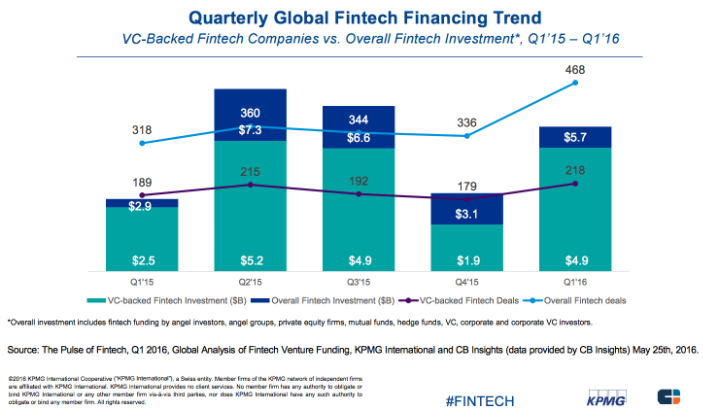

The last quarter of 2015 saw a reduction in investments into the fintech sector, with a sensible decrease from the incredible numbers of the previous quarters. Market analysts started to become skeptical that the industry could continue to grow at the same pace, with a slowdown for the start of the year that was foregone. However, the reality turned out to be a different story, with another record quarter of backing for new innovation in the financial services sector.

According to a new report from CBInsight and KPMG the deal activity on fintech startups rose 39% in Q1 2016 over the previous quarter, and it’s now on track to reach new records in this year. With $4.9B deployed across 218 deals, VC-backed companies took 86% of overall fintech funding.

Warren Mead Global Co-Leader of Fintech, KPMG International and Partner, KPMG in the UK, said: “Fintech had a very strong start to the year, and with the recent multi-billion dollar investment in Ant Financial in April, we are starting to see fintech move into the mega-deal space”.

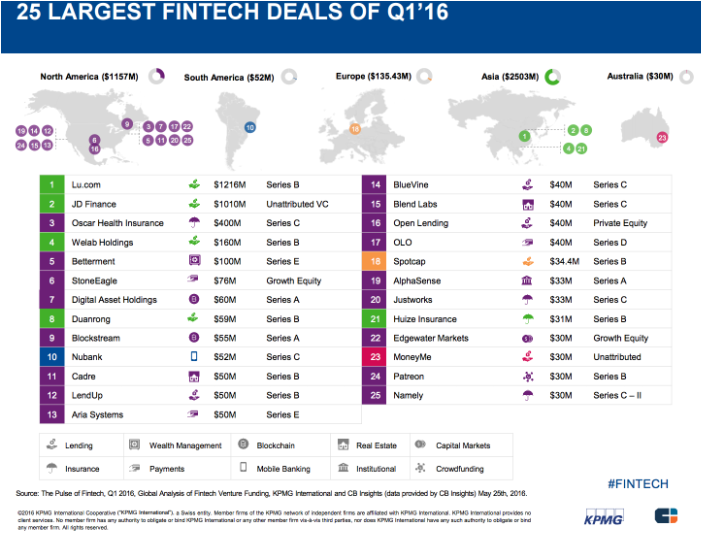

It’s a fact that growth in funding during the last months has been supported by large investments, with thirteen $50M+ rounds in VC-backed fintech companies. The impressive growth in Asia, from $0.5B to $2.6B in just a quarter, was largely due to $1B+ mega-rounds to Lu.Com and JD Finance. Despite the current level of uncertainty, stock market volatility and the impending Brexit referendum, that could see the UK leaving the European Union, the number of fintech deals in Europe increased by a 25% over the previous quarter, with no mega-rounds and one large round between the top 25 with a German online lending platform called Spotcap that raised $34.4 million in February.

It’s a fact that growth in funding during the last months has been supported by large investments, with thirteen $50M+ rounds in VC-backed fintech companies. The impressive growth in Asia, from $0.5B to $2.6B in just a quarter, was largely due to $1B+ mega-rounds to Lu.Com and JD Finance. Despite the current level of uncertainty, stock market volatility and the impending Brexit referendum, that could see the UK leaving the European Union, the number of fintech deals in Europe increased by a 25% over the previous quarter, with no mega-rounds and one large round between the top 25 with a German online lending platform called Spotcap that raised $34.4 million in February.

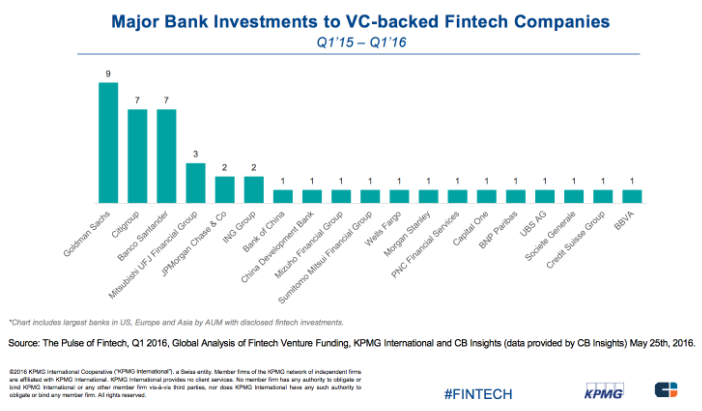

As we are seeing from the conversations with our clients and partners, it’s reported that a rising number of insurance companies, banks and financing institutions are looking to forge partnerships with fintech companies, to help them with innovation inside their organizations. Along with a rise in interest from traditional finance companies to partner with startups, there is also increased attention from major banks to invest in the sector. Goldman Sachs, Citigroup and Banco Santander are those with the highest number of investments in VC-backed financial technology companies in the past year.

Clearly the financial technology industry is growing at an astounding pace, but while there are some areas like the payments space, that especially in the US is arguably starting to be saturated, also because of huge successes of companies like Stripe and Square, there are also few areas of fintech that are gaining momentum, like for example Regulation Technology (RegTech), Robo Advisory and Insurance Technology (InsuranceTech or InsurTech). Let’s take a look at each of these sub-sector.

InsuranceTech startups are trying to wake up the insurance industry, from a long sleep creating new online distributional and brokerage platforms. “InsuranceTech has really taken off in the last 6 months both in terms of new innovations and investment. From a corporate perspective, many large insurance companies are investing in tech companies and building innovation labs to bring that innovation back into their core business.” said Jan Reinmueller Principal Advisor, and Head of Innovation Ventures, KPMG in Singapore.

RegTech is technology that seeks to provide regulatory solutions, that can help decrease costs related to risk management and compliance monitoring. The UK is taking the early lead in the area, with the Financial Conduct Authority (FCA) opening a regulatory sandbox to allow businesses to test innovative services, products and business models aimed at enhancing customer outcomes while mitigating regulatory and reputational risks. Area growth and investments are expected to rise significantly over the coming year.

Robo advisory is practically speaking an online wealth management service providing automated portfolio management advice with no use of human financial planners. This area has already seen a lot of growth with multiple millions already invested (Betterment raised $100 million in a Series E funding round in Q1 2016), with companies becoming more mature and trying to broaden their offer with more sophisticated portfolio construction, further investments are expected to be seen in the coming months.

While a more mature market always comes with its own challenges, we remain convinced that the basic premise and inception of new models entering finance are still as relevant today as a few years ago. Looking at the data and activity from the broader market, it’s clear many share this world view and are positioning themselves in the market as it grows.

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed