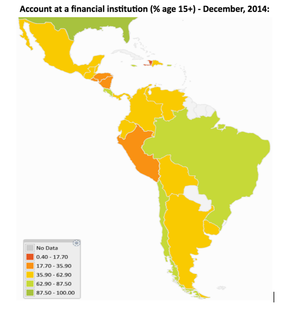

According to the World Bank’s Global Financial Inclusion Database, only 51% of the population in Latin America and the Caribbean has a bank account. This figure varies greatly between countries, with more than 80% of the adult population remaining ‘unbanked’ in Nicaragua for less than 35% in Brazil and Costa Rica.

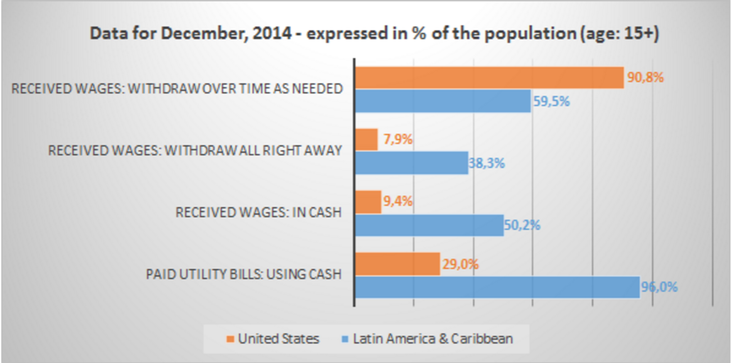

Furthermore, it means that millions of people have to use cash for each transaction across the continent. With for instance, 96% of the population paying its utility bills in cash – which is more than 3 times the level than can be observed in the United States or the Euro Area.

Likewise, half of the population receive its wages in cash and overall, almost 40% of all wages are withdrawn right away. Far from what can be observed in the West: only 10% of the wages are received in cash, and between 4% and 7% of all wages are withdrawn right away.

With so much cash circulating, issues of safety inevitably arise, and without a bank account it becomes harder to invest or save for retirement. Something even more problematic in countries known for the fluctuations of their respective currencies.

Likewise, half of the population receive its wages in cash and overall, almost 40% of all wages are withdrawn right away. Far from what can be observed in the West: only 10% of the wages are received in cash, and between 4% and 7% of all wages are withdrawn right away.

With so much cash circulating, issues of safety inevitably arise, and without a bank account it becomes harder to invest or save for retirement. Something even more problematic in countries known for the fluctuations of their respective currencies.

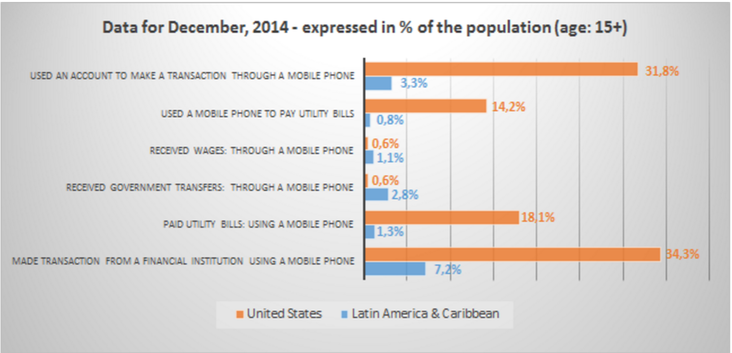

The situation is starting to change, with financial technology companies offering new and cheaper alternatives to traditional banking. All over Latin America, Fintech emerged as way for people to easily access and use their wages and savings. An example would be the numerous mobile money services, which enable the ‘unbanked’ population to make and receive payments through their mobile phones. Today, mobile money services are available in almost every Latin American country, and with an average of 47.4% the region is home to the world’s highest active customer rate (defined as the number of accounts that were used to conduct at least one transaction over the past 90 days). Yet, the total share of adults with a mobile money account is less than 3% in the Latin America & Caribbean region.

Companies like Mimoni, the largest online short-term consumer lender for the unbanked population in Latin America,proved themselves able to disrupt a multi-billion dollar market, and other innovative services are growing at a rapid pace. For the second year in a row, mobile money based remittances are growing by more than 50% in the region and the number of adults receiving governments transfers through a phone is 3 to 5 times higher than in Europe or in the United States (respectively).

Like in the rest of the world, financial technologies were originally developed by startups in Latin America. However, traditional banks are now using Fintech to reduce their costs and reach out to untapped markets. Rather than a risk, some see an opportunity in the rise of the sector. For example, Richard Eldridge - CEO and co-founder of Fintech company Lenddo – observes that “some of the biggest banks are being the most innovative [and] are going to compete with the disruptors”. Adding that ultimately, “the consumer will win”.

Beyond the way Fintech disrupts existing models in Latin America, it is also becoming a way to achieve financial inclusion in the region. Mobile money services, credit ratings based on alternative data, new ways of financing SMEs, personal lending…if different in nature, innovative financial technology services are ways to bypass regional issues, and ultimately grant people and businesses an access to appropriate financial products and services.

At Crowd Valley, we are already actively working in the region and look forward to partnering with both established organizations and new innovators to provide more services and value to the end users as the financial services market continues its modernization in Latin America.

Sources:

1. Mobile Financial Services in Latin America - GSMA 2015

2. State Of The Industry Report - GSMA 2015

3. How Fintech is Boosting Financial Inclusion in Latin America (http://www.fintech.finance/news/how-fintech-is-boosting-financial-inclusion-in-latin-america/)

4. Fintech Lagging in Latin America Because of Regulation (http://www.theepochtimes.com/n3/2094318-fintech-lagging-in-latin-america-because-of-regulation/)

About the author - Enzo Ramos

Born and raised in France, Enzo began working within Fintech in 2014, covering the regulatory changes than enabled the creation of French equity crowdfunding platforms for Lyon Place Financière, an association that regroups all actors of Auvergne-Rhône-Alpes’ financial place. There, he also worked on an exhaustive analysis of the regional stock market among other duties. Enzo has lived and studied in different countries, including the United States (Philadelphia & Monroe,MI) and France (Paris & Lyon).

Born and raised in France, Enzo began working within Fintech in 2014, covering the regulatory changes than enabled the creation of French equity crowdfunding platforms for Lyon Place Financière, an association that regroups all actors of Auvergne-Rhône-Alpes’ financial place. There, he also worked on an exhaustive analysis of the regional stock market among other duties. Enzo has lived and studied in different countries, including the United States (Philadelphia & Monroe,MI) and France (Paris & Lyon).

RSS Feed

RSS Feed