Climate change and global warming are two topics media, policymakers and scientists often talk about. Some see them as an hypothetical future situation, others instead consider them as a present issue. No matter the different stakeholders’ views, the UN, in its last report on climate change, insisted on the necessity to move from fossil fuels towards low-carbon alternatives. In particular, a commonly cited statistic says that there should be an investment of $ 1 trillion by 2030, in order to avoid the worst consequences of climate change.

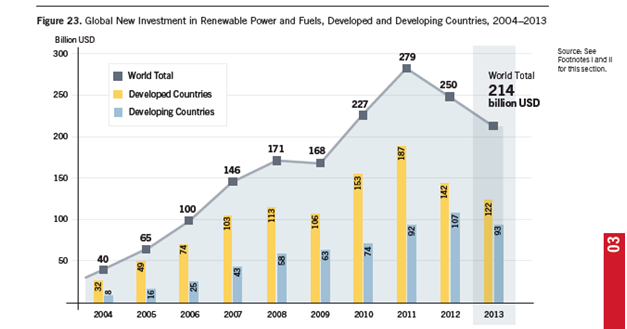

However, as showed by the Renewables 2014 Global Status Report, investment in renewable energies has decreased in the last two years.

The table above, taken from the aforementioned report, clearly shows the global decrease in investment flow into renewable energies (hydropower excluded). The decrease is particularly stronger in the western countries: if Europe in 2013 invested 44% less than in 2012, China alone invested more in renewables than the entire EU, representing the only case together with India where investment increased during 2013.

The situation is therefore somehow critical: an increased investment is needed, but data show it is instead decreasing. The Renewables 2014 Global Status Report mentions crowdfunding, in the section dedicated to investment sources for renewable energies projects, saying that it “continued to become a more mainstream means of raising money in an increasing number of countries”.With this statement in that particular section, the report acknowledges the potential of crowdfunding as a financial source for renewable energies, which in the following years may play a more important role in the energy sector, contributing to bridge the current investment gap and driving our economies more and more away from fossil fuels. Additionally. crowdinvesting in renewables offers to everyone the opportunity to invest even small amounts in a more sustainable future and contribute actively to fight climate change.

References

Paddison, L. (2014). Investment in renewables: how to grow the low-carbon economy,

Renewable Energy Policy Network for 21st Century. Renewables 2014: Global Status Report.

Image credit to: Oxfam International. http://bit.ly/1vmGtGM

The situation is therefore somehow critical: an increased investment is needed, but data show it is instead decreasing. The Renewables 2014 Global Status Report mentions crowdfunding, in the section dedicated to investment sources for renewable energies projects, saying that it “continued to become a more mainstream means of raising money in an increasing number of countries”.With this statement in that particular section, the report acknowledges the potential of crowdfunding as a financial source for renewable energies, which in the following years may play a more important role in the energy sector, contributing to bridge the current investment gap and driving our economies more and more away from fossil fuels. Additionally. crowdinvesting in renewables offers to everyone the opportunity to invest even small amounts in a more sustainable future and contribute actively to fight climate change.

References

Paddison, L. (2014). Investment in renewables: how to grow the low-carbon economy,

Renewable Energy Policy Network for 21st Century. Renewables 2014: Global Status Report.

Image credit to: Oxfam International. http://bit.ly/1vmGtGM

About the author - Irene Tordera

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

Born and raised in Milan, Italy, Irene is an International Business graduate, with a strong interest for innovative ideas that can simplify our lives.

During her studies, she co-founded an online community for sportspeople and worked in marketing positions at Ogilvy & Mather Advertising and at the European Business Angel Network, in Brussels. She is a passionate blogger about crowdfunding and the startup ecosystem.

RSS Feed

RSS Feed