One year has passed since the SEC released Title II, which removed the ban on general solicitation and general advertising for private issuers. Since then the entire US crowdfunding sector has been waiting the famous Title III, which would eventually allow also non accredited investors to invest through equity crowdfunding portals. Nevertheless, even though Title III is still missing, the US market of equity crowdfunding has been flourishing with interesting numbers.

As reported in the last Crowd Valley Market Report, the most diffused asset class among the US securities crowdfunding portals is private companies. During this year, since the release of Tite II, an estimated total of 534 out of 3,361 private companies successfully hit their equity crowdfunding target, collecting all together $217.7 million equity capital, which averages $407,685 per company. Not a bad start, especially considering that this sum comes only from accredited investors and that it is estimated that only a minority of the existing 9 million US professional investor signed up on equity crowdfunding portals. Most of the equity crowdfunding activity (both raising capital and investing ) is done in California, New York, Florida, Texas and Illinois.

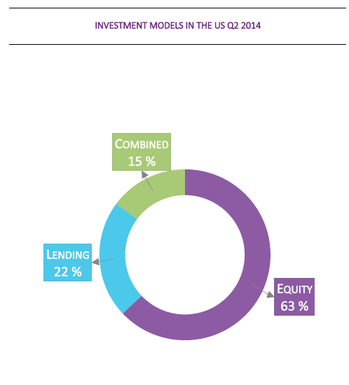

Additionally to private companies, there is another asset class that is currently booming: real estate. In its last report, Crowd Valley observed that a bit more than one third of the total demand for crowdfunding technology was directed towards Crowd Valley's real estate platform product. According to a recent statistic, about 80% of the existing real estate platforms in the US uses an equity crowdfunding investment model, which again is at the moment limited to accredited investors.

Given these numbers, it is possible to observe that, although equity investments through crowdfunding portal are still limited to a certain category of investors, the market has reached an interesting size. This is supposed to scale further up as soon as Title III is released, giving this way the chance to any US saver to invest even a limited sum along venture capitalists or angels, helping bridging the early stage finance gap.

References

Crowd Valley Market Report Q2 2014.

Koplovitz, K. (2014). One Year After Title II And Equity Crowdfunding. Huffington Post.

Additionally to private companies, there is another asset class that is currently booming: real estate. In its last report, Crowd Valley observed that a bit more than one third of the total demand for crowdfunding technology was directed towards Crowd Valley's real estate platform product. According to a recent statistic, about 80% of the existing real estate platforms in the US uses an equity crowdfunding investment model, which again is at the moment limited to accredited investors.

Given these numbers, it is possible to observe that, although equity investments through crowdfunding portal are still limited to a certain category of investors, the market has reached an interesting size. This is supposed to scale further up as soon as Title III is released, giving this way the chance to any US saver to invest even a limited sum along venture capitalists or angels, helping bridging the early stage finance gap.

References

Crowd Valley Market Report Q2 2014.

Koplovitz, K. (2014). One Year After Title II And Equity Crowdfunding. Huffington Post.

About the author - Irene Tordera

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

RSS Feed

RSS Feed