Credit to : Wikipedia

Credit to : Wikipedia It's no secret that the European financial markets and economies have been hit particularly hard by the financial crisis and recession. It has been discussed and analyzed every day in every form of media, yet many of the problems remain unresolved. Progress has been difficult to make, both at a European and a national level, as regulators search for solutions. We believe crowdfunding, with its potential for increased capital flows and the resulting job creation, can be a part of the solution. And what is not often discussed during the recitation of Europe's woes is that it was in Europe, courtesy of CONSOB, the Italian financial regulator, that the first steps were taken to introduce crowdfunding as a viable, stable and reliable option for growth.

Crowd Valley has been invited to advise the European Commission on a regulatory policy and a framework for stimulating growth in the small- to medium-sized enterprise sector (SMEs). Markus from the Crowd Valley team will appear before the European Commission on Monday in Brussels to share his views on the need for a uniform market in Europe and how to improve conditions for SME-led innovation, growth and resourcing.

In many important respects, particularly with regard to securities regulation in relation to crowdfunding, Europe remains highly fragmented. Even with our experience, it remains extremely difficult to navigate the various regulatory regimes in Europe; we suspect that, for an SME, doing so might be nearly impossible. Unification of the crowdfunding market across Europe could create one of the world's largest markets and help leverage the power of the Internet to move capital and create jobs.

State of Seed-Stage and SME finance in Europe

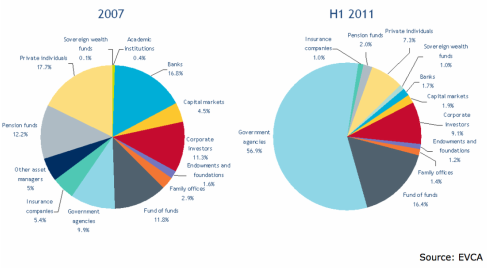

Financial support for early stage companies that represent a large portion of innovation and job growth across the global (GEM, 2011) has been dismal in the whole of Europe. Venture Capital funds have invested only 3-4% of all their investments into seed-stage deals, while total VC investments have decreased 45% since the start of the financial crisis (EVCA, 2012). Part of this decrease is likely due to the structural challenges faced by the VC market, particularly its continued reliance on the public sector since the start of the financial crisis. Private placements are an increasingly small part of the entire venture sector's investments, where the majority of capital originates from public sources through government agencies like the European Investment Fund (EIF). The EIF's intervention is a conscious choice, but the repercussions of the lessened private capital may be unforeseeable. Public capital has been coupled with lesser efficiency than that of private capital, which may amplify structural issues.

In many important respects, particularly with regard to securities regulation in relation to crowdfunding, Europe remains highly fragmented. Even with our experience, it remains extremely difficult to navigate the various regulatory regimes in Europe; we suspect that, for an SME, doing so might be nearly impossible. Unification of the crowdfunding market across Europe could create one of the world's largest markets and help leverage the power of the Internet to move capital and create jobs.

State of Seed-Stage and SME finance in Europe

Financial support for early stage companies that represent a large portion of innovation and job growth across the global (GEM, 2011) has been dismal in the whole of Europe. Venture Capital funds have invested only 3-4% of all their investments into seed-stage deals, while total VC investments have decreased 45% since the start of the financial crisis (EVCA, 2012). Part of this decrease is likely due to the structural challenges faced by the VC market, particularly its continued reliance on the public sector since the start of the financial crisis. Private placements are an increasingly small part of the entire venture sector's investments, where the majority of capital originates from public sources through government agencies like the European Investment Fund (EIF). The EIF's intervention is a conscious choice, but the repercussions of the lessened private capital may be unforeseeable. Public capital has been coupled with lesser efficiency than that of private capital, which may amplify structural issues.

Despite the fact that the Eurozone's GDP is roughly $2 trillion (or roughly 12%) larger than that of the United States, the market for business angel investments is 80% smaller in the Euro zone than in the United States ($5 billion vs $20 billion) . This, coupled with the inability or unwillingness of VC funds to make sub 1M€ investments, creates a real gap in seed-stage investments for SMEs. We believe that crowdfunding can help fill this gap. Furthermore, there is capital inflow into Europe possibly due to deflated price levels and a positive long term outlook from outside the continent, such as from the Middle East and Asia. This is true for many sectors, including in limited significance the startup and SME sector, but also for example real estate properties in high value locations. If SMEs can gain access to seed capital, such opportunities can result in real growth for the continent.

