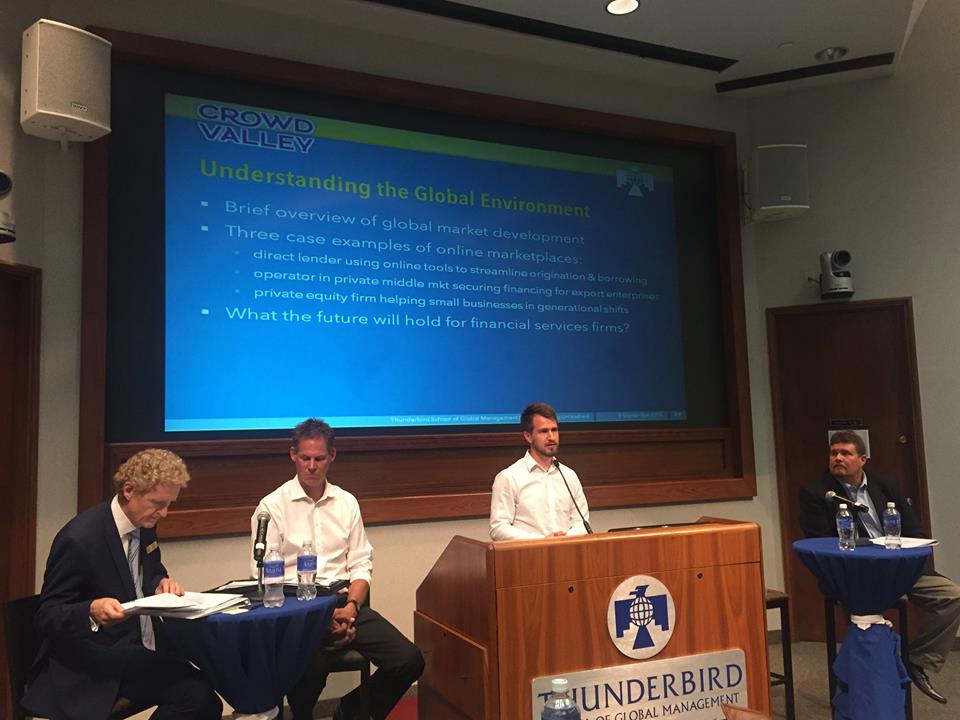

| On September 9, 2015 at the Thunderbird School of Global Management in Phoenix in Arizona, I had the privilege of representing Crowd Valley and talking about how the digital investing market is emerging around the world. With an international alumni network of over 40,000 individuals, it seemed the topic fit Thunderbird like a glove. With Crowd Valley’s network of hundreds of global stakeholders, we were able to cover quite a few practical examples and considerations. |

Moderated by Dr Gary Gibbons a true expert in the field of finance and an advisor to e.g. the SEC, the event featured speakers such as Bruce B Wuollet, a distinguished real estate investor, Scott Kelly, an experienced investment banker, and Mark Svejda, a specialist attorney with three decades of background. With intra-state regulation for Arizona underway, a local demand for new funding models is evident.

The event covered the current state of the digital investing market and highlighted some specific topics around the different models and distinctions between debt and equity financing, as well as examples from various asset classes. Requirements not only for online marketplaces, but also for individual companies and offerings were discussed, such as investor onboarding with verification around know your customer (KYC) requirements, as well as bad actor checks. Compliance and operational requirements were clearly highlighted, as well as specific issues such as the complexity of interpretations available around heightened verification requirements on accredited investor status in regulation D, 506(c) offerings.

Speaking on how the international market is developing, drawing on Crowd Valley’s global operations, we discussed how the market is emerging in different fashions at different paces around the world and how the development is not because of absent regulation, but often clarity in how the regulatory framework has been implemented with the leading example found in the UK with the FCAs rule making. Here are some of the main points we discussed on the international market:

1) Online lending and investing is a diverse and fragmented field, with various asset classes, operating models, geographies and niches served.

2) Ongoing changes will fundamentally change financial services value chains, with leading incumbents investing hundreds of millions into new offerings and challengers emerging each day.

3) At the end of the day, the market is still financial services with all its regulation and complexity. The need for sophisticated and robust infrastructure in all operations is crucial.

At times it may seem that the development in specific parts of the world is falling behind the curve. As appealing as the simplification may be, the topic is far more complex, with the development pace of each market unique in how it translates to practical operating models and granted, the possibility of such models. For example here in the US, its at times easy to pass blame on federal rule making, while forgetting that most successful platforms operate not under new regulation, but rather under existing and proven rules and exemptions.

We at Crowd Valley continue to work on developing the market with leading institutions such as the Thunderbird University and welcome the opportunity to contribute to a viable and sustainable developing ecosystem, both locally in Arizona, domestically in various countries and on the global arena. If you are interested in partnering with us, do not hesitate to get in touch.

See Markus's speech in this video (starting at 1:03:02).

The event covered the current state of the digital investing market and highlighted some specific topics around the different models and distinctions between debt and equity financing, as well as examples from various asset classes. Requirements not only for online marketplaces, but also for individual companies and offerings were discussed, such as investor onboarding with verification around know your customer (KYC) requirements, as well as bad actor checks. Compliance and operational requirements were clearly highlighted, as well as specific issues such as the complexity of interpretations available around heightened verification requirements on accredited investor status in regulation D, 506(c) offerings.

Speaking on how the international market is developing, drawing on Crowd Valley’s global operations, we discussed how the market is emerging in different fashions at different paces around the world and how the development is not because of absent regulation, but often clarity in how the regulatory framework has been implemented with the leading example found in the UK with the FCAs rule making. Here are some of the main points we discussed on the international market:

1) Online lending and investing is a diverse and fragmented field, with various asset classes, operating models, geographies and niches served.

2) Ongoing changes will fundamentally change financial services value chains, with leading incumbents investing hundreds of millions into new offerings and challengers emerging each day.

3) At the end of the day, the market is still financial services with all its regulation and complexity. The need for sophisticated and robust infrastructure in all operations is crucial.

At times it may seem that the development in specific parts of the world is falling behind the curve. As appealing as the simplification may be, the topic is far more complex, with the development pace of each market unique in how it translates to practical operating models and granted, the possibility of such models. For example here in the US, its at times easy to pass blame on federal rule making, while forgetting that most successful platforms operate not under new regulation, but rather under existing and proven rules and exemptions.

We at Crowd Valley continue to work on developing the market with leading institutions such as the Thunderbird University and welcome the opportunity to contribute to a viable and sustainable developing ecosystem, both locally in Arizona, domestically in various countries and on the global arena. If you are interested in partnering with us, do not hesitate to get in touch.

See Markus's speech in this video (starting at 1:03:02).

| About the author - Markus Lampinen Internationally awarded entrepreneur, active in pioneering new securities models worldwide at the intersection of the Internet and the securities markets. Markus serves as the CEO of Crowd Valley Inc, a US-based crowdfunding marketplace platform provider and part of the Grow VC Group. He is also a global investor and partner in the Grow VC Group. Since 2009, he has recruited over 120 individuals in the digital securities market, built up a operations on six continents and been recognized as one of the top 100 thought leaders in crowdfunding. In his earlier businesses, he served in diverse executive roles, for example taking on the responsibilities of CFO and increasing sales growth of over 270% per year over several subsequent years. Markus has studied finance, management and computer sciences, and holds an M.S. and a B.A. in Economics. Markus has pioneered new funding models in the US and Europe, advised policy makers worldwide—including the SEC, the European Commission and Italian regulator CONSOB—for more effective markets, and worked with visionary organizations such as the World Bank and the Kauffman Foundation to improve frameworks for new funding models, including crowdfunding, cross-border investments and private placements. He serves as a frequent public speaker on related themes. He is married and constantly bringing presents from his travels to his two children. |

RSS Feed

RSS Feed