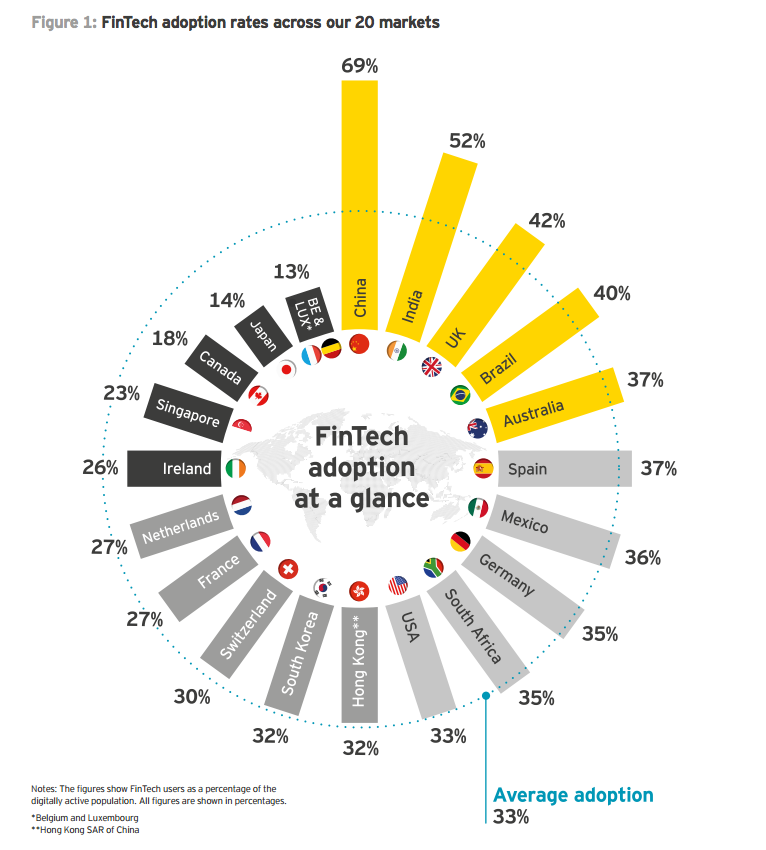

Fintech adoption is growing rapidly all over the world, but it’s in the emerging countries that it’s increasing at the fastest rate. According to a report just released by Ernst & Young, the EY FinTech Adoption Index 2017, where the consultancy firm surveyed more than 22,000 people from 20 different markets, the Chinese market is the one with the highest Fintech adoption rate, with 69% of the respondents saying that they were regularly using Fintech services.

India got second in the rankings with a 52% adoption rate, followed by the UK and Brazil, with 42% and 40% respectively. The average adoption rate, defined by those using at least two Fintech services, is 33% for the twenty markets taken in consideration and 46% if we consider just the emerging markets, where tech literacy is high but the diffusion of financial services is still limited. All in all, the survey finds that the initial mass adoption of Fintech has been achieved in most markets with evidence of increasing awareness, with 84% of customers now aware of the existence of Fintech services, against the 62% of 2015.

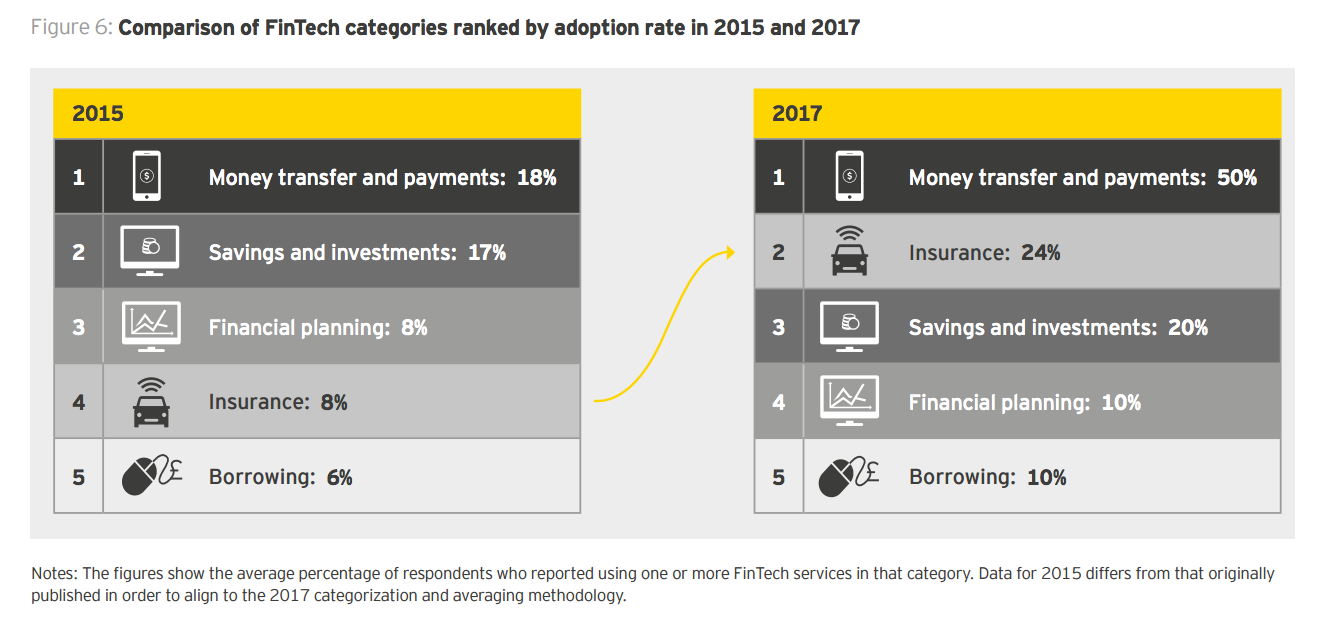

The financial technology industry is reaching a new development stage, Fintech firms that are continuing to expand their offerings and new players, including major financial institutions and established tech firms are joining the market. The effort of policymakers to improve the regulatory frameworks is facilitating the boom of new services. In term of popularity among the different categories, are money transfer and payments that top the list, while it’s Insurtech which is experiencing the most significant growth.

Source: Page 14 of the EY FinTech Adoption Index 2017.

By looking at the type of users, unsurprisingly the younger consumer segment, those in the range between 25 and 34 years old have a 48% average adoption, highlighting that those with the higher rate, despite having an increasing need for financial services lack a strong relationship with the traditional players.

Assisted by global technological and internet proliferation, Fintech adoption will continue to gain momentum. Among the respondents, it is found that consumer sentiment toward Fintech is strongly positive, with adoption expected to increase in all categories and markets, with the forecast to reach an average of 52%. Borrowing and financial planning are the categories forecasted to grow the most as fintech boosts financial inclusion allowing individuals at every level of society access to capital and financial services to be able to pursue their ideas as well as secure their futures for themselves and their families through professional financial services.

Crowd Valley is excited to support this wave of adoption on a global level, with our infrastructure ready to support the workflows in any ecosystem as well as embrace new technologies and approaches that our clients may want, in a bid to stay a pioneer in providing an efficient, robust and transparent financial services platform.

For additional insight on the current status of the Fintech industry development you can download the report from here.

Assisted by global technological and internet proliferation, Fintech adoption will continue to gain momentum. Among the respondents, it is found that consumer sentiment toward Fintech is strongly positive, with adoption expected to increase in all categories and markets, with the forecast to reach an average of 52%. Borrowing and financial planning are the categories forecasted to grow the most as fintech boosts financial inclusion allowing individuals at every level of society access to capital and financial services to be able to pursue their ideas as well as secure their futures for themselves and their families through professional financial services.

Crowd Valley is excited to support this wave of adoption on a global level, with our infrastructure ready to support the workflows in any ecosystem as well as embrace new technologies and approaches that our clients may want, in a bid to stay a pioneer in providing an efficient, robust and transparent financial services platform.

For additional insight on the current status of the Fintech industry development you can download the report from here.

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the Fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Valencia and Barcelona, where he currently lives. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the Fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Valencia and Barcelona, where he currently lives. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed