“Driven by technology on the supply side and the financial crisis on the demand side, an investment revolution has begun.”

Andrew Haldane, Executive Director, Bank of England

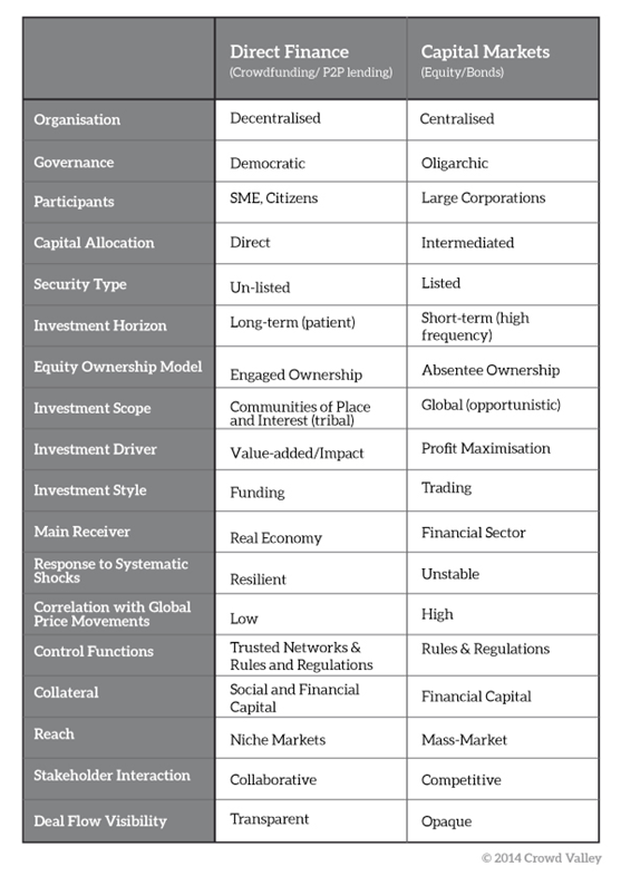

Direct financing, such as equity crowdfunding and P2P lending, as well as capital markets act both as an information bridge and a conduit of financial flows between a large number of investees/borrowers and a large number of investors/lenders who receive a return for their investment. But the similarities already stop there. The design and characteristics of those two marketplaces are profoundly different.

Andrew Haldane, Executive Director, Bank of England

Direct financing, such as equity crowdfunding and P2P lending, as well as capital markets act both as an information bridge and a conduit of financial flows between a large number of investees/borrowers and a large number of investors/lenders who receive a return for their investment. But the similarities already stop there. The design and characteristics of those two marketplaces are profoundly different.

The table below attempts to illustrates differences in a simplified way.

It is becoming more and more obvious that capital markets and the banking system institutionalise irresponsibility and is unsustainable. The nascent market of direct finance promises to deliver a better, intrinsically social system with embedded accountability. It reconnects people with the reality of their money and empowers them to create a world they want to see.

Direct finance is far better aligned with the real economy of the 21st century, which is increasingly decentralised. A trend which is reinforced by an growing start-up culture which is fuelled by a familiar driving force: crowdfunding. Together with complementary currencies such as digital money and other emerging innovations in particular in the payment sector one can truly say that an investment revolution is on its way.

Photo Credit: Rafael Matsunaga: https://bit.ly/p/JmU2w

It is becoming more and more obvious that capital markets and the banking system institutionalise irresponsibility and is unsustainable. The nascent market of direct finance promises to deliver a better, intrinsically social system with embedded accountability. It reconnects people with the reality of their money and empowers them to create a world they want to see.

Direct finance is far better aligned with the real economy of the 21st century, which is increasingly decentralised. A trend which is reinforced by an growing start-up culture which is fuelled by a familiar driving force: crowdfunding. Together with complementary currencies such as digital money and other emerging innovations in particular in the payment sector one can truly say that an investment revolution is on its way.

Photo Credit: Rafael Matsunaga: https://bit.ly/p/JmU2w

About the author - Rex Kempcke

Rex is an innovative banker with more than 15 years experience in retail banking, treasury and commodity trading at Commerzbank, J.P. Morgan and ABB Financial Services. Through his passion for entrepreneurship and new markets he got involved during the dot-com era in building up a business incubation unit for ABB, subsequently spinning off a company which pioneered the implementation of the European emissions trading scheme. He continued his career in the climate change sector first by joining EcoSecurties, a leading startup company in developing carbon reduction projects worldwide, and more recently as director in the environmental markets team of BNP Paribas.

Rex strongly believes that crowdfunding will cause a paradigm shift in the financial service industry and that it will make a significant contribution to the transition towards a sustainable economy. Born and raised in Germany, he gained a qualification as banker and a Masters degree in economics from University Hamburg. He currently lives in the UK with his wife and two daughters.

Rex is an innovative banker with more than 15 years experience in retail banking, treasury and commodity trading at Commerzbank, J.P. Morgan and ABB Financial Services. Through his passion for entrepreneurship and new markets he got involved during the dot-com era in building up a business incubation unit for ABB, subsequently spinning off a company which pioneered the implementation of the European emissions trading scheme. He continued his career in the climate change sector first by joining EcoSecurties, a leading startup company in developing carbon reduction projects worldwide, and more recently as director in the environmental markets team of BNP Paribas.

Rex strongly believes that crowdfunding will cause a paradigm shift in the financial service industry and that it will make a significant contribution to the transition towards a sustainable economy. Born and raised in Germany, he gained a qualification as banker and a Masters degree in economics from University Hamburg. He currently lives in the UK with his wife and two daughters.

RSS Feed

RSS Feed