It's also worth noting that SME's in Europe account for over 99% of all European businesses. As in the US, these companies are also responsible for net employment increase, innovation and research and development across the market. Out of the 99% SME's, 9 out of 10 is considered a micro company, employing under 10 people (EC, 2010). This further reinforces the impact and importance of the seed stage even in macroeconomic terms.

Prospectus 'Passporting' as a Benchmark

The European Prospectus Directive (Directive 2003/71/EC of the European Parliament and of the Council of 4 November 2003) was enacted to facilitate the use of one prospectus for offers and sales of securities to the public and admissions to trading in more than one member state in an efficient and purposeful manner. Article 17 of the Prospectus Directive states that a prospectus (and its supplements), if approved by the competent authority of the home member state, is valid for public offers and admissions in any number of host member states.

The process of passporting out of a home country has proven to be a valuable part of the regulated financial markets in the fragmented financial market within Europe. Furthermore, with respect to unregistered offerings to sophisticated investors, such as angel and private deals, the regulatory landscape is generally thought to be much more conducive and uniform, leading to more cross border and international fund raisings. Crowdfunding and the facilitation of securities via new online models must evolve to allow for cross border fundraising in order to facilitate the type of deal and capital flow to make the market viable, both for capital raising and for growth of the relevant SME's. Issuers simply do not have the time or the sophistication to understand and follow 27 different regulatory regimes.

Conclusion and Consideration

It is therefore suggested that the already functional processes and best processes of Passporting of Prospectuses be studied and evaluated as to lightening requirements and making available exemptions in order to facilitate capital offerings cross national lines. We believe creating a robust, but fair framework for unregistered offerings such as crowdfunding will support innovation, job growth and the unification of the world's largest market.

It's also worth noting that SME's in Europe account for over 99% of all European businesses. As in the US, these companies are also responsible for net employment increase, innovation and research and development across the market. Out of the 99% SME's, 9 out of 10 is considered a micro company, employing under 10 people (EC, 2010). This further reinforces the impact and importance of the seed stage even in macroeconomic terms.

Prospectus 'Passporting' as a Benchmark

The European Prospectus Directive (Directive 2003/71/EC of the European Parliament and of the Council of 4 November 2003) was enacted to facilitate the use of one prospectus for offers and sales of securities to the public and admissions to trading in more than one member state in an efficient and purposeful manner. Article 17 of the Prospectus Directive states that a prospectus (and its supplements), if approved by the competent authority of the home member state, is valid for public offers and admissions in any number of host member states.

The process of passporting out of a home country has proven to be a valuable part of the regulated financial markets in the fragmented financial market within Europe. Furthermore, with respect to unregistered offerings to sophisticated investors, such as angel and private deals, the regulatory landscape is generally thought to be much more conducive and uniform, leading to more cross border and international fund raisings. Crowdfunding and the facilitation of securities via new online models must evolve to allow for cross border fundraising in order to facilitate the type of deal and capital flow to make the market viable, both for capital raising and for growth of the relevant SME's. Issuers simply do not have the time or the sophistication to understand and follow 27 different regulatory regimes.

Conclusion and Consideration

It is therefore suggested that the already functional processes and best processes of Passporting of Prospectuses be studied and evaluated as to lightening requirements and making available exemptions in order to facilitate capital offerings cross national lines. We believe creating a robust, but fair framework for unregistered offerings such as crowdfunding will support innovation, job growth and the unification of the world's largest market.

About the author - Markus Lampinen

Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets.

Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and a spinoff from the Grow VC Group. He is also a global investor and Senior Partner at the Grow VC Group. During his tenure as COO of Grow VC, he recruited over 120 individuals, built up a global team on six continents and expanded operations to over 150 countries. In his earlier businesses, he served in diverse roles, taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus holds an M.S. and a B.A. in Economics.

Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children.

Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets.

Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and a spinoff from the Grow VC Group. He is also a global investor and Senior Partner at the Grow VC Group. During his tenure as COO of Grow VC, he recruited over 120 individuals, built up a global team on six continents and expanded operations to over 150 countries. In his earlier businesses, he served in diverse roles, taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus holds an M.S. and a B.A. in Economics.

Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children.

RSS Feed

RSS Feed