Securities Crowdfunding Market Matrix

Securities Crowdfunding Market Matrix “Nothing is as powerful as an idea whose time has come” Victor Hugo

When analysing the crowdfunding market it is typically broken down into four main categories such as donation, reward, debt and equity. Securities crowdfunding, which is the generic clause for debt and equity crowdfunding, is sometimes also called crowdfund investing or crowdfinance. As argued in a previous post, crowdfunding is not a new asset class; it is rather a new conduit for financial flows which dis-intermediates the supply chain of capital allocation, and provides efficiency and transparency in the investment process, enabling investor and issuer to interact in better and more productive ways. In addition it reduces the search cost for the investor and allows for a high degree of risk diversification.

When analysing the crowdfunding market it is typically broken down into four main categories such as donation, reward, debt and equity. Securities crowdfunding, which is the generic clause for debt and equity crowdfunding, is sometimes also called crowdfund investing or crowdfinance. As argued in a previous post, crowdfunding is not a new asset class; it is rather a new conduit for financial flows which dis-intermediates the supply chain of capital allocation, and provides efficiency and transparency in the investment process, enabling investor and issuer to interact in better and more productive ways. In addition it reduces the search cost for the investor and allows for a high degree of risk diversification.

So it is no surprise that crowdfunding is rapidly dispersing into many sectors of the financial services industry. A wide range of institutional investors are suddenly beginning to show an interest in crowdfunding as it allows them directly to invest small amounts (for them) into projects or companies that offer higher yields compared to traditional bond or equities markets. The key obstacles that normally block institutional investors from making investments in smaller businesses or projects are the excessive “due diligence” requirements in proportion to the size of the investment. This obstacle can be removed by crowdfunding platforms as they provide for standardized and transparent due diligences practises whose results can be shared by many investors. In addition it enhances the liquidity of such assets and gives the investor the ability to optimize and rebalance their portfolio. The advantages for the issuer are equally compelling as they have access to a deeper investor pool and a lower cost of capital. A good example is B2B lending which works in the same way as peer-to-peer lending but with a different type of 'peers' and larger amounts.

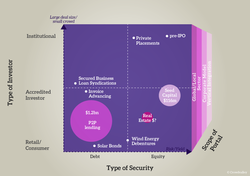

In order to understand better in which directions crowdfunding is evolving, we attempted to map out the landscape of emerging business models across the spectrum of securities crowdfunding portals. As with most categorisations it simplifies the reality and doesn't consider distinctive features of each jurisdiction around the globe. For example, equity crowdfunding in the US is so far only allowed for accredited investors while in the UK and other parts of Europe there are different restrictions.

While the graph is probably mostly self-explanatory, a few comments for better understanding: In order to make the four categories in the graph more granular, we added to the Y-axis the (average) size of transaction and crowd. On the X-axis we assume that the risk is increasing from the left to right, which should mean a proportional increase in yield. Hybrid securities, which have features from debt and equity securities, as well as royalty models are appearing, hence the circle on the vertical dividing line. We also see institutional investors acting as co-investors on consumer platforms, which explains why the seed-capital circle goes across the horizontal dividing line. The size of the circle designates the market volume of the business model globally, but due to large size of the p2p lending market (estimated global at $1.2bn in 2012 compared to start-up finance of $116m1), the scaling is out of proportion. Also there is no claim of accuracy of the location of the circles, it is at this stage for illustrative purposes only.

The three-dimensional aspect depicts the scope of the platform, e.g regional vs global, the targeted sector, e.g. sector-specific vs generic, as well as the corporate model of the portal, e.g. non-profit vs commercial. We also see 'themed' platforms emerging which offer products across the two securities sectors e.g impact investments. Furthermore portals can be differentiated by being involved in the pre-selecting issuers (or not), as well as the depth or vertical integration of the platform, meaning: is it just a matchmaking front-end with manual fulfilment or are business processes seamlessly integrated into backend processes of issuer and investor? The trends towards full process integration is evidenced by the service industries which are developing around crowdfunding platforms.

The market matrix is work in progress as the crowdfunding market unfolds. The market is in its infancy with many (exciting) uncertainties, but one thing seems certain: we will see far more and bigger circles on the map in the not too distant future, in particular in the institutional crowdfunding space. Its time has certainly come.

References:

1CROWDFUNDING INDUSTRY REPORT 2012, Crowdsourcing LLC, Massolution

In order to understand better in which directions crowdfunding is evolving, we attempted to map out the landscape of emerging business models across the spectrum of securities crowdfunding portals. As with most categorisations it simplifies the reality and doesn't consider distinctive features of each jurisdiction around the globe. For example, equity crowdfunding in the US is so far only allowed for accredited investors while in the UK and other parts of Europe there are different restrictions.

While the graph is probably mostly self-explanatory, a few comments for better understanding: In order to make the four categories in the graph more granular, we added to the Y-axis the (average) size of transaction and crowd. On the X-axis we assume that the risk is increasing from the left to right, which should mean a proportional increase in yield. Hybrid securities, which have features from debt and equity securities, as well as royalty models are appearing, hence the circle on the vertical dividing line. We also see institutional investors acting as co-investors on consumer platforms, which explains why the seed-capital circle goes across the horizontal dividing line. The size of the circle designates the market volume of the business model globally, but due to large size of the p2p lending market (estimated global at $1.2bn in 2012 compared to start-up finance of $116m1), the scaling is out of proportion. Also there is no claim of accuracy of the location of the circles, it is at this stage for illustrative purposes only.

The three-dimensional aspect depicts the scope of the platform, e.g regional vs global, the targeted sector, e.g. sector-specific vs generic, as well as the corporate model of the portal, e.g. non-profit vs commercial. We also see 'themed' platforms emerging which offer products across the two securities sectors e.g impact investments. Furthermore portals can be differentiated by being involved in the pre-selecting issuers (or not), as well as the depth or vertical integration of the platform, meaning: is it just a matchmaking front-end with manual fulfilment or are business processes seamlessly integrated into backend processes of issuer and investor? The trends towards full process integration is evidenced by the service industries which are developing around crowdfunding platforms.

The market matrix is work in progress as the crowdfunding market unfolds. The market is in its infancy with many (exciting) uncertainties, but one thing seems certain: we will see far more and bigger circles on the map in the not too distant future, in particular in the institutional crowdfunding space. Its time has certainly come.

References:

1CROWDFUNDING INDUSTRY REPORT 2012, Crowdsourcing LLC, Massolution

Rex is an innovative banker with more than 15 years experience in retail banking, treasury and commodity trading at Commerzbank, J.P. Morgan and ABB Financial Services. Through his passion for entrepreneurship and new markets he got involved during the dot-com era in building up a business incubation unit for ABB, subsequently spinning off a company which pioneered the implementation of the European emissions trading scheme. He continued his career in the climate change sector first by joining EcoSecurties, a leading startup company in developing carbon reduction projects worldwide, and more recently as director in the environmental markets team of BNP Paribas.

Rex strongly believes that crowdfunding will cause a paradigm shift in the financial service industry and that it will make a significant contribution to the transition towards a sustainable economy.

Rex strongly believes that crowdfunding will cause a paradigm shift in the financial service industry and that it will make a significant contribution to the transition towards a sustainable economy.

RSS Feed

RSS Feed