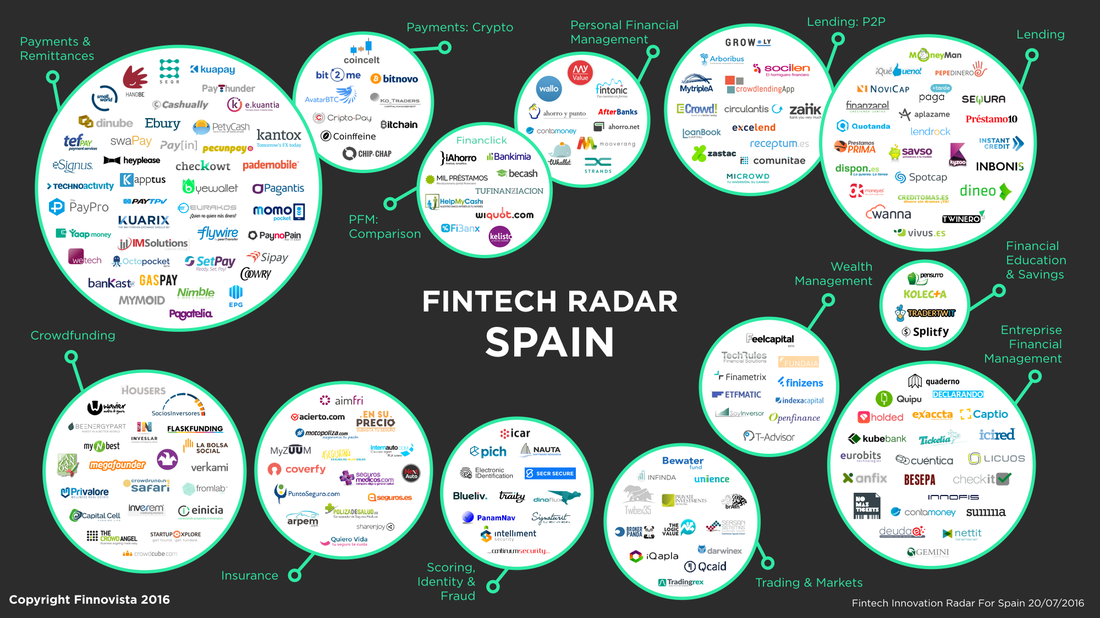

Fintech has not been on the radar in Spain long, it was long not known by most of the people and with just 50 financial technology companies, and with few successes. But things have improved quite rapidly and accordingly to Fintech Radar Spain 2016, prepared by Finnovista, the sector can now count 208 startups, with a 400% increase in just three years, and few players that are making waves.

The fintech industry has growth at an impressive rate, not just in Spain but also in other parts of the world, presenting an opportunity for the country to modernize the financial sector and the banking system. What’s interesting about Spain in particular is that it has seen a growth in the whole technology sector, despite the economic crisis that has gripped harder than in most of other countries, and the confused political situation. Spain is still without government, with a third public vote in sight in less than a year. What has helped out is that housing and office space is cheap, with a low cost of living even in Madrid and Barcelona if you compare it with London and New York. The extremely high level of youth unemployment, which is gradually getting better but still at 43.9%, has had an impact, creating an enormous pool of talented engineers and business graduates ready to join the most promising new ventures or to start their own company.

But it’s not only the recent successes and the abundance of talent that makes Spain well positioned with Fintech, it’s also about the role that it can play with the LATAM countries, on which its connections are always strong. With 208 startups, Spain is now the largest fintech market in Ibero-America, followed by Brazil with 130, Mexico 128, Colombia 77 and Chile with 56 financial technology ventures.

The advancements in Latin America have been encouraging, with financial technology companies offering new and cheaper alternatives to traditional banking, fintech emerged as a way for people to easily access and use their wages and savings, and beyond the disruption, it is also becoming a way to achieve financial inclusion in the region.

Spain is leading over LATAM in all the fintech sub-sectors except Financial Education & Saving, with Latin America in the lead. In Spain, the segments with most companies are Payments & Remittances (24%), Lending (19%), Enterprise Financial Management (11%), Crowdfunding (10%), Personal Finance Management (10%) and Insurance (8%).

With 80% of fintech startups offering products and services for consumers (B2C), this presents a clear threat or opportunity for those ready to take it, for Spanish banks. Some banks are leading the way, for example BBVA that has created a $250 million fintech fund, and bought two financial technology companies in the last year - Simple, an American online-only bank, for $117 million, and Holvi, another digital bank this time from Finland, for an undisclosed amount - it seems clear that most traditional financial players still have to realize the big opportunity they now have with this new wave of innovation.

More cooperation, partnerships, and acquisitions are in sight, not only in Spain but also elsewhere, as banks, insurance companies and more in general all the traditional financial players, are on a steep learning curve. Think for example about the 600 bank branches that have been closed down in Spain in 2015 alone, that the sector has no alternative but to embrace technology and innovation for more growth.

With 80% of fintech startups offering products and services for consumers (B2C), this presents a clear threat or opportunity for those ready to take it, for Spanish banks. Some banks are leading the way, for example BBVA that has created a $250 million fintech fund, and bought two financial technology companies in the last year - Simple, an American online-only bank, for $117 million, and Holvi, another digital bank this time from Finland, for an undisclosed amount - it seems clear that most traditional financial players still have to realize the big opportunity they now have with this new wave of innovation.

More cooperation, partnerships, and acquisitions are in sight, not only in Spain but also elsewhere, as banks, insurance companies and more in general all the traditional financial players, are on a steep learning curve. Think for example about the 600 bank branches that have been closed down in Spain in 2015 alone, that the sector has no alternative but to embrace technology and innovation for more growth.

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed