In the past five-to-six years, crowdfunding has undergone impressive growth, finding several new applications and evolving into several forms. In particular, we have seen the birth of securities crowdfunding, that is online investing into securities, like debt or equity. This new financing method is getting more and more attention from national regulators and traditional financial sector actors – e.g. broker-dealers, investment banks, private equity funds, etc. – that see it as an innovation, bringing along more transparency and efficiency, that is here to stay.

Having acknowledged the paradigm shift that crowdfunding is bringing about, national regulators had to react. Crowd Valley has been involved in several discussions with regulators from different countries, whose focus, of course, is mainly on equity crowdfunding in its original form, that is online investing in startups and how to open it up to the retail investors, while at the same time protecting them. Despite the fact that Italy is the only country that has already implemented a regulation for equity crowdfunding so far, a lot is moving in other countries too. The UK, the US, Canada and France are just a few of the countries whose governments are working on regulations for crowdfunding.

Looking at What Neighbor States are Doing.

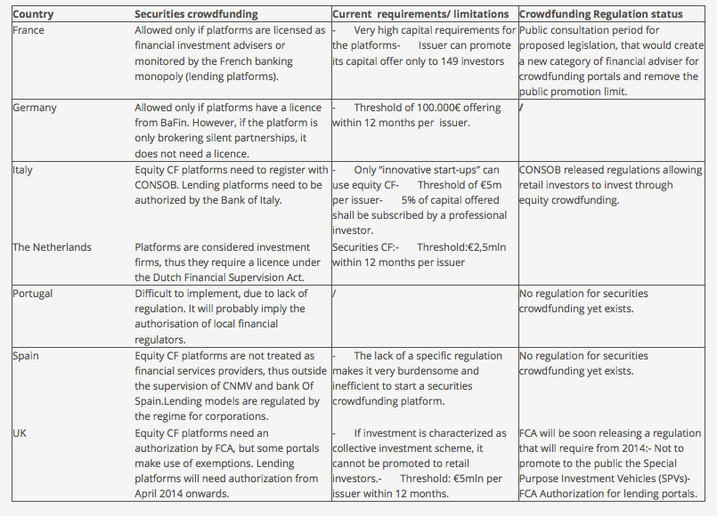

With regards to Europe, there is a growing concern expressed by several parties that the different legislations will obstruct the creation of a cross-border crowdfunding industry, thus limiting the innovative potential of crowdfunding. Regardless of whether a pan-European crowdfunding industry is needed, it is, nevertheless, important for each national regulator to observe what its neighbors are doing with respect to this new sector, in order to identify best practices. Based on research recently published by the European Crowdfunding Network (ECN), the legal situation of securities crowdfunding in some European states is reported below.

Will Pan-European Securities Crowdfunding Ever Happen?

As it is possible to see from the table, each country is treating securities crowdfunding in a different way and not all of them are at the same stage. However, this was quite predictable, since crowdfunding is still very novel and, as such, governments are trying to fit it within their existing legal frameworks. As the phenomenon becomes more familiar to everyone, regulators will be better able to understand it and evaluate whether there is a need to create a specific regulation, in order to facilitate its development. The real challenge will be, in that case, to harmonize the national crowdfunding regulations so as to form a cross-border European crowdfunding market. The European Commission, supported by ECN, has so far moved in the right direction, encouraging its member states to look at what the others are doing and launching a public consultation to frame European’s thoughts and opinions on the topic. Will we ever see a cross-border crowdfunding industry developing in Europe?

References:

European Crowdfunding Network. Review of Crowdfunding Regulation. (2013)

Reuters. European Commission Considers Regulation of Crowdfunding. (2013)

Photo Credit: https://bit.ly/p/8uvHKo

Looking at What Neighbor States are Doing.

With regards to Europe, there is a growing concern expressed by several parties that the different legislations will obstruct the creation of a cross-border crowdfunding industry, thus limiting the innovative potential of crowdfunding. Regardless of whether a pan-European crowdfunding industry is needed, it is, nevertheless, important for each national regulator to observe what its neighbors are doing with respect to this new sector, in order to identify best practices. Based on research recently published by the European Crowdfunding Network (ECN), the legal situation of securities crowdfunding in some European states is reported below.

Will Pan-European Securities Crowdfunding Ever Happen?

As it is possible to see from the table, each country is treating securities crowdfunding in a different way and not all of them are at the same stage. However, this was quite predictable, since crowdfunding is still very novel and, as such, governments are trying to fit it within their existing legal frameworks. As the phenomenon becomes more familiar to everyone, regulators will be better able to understand it and evaluate whether there is a need to create a specific regulation, in order to facilitate its development. The real challenge will be, in that case, to harmonize the national crowdfunding regulations so as to form a cross-border European crowdfunding market. The European Commission, supported by ECN, has so far moved in the right direction, encouraging its member states to look at what the others are doing and launching a public consultation to frame European’s thoughts and opinions on the topic. Will we ever see a cross-border crowdfunding industry developing in Europe?

References:

European Crowdfunding Network. Review of Crowdfunding Regulation. (2013)

Reuters. European Commission Considers Regulation of Crowdfunding. (2013)

Photo Credit: https://bit.ly/p/8uvHKo

About the author - Irene Tordera

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

RSS Feed

RSS Feed