Distributed Ledger Technologies (or Blockchains) have gained a tremendous amount of traction over the last couple of years or so, and they are due to serve a far larger purpose than anyone could have imagined in the early Bitcoin days. This article aims to explain how distributed ledgers are changing the modern internet as we know it, on a very fundamental level.

Communication protocols like TCP/IP and HTTP were created in the early days of the internet, which were considered (and still are) great technological advances. These early protocols were developed by scientists and researchers without much financing or economic incentive for outperformance or competitiveness. Over the last 30 or so years, these protocols have been adopted in all aspects of society, creating the modern internet we know today. These protocols are still functioning even though they are somewhat restrictive and “thin” compared to new potential technologies, but at the same time, are difficult to replace due to the interconnectedness of modern systems, so the question stands: how do we find a way to adopt better technology, and how do they add value to society?

Distributed ledger technologies (DLT) are essentially new P2P versions of communication protocols, with embedded data and even processing capability between systems. These are being developed and used today for various reasons; store of monetary value (such as Bitcoin), processing power (Ethereum), or data storage (StorJ and Siacoin). New DLT’s are being developed continuously, a handful are raising funding at the time of writing this article.

The important thing to understand about DLT’s is that each have their own embedded economic models, creating incentives for different parties in the system to develop, secure, and run the network of peers (or nodes). For example, Bitcoin is considered a store of value, where the Bitcoin holder pays miners to secure the network in the form of inflation. Meanwhile in Ethereum, network users use Ethereum tokens (Ether) to pay for processing power. This means that each token in each DLT’s network has a monetary value, since it can be exchanged for goods or services.

Why is Distributed Ledger Technology so important?

Distributed ledgers provide a new way of storing, maintaining, and accessing data. Rather than storing data on centralized servers, the data is stored across all peers (nodes) in the network, meaning that there’s a correct copy of data stored in “n” amount of locations across the globe, but how does this add any value? Decentralizing data decreases the risk of data loss, as a failure in a single node will only have a marginal impact on the entire network. Perhaps the most important feature of DLT is correctness, making data alterations in a single node will not affect the general consensus across all other nodes, meaning that historical data is nearly impossible to alter or manipulate without cooperation from over 50% of nodes in the network, this “correctness” or “immutability” has the potential of changing dynamics across all markets and verticals, as market participants can essentially operate in a trustless environment where all data can always be considered correct. It is even believed that this technology can reduce fraud and effectivize audit and regulatory activities, since validation of historic data is no longer an issue.

What effect will Distributed Ledgers have on the internet?

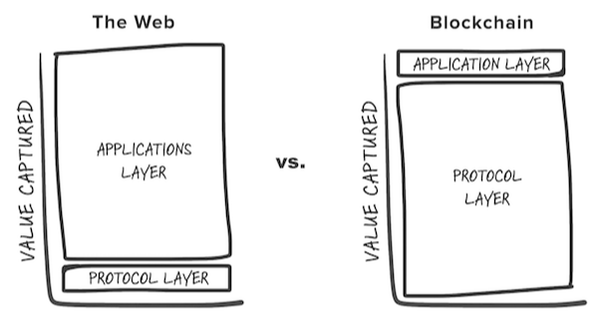

Traditional internet companies, like Facebook, Google and Twitter, hoard massive amounts of data, and the vast majority of their revenues and market value is based on proprietary data. These companies use a “thin protocol” layer (TCP/IP, HTTPS) to access their services. In the current market, the vast majority of value is captured in the company, while the “thin protocol” is only a means of accessing their service.

Distributed ledger technologies (DLT) are essentially new P2P versions of communication protocols, with embedded data and even processing capability between systems. These are being developed and used today for various reasons; store of monetary value (such as Bitcoin), processing power (Ethereum), or data storage (StorJ and Siacoin). New DLT’s are being developed continuously, a handful are raising funding at the time of writing this article.

The important thing to understand about DLT’s is that each have their own embedded economic models, creating incentives for different parties in the system to develop, secure, and run the network of peers (or nodes). For example, Bitcoin is considered a store of value, where the Bitcoin holder pays miners to secure the network in the form of inflation. Meanwhile in Ethereum, network users use Ethereum tokens (Ether) to pay for processing power. This means that each token in each DLT’s network has a monetary value, since it can be exchanged for goods or services.

Why is Distributed Ledger Technology so important?

Distributed ledgers provide a new way of storing, maintaining, and accessing data. Rather than storing data on centralized servers, the data is stored across all peers (nodes) in the network, meaning that there’s a correct copy of data stored in “n” amount of locations across the globe, but how does this add any value? Decentralizing data decreases the risk of data loss, as a failure in a single node will only have a marginal impact on the entire network. Perhaps the most important feature of DLT is correctness, making data alterations in a single node will not affect the general consensus across all other nodes, meaning that historical data is nearly impossible to alter or manipulate without cooperation from over 50% of nodes in the network, this “correctness” or “immutability” has the potential of changing dynamics across all markets and verticals, as market participants can essentially operate in a trustless environment where all data can always be considered correct. It is even believed that this technology can reduce fraud and effectivize audit and regulatory activities, since validation of historic data is no longer an issue.

What effect will Distributed Ledgers have on the internet?

Traditional internet companies, like Facebook, Google and Twitter, hoard massive amounts of data, and the vast majority of their revenues and market value is based on proprietary data. These companies use a “thin protocol” layer (TCP/IP, HTTPS) to access their services. In the current market, the vast majority of value is captured in the company, while the “thin protocol” is only a means of accessing their service.

Now imagine a world where data and processing power is housed within the internet protocol (i.e. Ethereum Virtual Machine), and the internet application is simply a thin layer sitting on top. This means that most of the value lies within the “fat protocol”, while the internet companies themselves capture only a smaller proportion based on what type of user experience they can provide. In this environment, entry barriers to very capital and data intensive industries are far lower, and we can expect a much higher level of competitiveness, better user experience, and general social benefit. The scalability of distributed ledgers is often debated, but in case the underlying technology catches up, we may even see performance related scale advantages in using distributed ledgers.

There is no guarantee that data and processing will move to a distributed environment, but as more and more data is stored on distributed ledgers, the higher the value of utilizing that technology there will be, this “network effect” may lead to exponential growth in adoption of distributed ledgers.

There is no guarantee that data and processing will move to a distributed environment, but as more and more data is stored on distributed ledgers, the higher the value of utilizing that technology there will be, this “network effect” may lead to exponential growth in adoption of distributed ledgers.

About the Author: Alexander Berg

Alex has been working with Crowd Valley for over 3 years, he has managed planning and development on several dozen client cases locally in London, New York, Helsinki, and San Francisco, and remotely on a global scale. He specializes in process design for P2P/P2B lending, equity crowdfunding, real estate crowdfunding, and corporate debt issuance applications. He has worked with clients ranging from startups to larger institutions and banks. Alex also oversees development and release cycles for the Crowd Valley API, managing a team of more than 10 developers. He has held presentations and workshop sessions for various participants in the Fintech and Financial Services space. Alex holds a BSc in Finance and Statistics from a triple accredited university, Hanken School of Economics.

Alex has been working with Crowd Valley for over 3 years, he has managed planning and development on several dozen client cases locally in London, New York, Helsinki, and San Francisco, and remotely on a global scale. He specializes in process design for P2P/P2B lending, equity crowdfunding, real estate crowdfunding, and corporate debt issuance applications. He has worked with clients ranging from startups to larger institutions and banks. Alex also oversees development and release cycles for the Crowd Valley API, managing a team of more than 10 developers. He has held presentations and workshop sessions for various participants in the Fintech and Financial Services space. Alex holds a BSc in Finance and Statistics from a triple accredited university, Hanken School of Economics.

RSS Feed

RSS Feed