On February 25th Crowd Valley's CTO, Paul Higgins took part in a panel discussion hosted by BrightTALK entitled 'How Regtech can hep with Know-Your-Customer and Data Sharing Challenges'.

Online finance marketplaces operate in an environment of heavy regulations that can include requirements for:

- financial promotions and marketing of private securities;

- identifiable consumer data and PCI compliance;

- investor accreditation and eligibility;

- Know Your Customer (KYC); and

- Anti Money Laundering (AML).

At the same time, your users expect great online experiences, frictionless and instantaneous online processes, and an uninvasive ‘need-to-know’ approach to collecting their personal information. The online ecosystem for REGTECH has grown up rapidly in the past few years and fintech companies have a broader choice now than they have ever had. However, it is not always obvious which ones to choose.

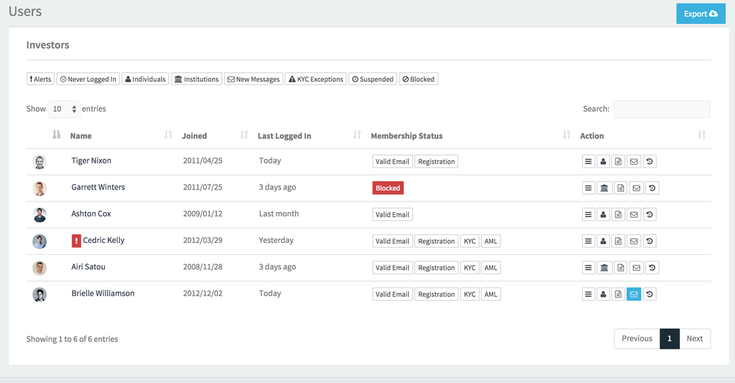

The KYC/AML process itself must take into account:

- The regulatory requirements for your platform's users: what information do you need to collect in order to satisfy your compliance obligations?

- Your business requirements: what do you need to collect in order to make the platform work in the correct way? How do you want to be able to segment or categorize your users?

- Your UX requirements: what information are your users likely to be willing to provide at each stage in the process?

The webinar discussed these points in the context of a couple of case studies from Crowd Valley's customer base, illustrating how to convert a compliance process flow-chart into an online user experience by building on top of the Crowd Valley API.

The full webinar recording can now be viewed on-demand. Paul's slides are also available to view here:

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed