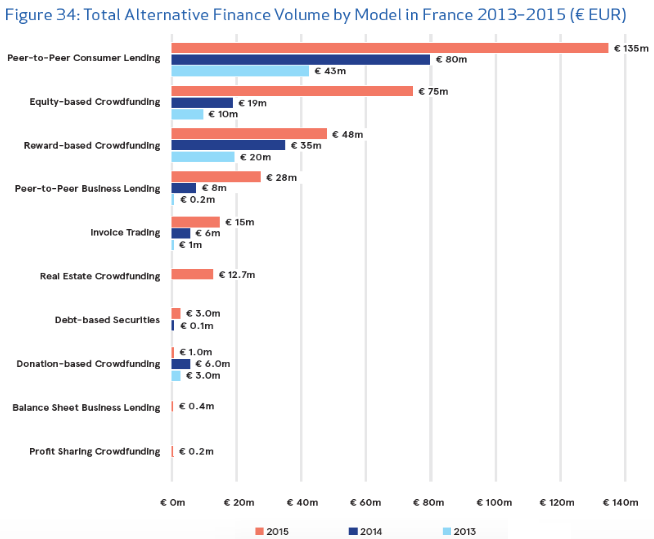

The alternative finance sector in France is experiencing great momentum. It’s the second largest market in Europe after the UK, with a volume that has more than doubled between 2013 and 2014 (+103%) and then again between 2014 and 2015 (+107%), reaching €319 million in the past year. France is also home to nearly half of the largest banks in Europe. The updated regulations, published in the Journal Officiel the 30th of October 2016, could be what is needed to allow the market to take off and reach the next level.

In France the entire alternative finance market is experiencing significant growth, but it is the equity crowdfunding sector that have seen the biggest growth in the past year, with the volume of investments passing from €19 million in 2014 to €75 million in 2015, with a +298% growth year on year. Peer-to-peer consumer lending remains the the most popular model in the country, accounting for 42% of the total market in 2015, with a 68% growth year on year.

But what has changed with the updated regulations?

1 - Equity Crowdfunding

French equity based crowdfunding platforms (or crowdinvesting platforms), that are registered as Conseil en Investissement Participatif (CIP, equity investment advisor), with the national financial market regulator, the Autorité des marchés financiers (AMF), can allow firms to raise up to €2.5 million in funding, with a relevant increase on the previous cap of €1 million. For those looking for investors, there is now the additional the possibility of offering preferred shares in addition to simple shares, convertible bonds as well as participatory notes in addition to plain vanilla bonds.

2 - Peer-to-Peer Lending

Peer-to-peer lending platforms (or marketplace lending or crowdlending platforms), that are registered as Intermédiaire en Financement Participatif (IFP, crowdlending intermediary) with APCR, the national financial services regulator, now have the cap on lender contribution increased from €1,000 to €2,000 per investor per project, for loans that have an interest rate related to it. The cap for interest free loans was also raised from €4,000 to €5,000 per investor per project.

3 - Crowdfunding Debt Securities (“Minibons”)

The new decree also regulates the issuance of new financial instruments called “minibons”, a form of crowdfunding debt securities, that can be bought by individuals, corporations and investment funds. The instrument allows firms to lend to businesses on crowdfunding platforms that are registered as Conseil en Investissement Participatif (CIP, equity investment advisor), with AMF, the national financial market regulator. Firms willing to issue the “minibons” must have a minimum of three financial accounts, with funding that’s capped to €2.5 million for 12 months.

The firms operating in the alternative finance sector seemed quite satisfied with previous regulations, with 50% of those surveyed by the Cambridge Centre for Alternative Finance in their report titled “Sustaining Momentum”, found the rules applied to online investing and lending adequate and appropriate. A percentage that reached 59% when discussion the new national regulations.

All in all the alternative finance sector in France is in good shape at the moment and these enhanced regulations make us even more optimistic about the future developments. From equity and real estate crowdfunding to P2P consumer and business lending, as well as invoice trading, the investment volumes have growth at a significant pace in the recent years. Now looking at the current trends, with investments in technology firms that increased by 200% in Q3 2016 from the previous quarter, and taking in consideration also the UK’s vote to quit European Union, there are few good cards to play for France, and for Paris in particular, to get a bigger role in the financial technology industry.

More information about the updated regulations for equity crowdfunding and P2P lending can be found here, while the full decree (in French) can be downloaded from this link. If you have questions about the best opportunities to focus on and how to get the most out of our digital finance infrastructure to enter the market you just have to get in touch with us and we will be glad to assist you.

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed