Financial technology adoption has been incredibly fast in the most advanced economies, but it’s a totally different story for what concerns emerging countries, where the penetration of digital finance services is still very low. The good news for those economies, and for those looking to do business there, is that the potential growth is now extraordinary, thanks to the level of smartphone penetration.

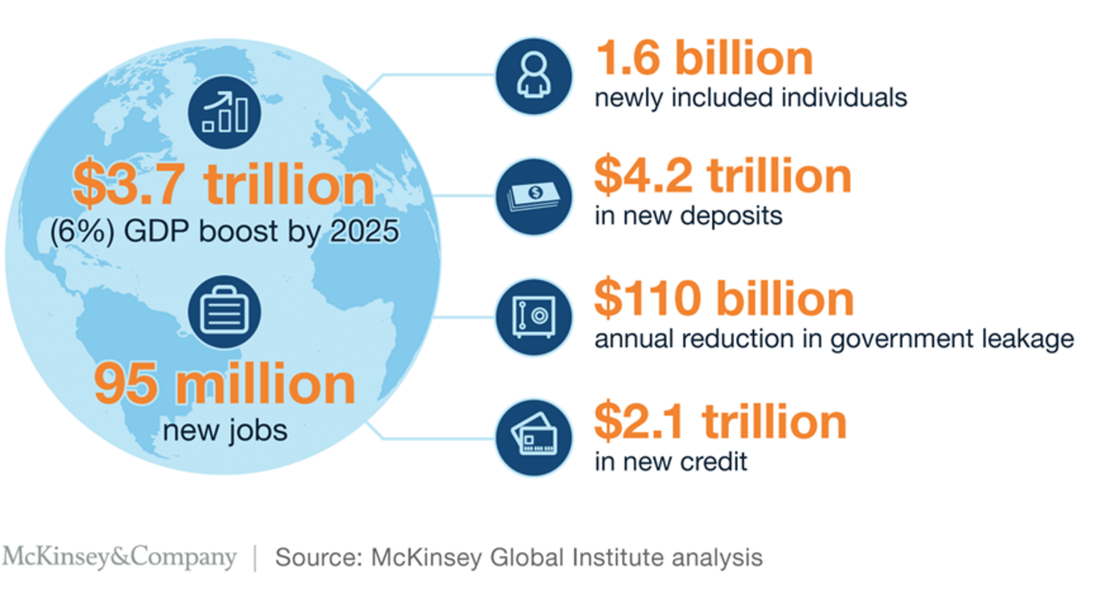

A new report called Digital Finance For All: Powering Inclusive Growth in Emerging Economies, by McKinsey Global Institute, estimates that with the adoption of digital finance, it is possible to create an additional 95 million jobs and $3.7 trillion in developing economies by 2025.

Currently there are approximately 2 billion people and 200 million businesses in the world that have no access to credit or savings. While only 55% of the adults in emerging countries have a financial account, there are about 80% of those that have a mobile phone, making the provision of financial services now viable which seemed out of reach not so far ago.

It’s estimated, that with the adoption of financial technology, it would be possible to increase the volume of loans to individuals and businesses by $2.1 trillion, and for governments to sensibly reduce their costs, by as much as $110 billion per year, simply by limiting the leakage in tax and spending. But the convenience is also clear for financial service providers, that could aspire to save $400 billion per year through digitization.

