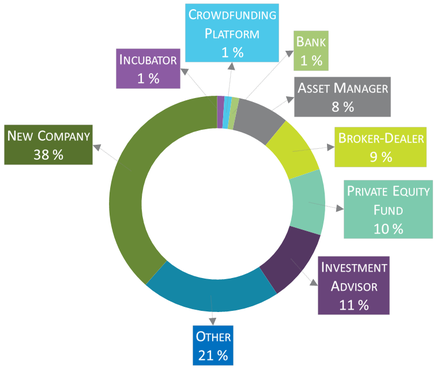

Breakdown of Organization Types Interested in Crowdfunding in Crowd Valley's 2014 Q2 Market Report

Breakdown of Organization Types Interested in Crowdfunding in Crowd Valley's 2014 Q2 Market Report As Malaysia’s framework for online investment marketplaces (equity crowd funding) is unveiled, there’s a lot of buzz around the region about the impact of new online funding models. While countries like Malaysia are looking to other countries for benchmarks, initial frameworks are still largely mirroring one another and real world applications will show how they can be applied to new regions.

The Immediate Call for Need for New Regulation – Really?

There may be an observation worth making, with regard to financial services powerhouses like Hong Kong and Singapore in South East Asia, similar to for example London and Frankfurt in Europe. When it comes to regulation, let’s be honest, there are a lot of existing frameworks within financial services and it hardly seems that new regulation, would be a requirement for new models to emerge. New models that combine the financial services industry and the efficiency of the Internet and new age tools.

As we’ve uncovered and also published in our Quarterly Research Reports, the new online investment marketplace is broad and includes broad categories such as early and later stage private company marketplaces, both equity and debt peer to peer marketplaces, various models for residential and commercial real estate marketplaces and expansions to existing investment models and activities.

Then on the other hand, financial services hubs include and encapsulate various financial brokers, asset managers, placement agents and so on, professional companies with deep and broad experience, track record and expertise in the market, regulated and holding financial services licenses under regulation which has been around in many cases for decades.

Putting Two and Two Together

Is there a discrepancy between operators who have the knowledge in the market, and those actually starting online investment marketplaces around the world? We don’t think so, but there is a lag in seeing the market for the opportunity it represents for established, financial services companies.

Since the popular discussion around the Internets application to the financial services market, is often debated in the context of early stage startups, its no wonder established operators don’t see an immediate fit. However, we could argue that is changing, with interest picking up from very established companies around the world, who see an opportunity to bring more efficiency and structure to their operations in for example a specific niche or vertical, or even create a new point of sale or user acquisition channel for their services.

The financial services market is complicated and it does require substantial resources in approaching a new model or structure in such a market. However, just because of an online application or expansion, one should not assume the nature of the business would be any different than what is already tried and true in many other models and approaches. The efficiency or structural gains, however, can be substantial in establishing an actual asset for the business rather than simply a new business expense.

For a professional organization in financial services, leveraging existing licenses and ongoing operations, is often a natural step to develop expanded offerings. However, despite possible long term aims and goals, it is more of a platform to build on top of, like a business roadmap for the future, than an immediate change of direction.

Anticipating Trends in Asset Classes

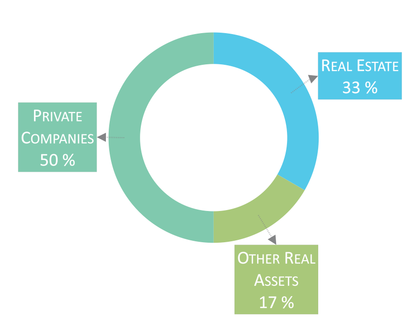

To date, we have observed a relatively even distribution of interest from established financial services companies, half of which represents an interest in private companies, a third real estate and the rest other real assets. Given interest in assets such as properties also magnified in certain regions such as South East Asia (think for example Hong Kong, Singapore and other cities which have seen incredible rises in property prices), the rise of property marketplaces could be expected. Another way to consider the evolution, would be to think of what investor dollars are currently going into and what demographics around the world or in certain regions, like to be part of. These are surely going to be represented in new online investment marketplaces and focused around certain hubs.

There may be an observation worth making, with regard to financial services powerhouses like Hong Kong and Singapore in South East Asia, similar to for example London and Frankfurt in Europe. When it comes to regulation, let’s be honest, there are a lot of existing frameworks within financial services and it hardly seems that new regulation, would be a requirement for new models to emerge. New models that combine the financial services industry and the efficiency of the Internet and new age tools.

As we’ve uncovered and also published in our Quarterly Research Reports, the new online investment marketplace is broad and includes broad categories such as early and later stage private company marketplaces, both equity and debt peer to peer marketplaces, various models for residential and commercial real estate marketplaces and expansions to existing investment models and activities.

Then on the other hand, financial services hubs include and encapsulate various financial brokers, asset managers, placement agents and so on, professional companies with deep and broad experience, track record and expertise in the market, regulated and holding financial services licenses under regulation which has been around in many cases for decades.

Putting Two and Two Together

Is there a discrepancy between operators who have the knowledge in the market, and those actually starting online investment marketplaces around the world? We don’t think so, but there is a lag in seeing the market for the opportunity it represents for established, financial services companies.

Since the popular discussion around the Internets application to the financial services market, is often debated in the context of early stage startups, its no wonder established operators don’t see an immediate fit. However, we could argue that is changing, with interest picking up from very established companies around the world, who see an opportunity to bring more efficiency and structure to their operations in for example a specific niche or vertical, or even create a new point of sale or user acquisition channel for their services.

The financial services market is complicated and it does require substantial resources in approaching a new model or structure in such a market. However, just because of an online application or expansion, one should not assume the nature of the business would be any different than what is already tried and true in many other models and approaches. The efficiency or structural gains, however, can be substantial in establishing an actual asset for the business rather than simply a new business expense.

For a professional organization in financial services, leveraging existing licenses and ongoing operations, is often a natural step to develop expanded offerings. However, despite possible long term aims and goals, it is more of a platform to build on top of, like a business roadmap for the future, than an immediate change of direction.

Anticipating Trends in Asset Classes

To date, we have observed a relatively even distribution of interest from established financial services companies, half of which represents an interest in private companies, a third real estate and the rest other real assets. Given interest in assets such as properties also magnified in certain regions such as South East Asia (think for example Hong Kong, Singapore and other cities which have seen incredible rises in property prices), the rise of property marketplaces could be expected. Another way to consider the evolution, would be to think of what investor dollars are currently going into and what demographics around the world or in certain regions, like to be part of. These are surely going to be represented in new online investment marketplaces and focused around certain hubs.

| Gears in Motion We already see the gears in motion and despite a future looking narrative, this is far from the case. There is a real opportunity in the market for professional financial operators and more and more deeply credible and well established companies are building their marketplaces that expand their offering, but also will serve as a business asset for the future. Crowd Valley will be publishing insight on these applications and in the upcoming Quarterly Reviews and Market Research, and provide a look at the markets development, albeit in hindsight. |

About the author - Markus Lampinen

Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets.

Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and a spinoff from the Grow VC Group. He is also a global investor and Senior Partner at the Grow VC Group. During his tenure as COO of Grow VC, he recruited over 120 individuals, built up a global team on six continents and expanded operations to over 150 countries. In his earlier businesses, he served in diverse roles, taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus holds an M.S. and a B.A. in Economics.

Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children.

Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets.

Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and a spinoff from the Grow VC Group. He is also a global investor and Senior Partner at the Grow VC Group. During his tenure as COO of Grow VC, he recruited over 120 individuals, built up a global team on six continents and expanded operations to over 150 countries. In his earlier businesses, he served in diverse roles, taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus holds an M.S. and a B.A. in Economics.

Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children.

RSS Feed

RSS Feed