offerings. In fact, the regulation includes a total of six Titles, which we will summarize as an introduction to the topic below.

Title I attempts to streamline the process of going public for certain companies (i.e. pursuing an initial public offering) and creates a new reporting regime for certain young or growing companies (emerging growth companies or EGCs).

Title II concerns how private offerings are marketed (i.e. the removal of the prohibition on general solicitation and general advertising, creating the new “506c” rule allowing general solicitation of securities offerings) and creates a new exemption from registration for entities (or people) engaged in certain broker dealer activities for “accredited investor only” offerings.

Title III is the “crowdfunding exemption” that everyone is talking about but which is not available yet. Basically, Title III allows companies to raise small amounts of money from a large number of non-accredited investors without registering the securities with the SEC.

Title IV directs the SEC to exempt certain offerings of up to $50 million per issuer, per year from registration under the Securities Act. It is known as Regulation A+ (because Regulation A currently exempts similar offerings but with a cap at $5 million).

Title V and Title VI are less revolutionary than the other sections, but still important. Together they will essentially give certain companies more time before they are required to register their securities with the

SEC (i.e. stay private).

Title I is already in effect, as is Title II. Title III is much anticipated but not yet in effect. The timing for Title IV, pertaining to modifications on Regulation A rules, is unknown.

OK, So the US Has the JOBS Act. What Is Happening There?

The breadth of the new regulatory development with the JOBS Act has implications for capital structure, IPO on-ramp process, fund structures and investment vehicle designs. The JOBS Act also enables existing broken dealers and investment advisors to engage in crowdfunding activities largely under existing rules and regulations (see the figure above for operator profiles).

For instance, Title II, that is the public marketing and solicitation of securities offerings (i.e. the new Regulation D, rule 506C), may be applicable to crowdfunding marketplace, allowing a broader use of advertising in securities offerings.

First Movers in South East Asia

The Malaysian Securities Commission (MSC) drafted regulation for securities crowdfunding, looking closely at what countries like Australia, New Zealand and the US have done in this regard. The rules have ended a period of public consultation on the 5th of September 2014, which means the development of the rules is still in nascent stage. There is clear interest in these initial frameworks, from the broad investor community as well as the general public, and surely they will play an important reference template for the region. The MSC has already reviewed these initial guidelines and proposed amendments to the new rules.

While countries like Malaysia, New Zealand and Australia have been getting active in the regulatory debate, the absence of professional investment companies in the marketplace is still apparent. Like we mentioned in the United States, where licensed and regulated broker dealers and investment advisors conduct the majority of activity under existing regulatory frameworks in the marketplace, it seems there is a lot of untapped potential and opportunity in geographies with a strong investment culture and track record.

Other Regulatory Developments

The JOBS Act has also served as a benchmark or case study in various countries, and even within the US, where intra-state crowdfunding exemptions have emerged as a way to operate new marketplaces and investment models within state borders. There are currently a dozen or so intrastate exemptions to allow for a crowd investment model of sorts, but similar to broader activity in the new market, activity within state borders has remained largely conducted by professional investment firms.

The FCA in the UK has possibly the most sophisticated framework for these new marketplaces, including peer-to-peer lending business loan and equity crowd investment marketplaces. The passage of these frameworks has been incremental, with parties learning about the markets successes and challenges side by side in healthy collaboration.

Similarly, many other European countries have adopted new frameworks that generally follow or mirror the aims and models of other countries. A general aim could be seen as to foster a vibrant and viable development of new capital formation, and limit intervention where it is not productive.

It should be noted, that regulatory updates in the United States securities regulation may have been more direly needed given the broad and strict prior provisions around for example the marketing of securities offerings in the United States, as compared to regulations in Europe. However, there are other challenges in Europe, such as the market fragmentation and lack of uniform regulatory frameworks within private securities markets.

Top Down Support Speeds up Market Penetration

The UK also offers other support for the ecosystem in order to create complementary funding mechanisms for needed causes. These include tax incentives (known as the enterprise investment scheme, EIS and seed enterprise investment scheme, SEIS) for investors in early private companies, as well as tax discounts to peer-to-peer lending, which was announced by Her Majesty’s Treasury on July 1st, 2014, as part of the Individual Savings Account (ISA) system.

These systems can be seen to speed up maturation of the nascent crowdfunding market, by providing supportive provisions and models for operators and participants alike. Their impact in the investment process is undeniable.

Market Implications

These new marketplaces can be seen as a source of capital for underrepresented asset classes such as early stage companies (startups), later stage private companies in need for expansion capital, renewable energy projects and so on (see the figure below on asset representation). On the other hand, these marketplaces often allow access to new investor demographics that previously did not have the access or ability to participate in such asset classes directly without going through their asset manager or through a fund structure.

Opportunity or Threat?

To date, we have observed a relatively even distribution of interest from established financial services companies, half of which represent an interest in private companies, a third in real estate and the rest in other real assets. Given that interest in assets such as properties accentuated in certain regions such as South East Asia (Singapore and other cities which have seen significant income rise), the rise of property marketplaces could be expected.

Another way to consider the progress in online investment markets would be to think of what investments are currently prominent in the existing marketplace and appealing to what investors and what geographies. The opportunities would likely give rise to new online investment marketplaces organized around certain hubs.

We already see the gears in motion, and despite often talked about developments looking far into the future, the opportunities are real today. There is a real opportunity in the market for professional financial operators; and more and more credible and well-established companies are building their instant marketplaces as well as their

expanded instant offerings as channel for the future.

Concluding Thoughts

The Grow VC Group works and collaborates with several companies in South East Asia, for example Singapore, Hong Kong, Mainland China and Malaysia. There are clearly still outstanding questions about fundamental changes to crowdfunding marketplaces in the longterm.

However, it is certain that these changes are making a shift in the fundraising landscape. There is no going back in the development, but seizing this opportunity presents a chance for financial services firms to put a stake in the ground and lay claim to new business opportunities.

This article was originally published in the HKVCA Journal. A New Leaf in Asia's Private Equity. Fall 2014.

| About the Author - Markus Lampinen Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets. Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and part of the Grow VC Group. He is also a global investor and partner in the Grow VC Group. Since 2009, he has recruited over 120 individuals in the digital securities market, built up a operations on six continents and been recognized as one of the top 100 thought leaders in crowdfunding. In his earlier businesses, he served in diverse executive roles, for example taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus has studied finance, management and computer sciences, and holds an M.S. and a B.A. in Economics. Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children. |

RSS Feed

RSS Feed