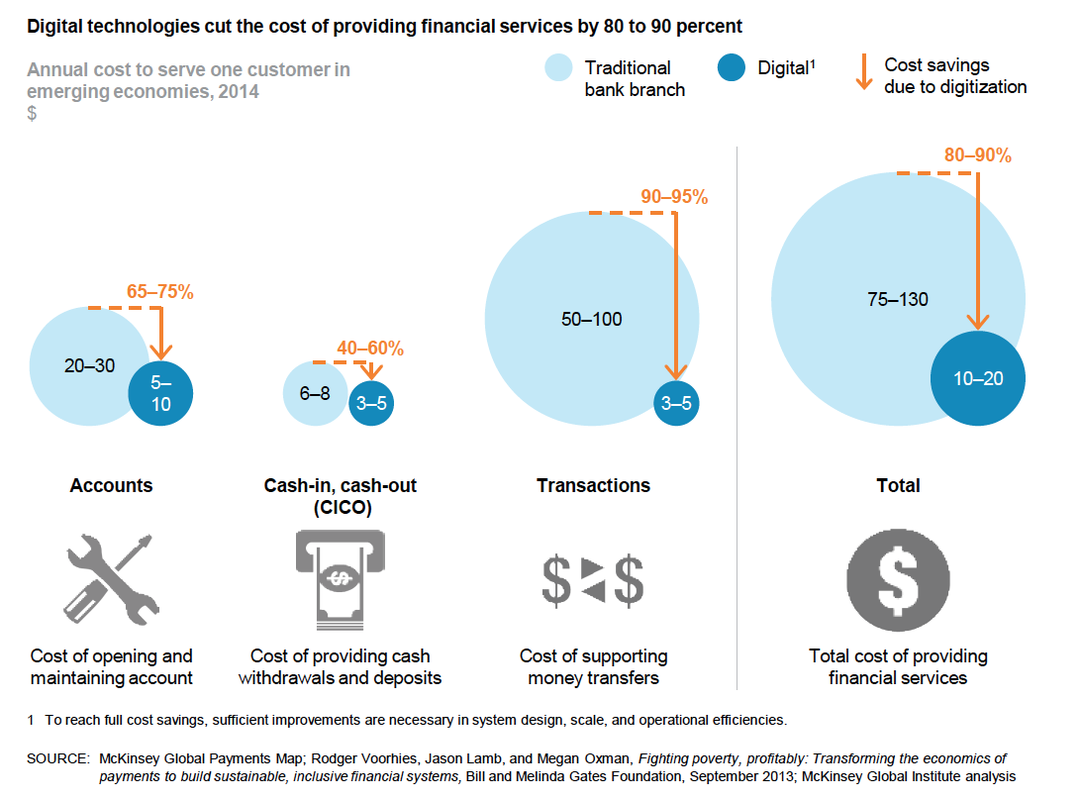

The possible cost reductions on payments for financial service providers are massive. Serving customers using mobile money accounts can account for 80% to 90% cost reductions compared to physical branches. In that position financial providers will be able to reach a higher number of customers, that would otherwise not be economically advantageous to serve.

It’s estimated, that with the adoption of financial technology, it would be possible to increase the volume of loans to individuals and businesses by $2.1 trillion, and for governments to sensibly reduce their costs, by as much as $110 billion per year, simply by limiting the leakage in tax and spending. But the convenience is also clear for financial service providers, that could aspire to save $400 billion per year through digitization.

The possible cost reductions on payments for financial service providers are massive. Serving customers using mobile money accounts can account for 80% to 90% cost reductions compared to physical branches. In that position financial providers will be able to reach a higher number of customers, that would otherwise not be economically advantageous to serve.

It’s not just about the payments. Another key aspect is to broaden access to credit for individuals, as well as for micro, small and medium enterprises (MSMEs). The report above estimates that a total of $2.1 trillion in new loans could be obtained thanks to the adoption of digital financial services, and in this way helping businesses willing to expand their activities.

