Big changes are happening in the financial services industry, with Fintech that has experienced a fantastic growth and with financial technology companies now on pace to see the level of investments to reach a new record in 2017. As part of this, there is a case represented by Real Estate, a trillions dollars sector that has been slow to change, which is seeing a wave of innovation with property technology, or Proptech.

We talked about Real Estate crowdfunding different times already, but when speaking about Proptech, we are considering a far broader segment, referring more in general to those companies using technology to “improve or reinvent the services we rely on in the property industry to buy, rent, sell, build, heat or manage residential and commercial property”, improving a range of related services from the access to mortgages to building energy efficient homes. And we are now starting to have very concrete examples about how this is changing the property market.

An illiquid market where it’s expensive to trade property and where “there is a large risk of abortive expenditure, and the result can be a very wide bid-offer spread” is listed as one of the key Real Estate’s current limit in a report called “PropTech 3.0: the future of real estate”, recently published by Professor Andrew Baum of the Saïd Business School at the University of Oxford. “Crowdfunding platforms, on line secondary market platforms and blockchain make this the most intriguing of FinTech questions. It seems very likely that the many tech-based contributions to the residential sales process will bear fruit. If investor protection issues can be solved, tech platforms will enable smaller residential assets to transact on platforms and exchanges in reasonable quantity, leading to exponential growth and radical change.” said Professor Baum.

Alex Gosling, CEO of HouseSimple.com, says that he managed the sale of more than 18,000 properties since the launch of its platform in 2015, with a rough £40M (approximately $54M) saved, considering the usual agent fee charged on the average UK house price. “As more people feel comfortable with the online model, we expect online agents to grab a bigger slice of the UK estate agency market. Currently, online estate agents have around 5% market share. We believe this will increase to 15%–20% by 2020,” Gosling says.

Returning to an area more familiar to our readers, there is RealtyShares, a San Francisco based company that just raised a new funding round of $28M, led by Cross Creek Advisors.

They developed a debt and equity Real Estate investments platform, that since its launch in 2013, has deployed $500M across more than 1,000 properties, with a typical transaction size between $2M and $5M.

Another good example of Proptech company that is doing well is Habito, a digital mortgage broker that just received investments for £18.5M (approximately $25M), in a raise led by the venture capital fund Atomico. Since its launch in April last year, Habito advised over 50,000 people on mortgages worth more than half a billion pounds. Niall Wass, Partner at Atomico, said that the big inefficiencies within the mortgage market present at the moment an attractive investment opportunity.

An illiquid market where it’s expensive to trade property and where “there is a large risk of abortive expenditure, and the result can be a very wide bid-offer spread” is listed as one of the key Real Estate’s current limit in a report called “PropTech 3.0: the future of real estate”, recently published by Professor Andrew Baum of the Saïd Business School at the University of Oxford. “Crowdfunding platforms, on line secondary market platforms and blockchain make this the most intriguing of FinTech questions. It seems very likely that the many tech-based contributions to the residential sales process will bear fruit. If investor protection issues can be solved, tech platforms will enable smaller residential assets to transact on platforms and exchanges in reasonable quantity, leading to exponential growth and radical change.” said Professor Baum.

Alex Gosling, CEO of HouseSimple.com, says that he managed the sale of more than 18,000 properties since the launch of its platform in 2015, with a rough £40M (approximately $54M) saved, considering the usual agent fee charged on the average UK house price. “As more people feel comfortable with the online model, we expect online agents to grab a bigger slice of the UK estate agency market. Currently, online estate agents have around 5% market share. We believe this will increase to 15%–20% by 2020,” Gosling says.

Returning to an area more familiar to our readers, there is RealtyShares, a San Francisco based company that just raised a new funding round of $28M, led by Cross Creek Advisors.

They developed a debt and equity Real Estate investments platform, that since its launch in 2013, has deployed $500M across more than 1,000 properties, with a typical transaction size between $2M and $5M.

Another good example of Proptech company that is doing well is Habito, a digital mortgage broker that just received investments for £18.5M (approximately $25M), in a raise led by the venture capital fund Atomico. Since its launch in April last year, Habito advised over 50,000 people on mortgages worth more than half a billion pounds. Niall Wass, Partner at Atomico, said that the big inefficiencies within the mortgage market present at the moment an attractive investment opportunity.

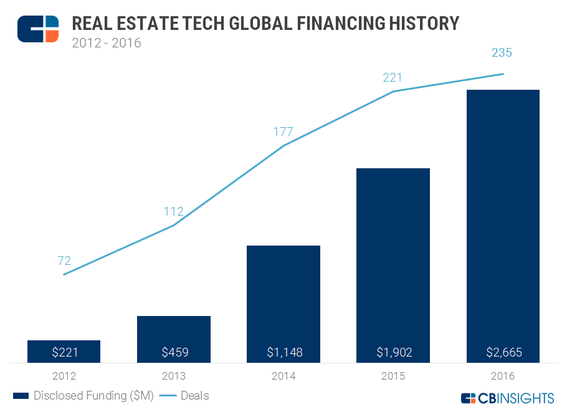

Looking more in general at the market, Proptech companies received about $6.4B in investments across 817 deals since 2012, with investments from venture capital that peaked last year. In 2017, with $1.46B already invested across 107 deals in the first part of the year, the total amount of dollars invested is expected to reach $3.4B, exceeding 2016 by 25%. We will need to wait to see how the market will develop in the future, but the perspectives at the moment certainly seem very positive, not the least considering the massive scale of the labor intense global property market.

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the Fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Valencia and Barcelona, where he currently lives. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the Fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Valencia and Barcelona, where he currently lives. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed