It has been over two years since the JOBS Act was passed, but famous Title III, which would allow crowdinvesting, has not yet been approved. While the entire US crowdfunding scene waits for the SEC to release the final rules, some states decided, in the meantime, to enable crowdinvesting within their borders.

Intrastate crowdfunding is a wider phenomenon than one could expect: according to Wikipedia, currently “thirteen (13) states have intrastate crowdfunding exemptions in place and fourteen (14) states are in various stages of enacting/considering sponsored legislation regarding such intrastate crowdfunding”. The first state to adopt equity crowdfunding exemptions was Kansas, back in 2011. However, until April 2014 only 10 companies were reported to have used the crowdfunding exemptions in place in the state. Why such a small number? Intrastate crowdfunding exemptions have a quite big limitation: crowdinvesting is restricted to investors resident in the state that approved the regulations. This has another implication that makes it even more difficult for an entrepreneur to use intrastate equity crowdfunding: the SEC prohibited the use of social media to make intrastate crowdfunding offerings, because the reach of these channels can be beyond state borders. And, as it is widely known, crowdfunding and social media often go hand in hand.

Another question that one could ask is what will happen to intrastate crowdfunding when Title III is eventually approved? According to some investors, federal equity crowdfunding will not substitute completely intrastate crowdfunding. In fact, intrastate equity crowdfunding potentially is a good finance source for small businesses that have a strong tie with a specific area, such as coffee shops or restaurants. These kinds of offerings are of interested most likely only to investors who live in the same area. However, what will be the destiny of intrastate crowdfunding after federal rules are approved by the SEC it is something we can only find out with time.

References

Clark, P. (2014). State Lawmakers Are Getting on the Crowdfunding Bandwagon. Bloomberg Business Week.

Stangler, D. (2014). State Equity Crowdfunding Policies Hold Promise.

Wikipedia. Crowdfunding Exemption Movement.

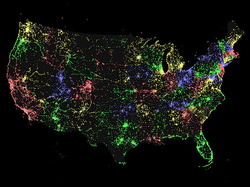

Image credit to: Jim Bumgardner http://bit.ly/Ub2YUc

Another question that one could ask is what will happen to intrastate crowdfunding when Title III is eventually approved? According to some investors, federal equity crowdfunding will not substitute completely intrastate crowdfunding. In fact, intrastate equity crowdfunding potentially is a good finance source for small businesses that have a strong tie with a specific area, such as coffee shops or restaurants. These kinds of offerings are of interested most likely only to investors who live in the same area. However, what will be the destiny of intrastate crowdfunding after federal rules are approved by the SEC it is something we can only find out with time.

References

Clark, P. (2014). State Lawmakers Are Getting on the Crowdfunding Bandwagon. Bloomberg Business Week.

Stangler, D. (2014). State Equity Crowdfunding Policies Hold Promise.

Wikipedia. Crowdfunding Exemption Movement.

Image credit to: Jim Bumgardner http://bit.ly/Ub2YUc

About the author - Irene Tordera

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

RSS Feed

RSS Feed