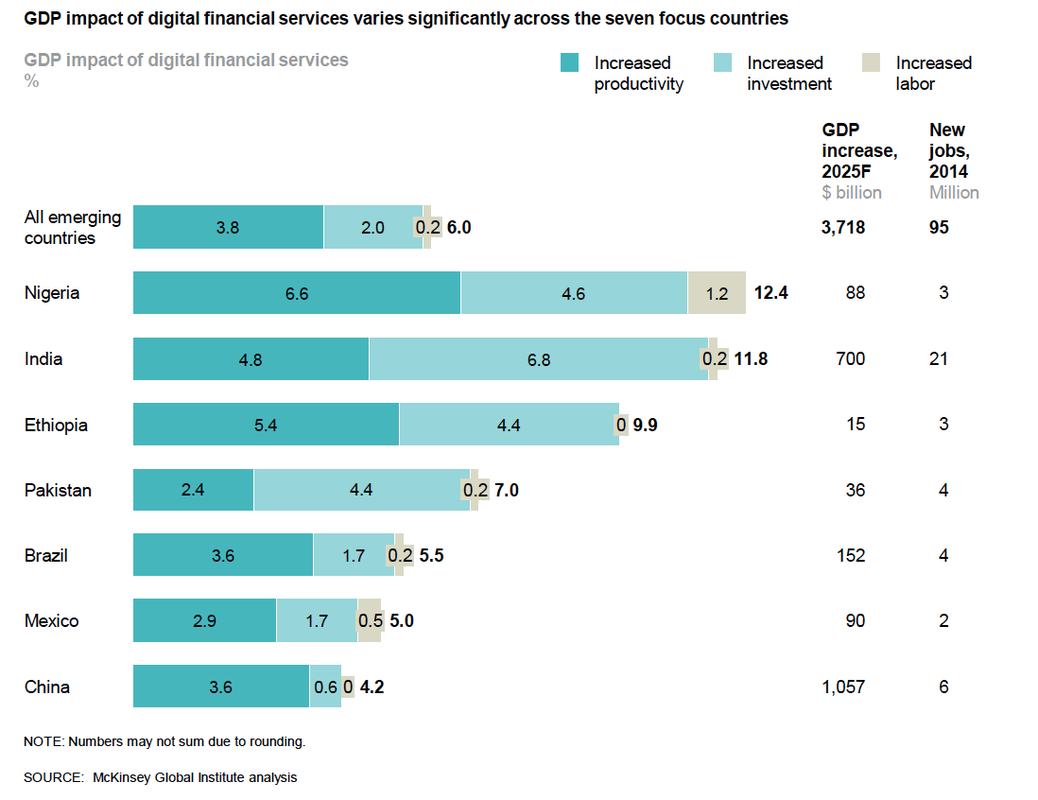

India, with $689 billion of additional credit, and a new credit to GDP ratio of 34%, and Mexico with $162 billion of additional credit, and a new credit to GDP ratio of 12%, represent two countries that could benefit additionally. Taking into consideration the overall impact of fintech adoption on the GDP, the lower income countries have the largest potential, considering their current levels of financial inclusions and digital payments, with possible increased labor, productivity and investment gains.

India, with $689 billion of additional credit, and a new credit to GDP ratio of 34%, and Mexico with $162 billion of additional credit, and a new credit to GDP ratio of 12%, represent two countries that could benefit additionally. Taking into consideration the overall impact of fintech adoption on the GDP, the lower income countries have the largest potential, considering their current levels of financial inclusions and digital payments, with possible increased labor, productivity and investment gains.

McKinsey identifies, “a mobile and digital infrastructure, a dynamic business environment for financial services, and digital finance products that meet the needs of individuals and small businesses in ways that are superior to the informal financial tools they use today”, the key points for businesses and governments have to achieve in order to secure the benefits that financial technology could bring, as well to support the substantial transformation happening in finance in the emerging economies.

Finance pioneers are advised, the opportunity with digital finance is remarkable.

The full report, Digital Finance For All: Powering Inclusive Growth in Emerging Economies, can be downloaded for free from this link: http://bit.ly/2drlmXp

Finance pioneers are advised, the opportunity with digital finance is remarkable.

The full report, Digital Finance For All: Powering Inclusive Growth in Emerging Economies, can be downloaded for free from this link: http://bit.ly/2drlmXp

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed