According to a report published by Accenture Strategy and the Partnership Fund for New York City, Q1 2016 was the first quarter ever that New York passed Silicon Valley in fintech venture financing.

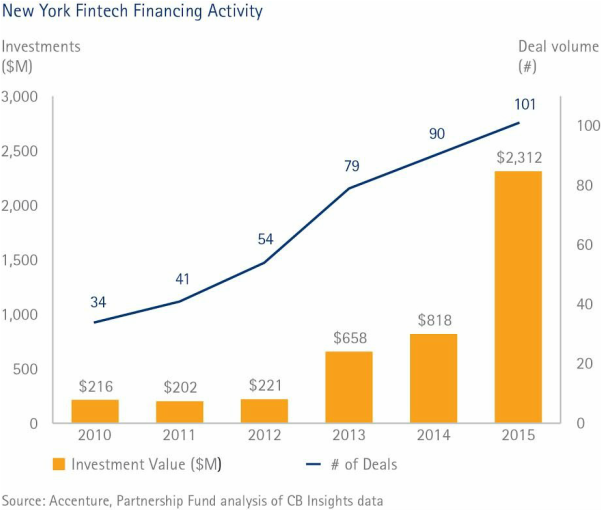

Financial technology (fintech) companies based in New York have been able to raise $690 million in venture capital funding in the first quarter of the year, against to the $511 raised in the Silicon Valley area. Compared to the previous year, fintech investment in New York tripled to $2.3 billion in 2015.

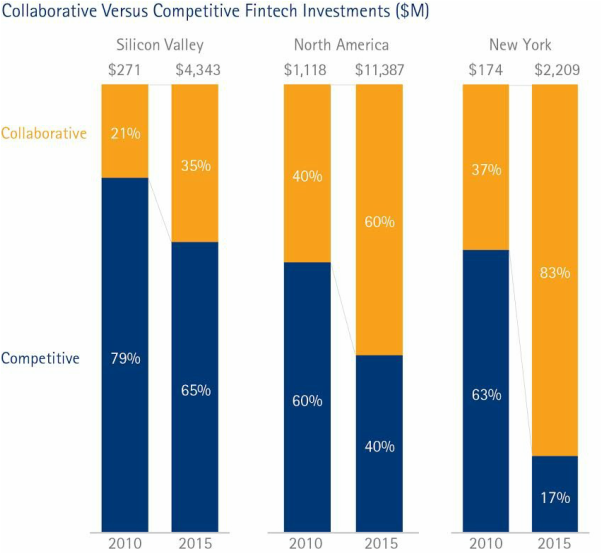

At a global level, the percentage of investments in fintech companies disrupting the financial services industry and that of of those looking to collaborate with traditional financial institutions has not changed much in the past five years, with the majority of the deals (62%) going to competitive companies.

In New York instead we can see a different story. While in 2010, only the 37% investments went to fintech companies collaborating with financial institutions, in 2015 the percentage rose to 83%.

As we have previously noted when examining the global fintech investments, as well as from the conversations that we had recently with our clients and partners, it emerges that a rising number of traditional financial players, like banks, financing institutions and insurance companies are looking to make partnerships with fintech startups, to help them with innovation inside their organizations. Contextually there is also increased attention from major banks to invest in the fintech sector with Goldman Sachs, Citigroup and Banco Santander between those with the highest number of investments.

“We are starting to see this shift. When we launched the FinTech Innovation Lab in 2010, 10 banks participated; this year nearly three times as many institutions, including insurance companies, hedge funds and payment companies, are working as mentors. We’ll know we’ve succeeded when onboarding innovation is second nature to financial institutions,” said Maria Gotsch, President and CEO of Partnership Fund for New York City.

All in all, a quarter with bigger investments doesn’t mean that New York is the new “fintech capital” of the US, where there isn’t clear singular leadership as there was in the recent years in Europe with London. The need for a more transparent, efficient and accessible financial market is strong both if you look at the East or at the West Coast, and we look forward to working with innovative leaders in their fields to grow this industry, that is now maturing at a good pace, in order to create a better and more democratic financial market for everyone

The full report, Fintech’s Golden Age, published by Accenture Strategy and the Partnership Fund for New York City, is available here: http://www.fintechinnovationlabnyc.com/media/additional/FinTech-New-York-Competition-to-Collaboration.pdf

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed