In recent times, everywhere one turns, disruption seems to impacting every aspect of the diversified financial services space, leaving no sector unturned whether it is in lending, borrowing, alternative finance or investment space. Financial technology coupled with social media input is altering the dynamic of the sector in pushing costs lower while creating a more efficient but equally more personalized user experience for investors and borrowers.

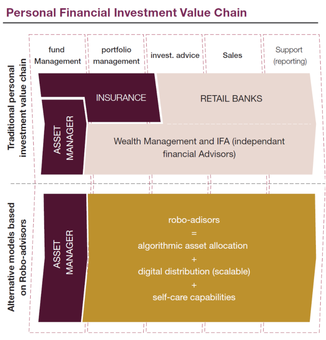

Image Source: Digital disruption in Asset and Wealth Management (Capgemini Consulting).

Image Source: Digital disruption in Asset and Wealth Management (Capgemini Consulting). The clear winner amidst this disruption and democratization of financial services is the consumer. Disruption has also allowed challengers to pose credible threats to age old traditional institutions drawing customers and funds away from the behemoth institutions. Despite the rampant change in funds flows and business models, a A PWC report from 2016 conveys that asset managers don’t see a significant threat coming from emerging technology, stating that even though many believe that asset and wealth managers will be disrupted by Fintech, industry players hold the belief that they are immune to the disturbance potential of new entrants. When asked about any type of threat, Asset managers were the least concerned. The surveyed industry players believe Fintech will have only a limited impact on their businesses.

However, there isn’t a better time for entry into the traditionally esoteric asset management market. So what has changed in the value chain that is creating a need for asset managers to reevaluate their business & pricing models as well as creating an opportunity for challengers to enter this market?

The primary challenge to the asset management space comes from financial technology developments in the form of robo-advisors and efficiency gains from big data and analytics which are paving the way for cost effective strategies. The impact of technology on the asset management space is particularly interesting because it seems to follow a set cycle for disruption; after leading the way with technology in the 1980s, asset and wealth managers (AWMs) have become dismissive of contemporary technology innovations and disruptions to their industry, which is surprising considering that the current model disrupted the traditional asset and wealth management space. In the 80s, with the emergence of online brokerages, wire houses gave the upstarts pejorative titles, such as “discount brokers”, holding the belief that these new business models would fail to take off, and the risk they posed to businesses was low. (Sound familiar?)

In reality, prices significantly dropped. Eventually, the upstarts introduced new pricing models by splitting advice from transactions – full service brokers started to charge on a fee per asset under management basis versus fees per trade.

But the attitude held by incumbents is not without reason. Financial services have constantly been under siege by start-ups and new entrants over many years and the attractive returns presented by the asset management space may have made the incumbents under even more pressure but has in turn also left them increasingly jaded to challengers. For years, it’s been easy to dismiss technology-driven startups in the retirement, wealth, and asset management industries. They couldn’t compete with the massive distribution and information technology advantages of incumbent firms. But conditions have become much more favorable to digital upstarts: consumers are ready, industry conditions favor innovation, and the technologies required to transform these industries finally work.

History could repeat itself again with the ongoing disruption caused by Fintech companies. Much like online brokerages, “robo-advisors” are classed as less valuable than human professional wealth advisors, and so far have been focusing mainly on low balance accounts. But the innovations under the umbrella of “robo-advisors” are becoming more sophisticated and, thus, enable advisors to service higher net worth accounts. The above image details the redundancies in the current asset management infrastructure where challengers embracing financial technology in combination with big data could alter the entire asset management dynamically utilizing the increased volume of funds brought in by millennial investors in lieu of lowered transaction and management costs.

How does this period of innovation appear unique from the those before?

Bull markets around the world have motivated consumers to consider investing in securities, which

has boosted some digital disruptors. But rising markets are just one of the industry factors favoring

today’s disruptors:

- ETFs make it easier to construct portfolios.

Thanks to the rise of low-cost, indexed ETFs in the last 20 years, digital investment managers have the building blocks they need to assemble low-fee, diversified, and automated portfolios. They key words here are low cost & diversified; two terms not commonly associated with the asset management space due to the investment minimums alongside high management fees on an annual basis.

- The regulatory environment favors upstarts.

Governments and regulators often look favorably at innovation in financial services as a way to bring more competition and transparency to a sector tarred by the financial crisis of 2008. For example, new regulations in countries like the Netherlands and the UK outlaw product commissions, forcing advisors to charge customers directly and exposing the true cost of financial advice to consumers. In the US, the Jumpstart Our Business Startups (JOBS) Act’s crowdfunding provision has created a teeming category of disruptors. Incumbent financial services firms, on the other hand, feel the full weight of regulation. The Dodd-Frank Wall Street Reform and Consumer Protection Act, for example, contains hundreds of provisions that restrict incumbents’ business practices.

- Regulators like consistency.

Software-based advice provides a clear audit trail (and digital signature). The combination of consistency, objectivity, and verifiability is appealing to regulators.

Digital enables new business models that bypass regulation altogether.

Some disruptors, such as social lenders like Lending Club and crowdfunding sites like Kickstarter, are just enablers: they don’t hold the capital, but instead connect people with money to people in need of funds. Without the burden of capital requirements or regulation, these marketplace businesses are quick to set up, cost-efficient, and more agile than traditional financial institutions. In this regard companies such as Crowd Valley have been making pioneering strides in providing infrastructure for digital automated marketplaces.

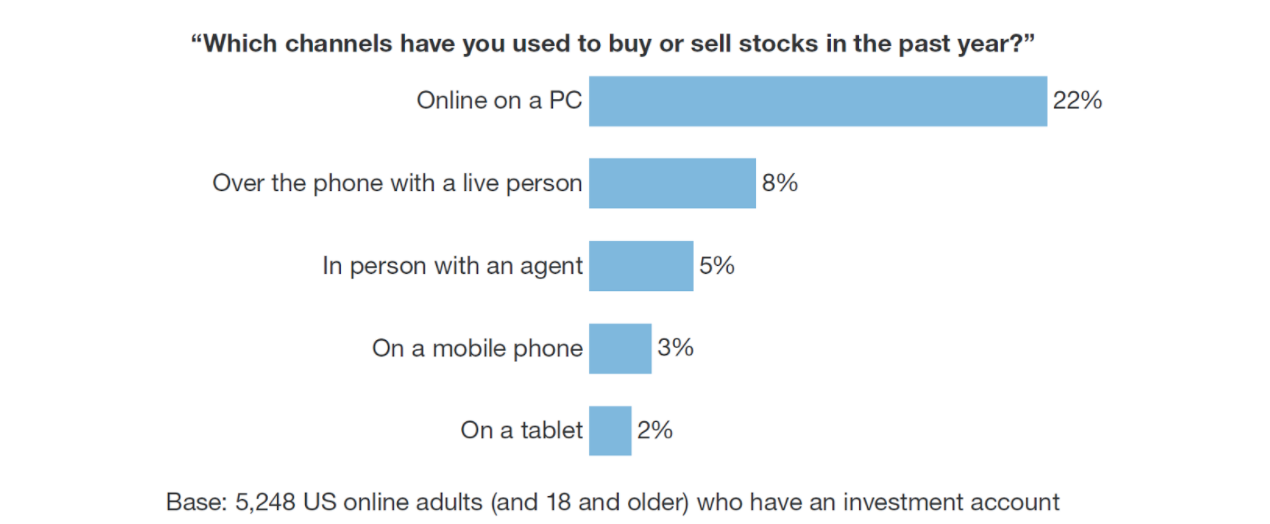

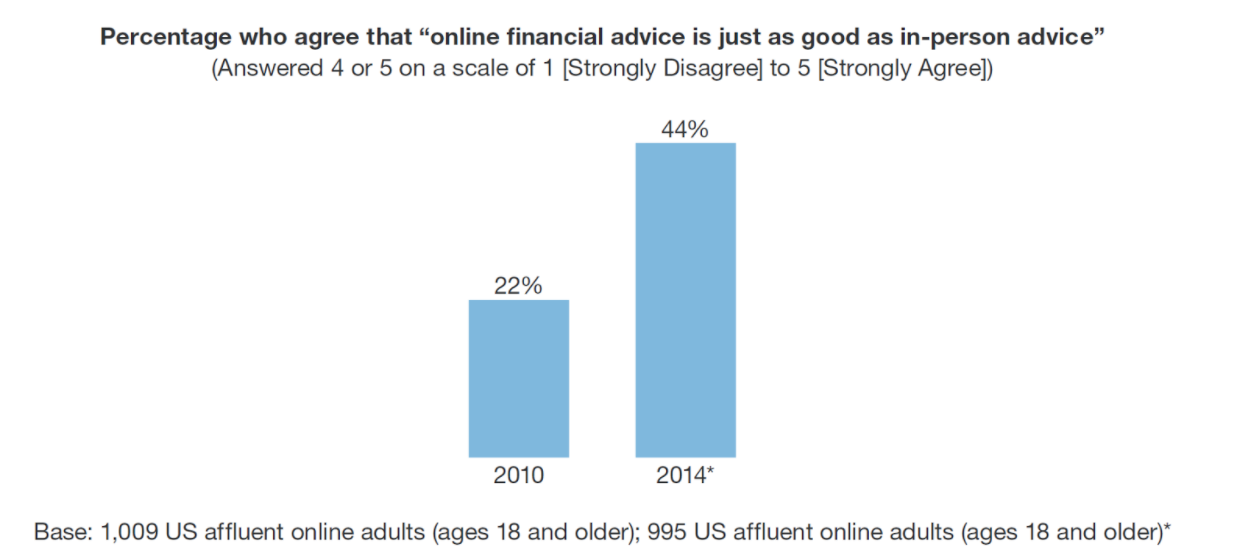

This environment is complemented by a significant change in the demographic composition as well, which is the true catalyst for innovation: as the “Boomer” generation moves into retirement, a new generation of investors, financial advisors, portfolio managers and clients are taking responsibility for a larger and larger share of assets. These individuals are more tech-savvy and, in many cases, conduct business primarily through digital channels, including mobile, with less emphasis on face-to-face contact. Have a look at two following graphs. The graphs by Forrester Research outline the media for stock transactions with the second graph providing clear insight on future trends.

has boosted some digital disruptors. But rising markets are just one of the industry factors favoring

today’s disruptors:

- ETFs make it easier to construct portfolios.

Thanks to the rise of low-cost, indexed ETFs in the last 20 years, digital investment managers have the building blocks they need to assemble low-fee, diversified, and automated portfolios. They key words here are low cost & diversified; two terms not commonly associated with the asset management space due to the investment minimums alongside high management fees on an annual basis.

- The regulatory environment favors upstarts.

Governments and regulators often look favorably at innovation in financial services as a way to bring more competition and transparency to a sector tarred by the financial crisis of 2008. For example, new regulations in countries like the Netherlands and the UK outlaw product commissions, forcing advisors to charge customers directly and exposing the true cost of financial advice to consumers. In the US, the Jumpstart Our Business Startups (JOBS) Act’s crowdfunding provision has created a teeming category of disruptors. Incumbent financial services firms, on the other hand, feel the full weight of regulation. The Dodd-Frank Wall Street Reform and Consumer Protection Act, for example, contains hundreds of provisions that restrict incumbents’ business practices.

- Regulators like consistency.

Software-based advice provides a clear audit trail (and digital signature). The combination of consistency, objectivity, and verifiability is appealing to regulators.

Digital enables new business models that bypass regulation altogether.

Some disruptors, such as social lenders like Lending Club and crowdfunding sites like Kickstarter, are just enablers: they don’t hold the capital, but instead connect people with money to people in need of funds. Without the burden of capital requirements or regulation, these marketplace businesses are quick to set up, cost-efficient, and more agile than traditional financial institutions. In this regard companies such as Crowd Valley have been making pioneering strides in providing infrastructure for digital automated marketplaces.

This environment is complemented by a significant change in the demographic composition as well, which is the true catalyst for innovation: as the “Boomer” generation moves into retirement, a new generation of investors, financial advisors, portfolio managers and clients are taking responsibility for a larger and larger share of assets. These individuals are more tech-savvy and, in many cases, conduct business primarily through digital channels, including mobile, with less emphasis on face-to-face contact. Have a look at two following graphs. The graphs by Forrester Research outline the media for stock transactions with the second graph providing clear insight on future trends.

With an increasing number of individuals transacting online as well as valuing the advice received digitally as equal to in-person advice, a number of redundancies in the current system are highlighted. In figure discussed at the start of the article, we saw how the current investment management space is split between a number of different human components, each carrying its own probability of error and inefficiency in conducting operations as well as providing advice. It is a stern reminder that we are human and that digitized automation powered by algorithms and big data analytics offer that efficiency & personalized experience human beings are unable to do so anymore. This inefficiency brought by the human component has contributed to higher costs associated with financial services and has thus kept a majority of the population out of the ability to invest and diversify in scale but technology has finally reached that stage that where it not only can step in and provide cost saving to incumbents and challengers alike but also make synergies between different digital businesses possible, thus opening doors to more investors and new investing options than ever before.

Since millennials hold just $1 trillion in wealth, with just $250 billion invested (and hold the bulk of the $1.2 trillion in US student debt), traditional wealth managers contend over high-net-worth baby boomers. This represents a huge opportunity to target younger HENRYs—high earners not rich yet. Millennial investors have shown a strong preference toward passive investing. Having lived through two crashes and a steady upward creep in asset prices in the recent environment, millennials don’t believe in beating the market. These millennial investors are tech savvy and conscious about fees. Thus, a major theme of Fintech innovation in the asset management space has been the automated buying and selling with fees charged on an annual basis rather than for each transaction. Further, millennial investors tend to favor ETFs over mutual funds, due to intraday liquidity and lower minimums. ETFs have become popular with boomers as well, having recently surpassed $3 trillion in market cap as an asset class. And millennials — the next generation of affluent investors — are particularly likely to prize fully digital interactions and to trust system-generated advice.

Changing role of Asset Managers.

With an inclusion of digitized user experiences & robo-advisors that provide advice based on real time data analysis, there is increased pressure on the current players to augment and enhance their present offering in the presence of more effective options. As a role, financial advisors and agents in this space could converge to a more client interfacing role-investment counselors and less of an analytical/research based advisory role.

Digital disruptors’ offers will lead investors to ask: if money can be managed this cheaply, am I getting the maximum value from my financial advisor? As acceptance of automated solutions grows, advisors must refocus on helping investors identify their values and goals, structure a diversified, long-term plan, and then stick with it. Clients will increasingly judge their advisors based on how comfortable they make the client feel, especially in difficult markets.

Domino effect of challengers.

Challengers have essentially issued a warning call to the established asset management space and human managers by entering the market with higher profitability/yield statistics and facilitating increased access scale and diversification. They also inject new aspects such as transparency in investing strategy, ability to play an active part in the investment lifecycle and receive personalized investment strategy based on automated/real time data analytics. As do-it-yourself and low-cost options multiply, investors will continue to demand more customized, outcome-based investment solutions in return for the price they pay. This will involve multiple asset classes and will require asset managers to acquire more data and use more technology in areas including risk and performance analysis, modeling and development of custom benchmarks. Once investors realize that a managed account can be manufactured for a fraction of what they’ve been paying, incumbent players will no longer be able to maintain their wealth management fees, which typically exceed 1%. Disruptors themselves are likely to be forced to cut prices as more firms adopt their approach.

The next move.

Active investment management is becoming an increasingly tough sell. Demand for index mutual funds and ETFs is accelerating. Digital investment managers use them as building blocks, and digital financial advice platforms tout them as effective alternatives to pricier fund options. As these digital disruptors gain momentum, they’ll contribute to the decline of active investment management. Even those investors who stick with active management could question the conventional wisdom about where investment talent resides, as social investing sites expose exceptionally talented individual investors. Advisors may create the stickiness, but the digital experience and the technology become the enabler to provide an omni-channel experience with the right amount of professional support. This can have a large impact on the economics of the industry as technology can reduce the friction causing high attrition rates and putting the market share of incumbents at risk.

The need of the hour is to embrace Fintech disruption in a complete or hybrid manner. To optimize the potential of digital technologies, asset management firms should concentrate on end-to-end solutions that streamline and automate as many processes as possible. Asset management firms struggle to find solutions that integrate processes from the front office all the way to the back office, so they have tended to build proprietary, customized systems. These systems worked well enough in a less complex environment, but now firms must address multiple demands including new regulatory requirements, new products and asset classes, better risk management and changing customer expectations. They must also keep costs in line with flattened fees. To do so, incumbents must look to foster partnerships with financial technology firms to provide the infrastructure and interfaces their clients demand. With cloud and API based technology, these firms are able to efficiently deliver these value additions to the existing asset management model at lower expenses than in-house development & operations.

The path for entry into this market for challengers is essentially the same. Cloud-based service providers have helped lower barriers to entry across many industries by reducing operational costs and seed capital needed to start a business. Those who are ready to embrace the Fintech disruption could go a step further and become first-movers in incorporating broader and multi-source data sets and forming a more holistic view of the customers. Innovative business models, such as marketplaces and investor networks, are changing the way investments are made.

There is a need to disrupt oneself or run the risk of disruptors doing it for you. Customer-obsessed incumbent Vanguard is willing to undercut its own offerings: as digital investment managers like Wealthfront gain momentum with diversified portfolios built largely with Vanguard ETFs, Vanguard is rolling out Vanguard Personal Advisor Services, which offers a managed account plus access to an advisor for an annual fee of 0.30% of assets under management — a price in range of the digital investment managers, and less than half that of an existing Vanguard service with the same features.

A recent PWC survey quoted an asset manager “The organization is not quite sure what to make of Fintech yet.” On the other hand, Fintechs and challengers have evaluate their potential impact for the AWM space extensively and would be looking to either collaborate or disrupt the current ecosystem, which shows increasing amount of assets under management as technology enables greater access and democratization. Crowd Valley’s infrastructure can support both challengers and incumbents embrace the capabilities of financial technology to provide quality digital user interfaces that are robust and accommodate a range of asset and wealth management functions. Feel free to evaluate our offering at www.crowdvalley.com and drop us a message.

Sources:

Fintech Analyst Report Part 3: Asset Management (Pitchbook)

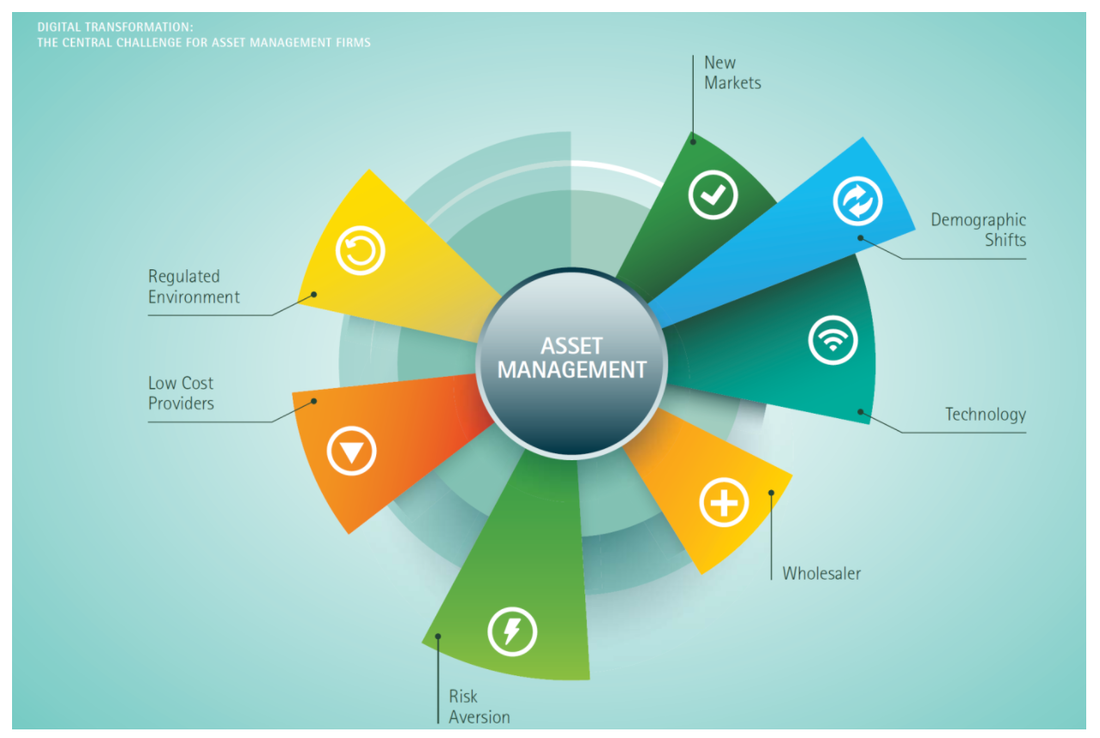

Digital Transformation: The Central Challenge for Asset Management Firms (Accenture)

Digital Disruption Threatens Wealth And Asset Management (Forrester Research)

Digital disruption in Asset and Wealth Management (Capgemini Consulting)

Beyond automated advice: How Fintech is shaping asset & wealth management (PWC)

Since millennials hold just $1 trillion in wealth, with just $250 billion invested (and hold the bulk of the $1.2 trillion in US student debt), traditional wealth managers contend over high-net-worth baby boomers. This represents a huge opportunity to target younger HENRYs—high earners not rich yet. Millennial investors have shown a strong preference toward passive investing. Having lived through two crashes and a steady upward creep in asset prices in the recent environment, millennials don’t believe in beating the market. These millennial investors are tech savvy and conscious about fees. Thus, a major theme of Fintech innovation in the asset management space has been the automated buying and selling with fees charged on an annual basis rather than for each transaction. Further, millennial investors tend to favor ETFs over mutual funds, due to intraday liquidity and lower minimums. ETFs have become popular with boomers as well, having recently surpassed $3 trillion in market cap as an asset class. And millennials — the next generation of affluent investors — are particularly likely to prize fully digital interactions and to trust system-generated advice.

Changing role of Asset Managers.

With an inclusion of digitized user experiences & robo-advisors that provide advice based on real time data analysis, there is increased pressure on the current players to augment and enhance their present offering in the presence of more effective options. As a role, financial advisors and agents in this space could converge to a more client interfacing role-investment counselors and less of an analytical/research based advisory role.

Digital disruptors’ offers will lead investors to ask: if money can be managed this cheaply, am I getting the maximum value from my financial advisor? As acceptance of automated solutions grows, advisors must refocus on helping investors identify their values and goals, structure a diversified, long-term plan, and then stick with it. Clients will increasingly judge their advisors based on how comfortable they make the client feel, especially in difficult markets.

Domino effect of challengers.

Challengers have essentially issued a warning call to the established asset management space and human managers by entering the market with higher profitability/yield statistics and facilitating increased access scale and diversification. They also inject new aspects such as transparency in investing strategy, ability to play an active part in the investment lifecycle and receive personalized investment strategy based on automated/real time data analytics. As do-it-yourself and low-cost options multiply, investors will continue to demand more customized, outcome-based investment solutions in return for the price they pay. This will involve multiple asset classes and will require asset managers to acquire more data and use more technology in areas including risk and performance analysis, modeling and development of custom benchmarks. Once investors realize that a managed account can be manufactured for a fraction of what they’ve been paying, incumbent players will no longer be able to maintain their wealth management fees, which typically exceed 1%. Disruptors themselves are likely to be forced to cut prices as more firms adopt their approach.

The next move.

Active investment management is becoming an increasingly tough sell. Demand for index mutual funds and ETFs is accelerating. Digital investment managers use them as building blocks, and digital financial advice platforms tout them as effective alternatives to pricier fund options. As these digital disruptors gain momentum, they’ll contribute to the decline of active investment management. Even those investors who stick with active management could question the conventional wisdom about where investment talent resides, as social investing sites expose exceptionally talented individual investors. Advisors may create the stickiness, but the digital experience and the technology become the enabler to provide an omni-channel experience with the right amount of professional support. This can have a large impact on the economics of the industry as technology can reduce the friction causing high attrition rates and putting the market share of incumbents at risk.

The need of the hour is to embrace Fintech disruption in a complete or hybrid manner. To optimize the potential of digital technologies, asset management firms should concentrate on end-to-end solutions that streamline and automate as many processes as possible. Asset management firms struggle to find solutions that integrate processes from the front office all the way to the back office, so they have tended to build proprietary, customized systems. These systems worked well enough in a less complex environment, but now firms must address multiple demands including new regulatory requirements, new products and asset classes, better risk management and changing customer expectations. They must also keep costs in line with flattened fees. To do so, incumbents must look to foster partnerships with financial technology firms to provide the infrastructure and interfaces their clients demand. With cloud and API based technology, these firms are able to efficiently deliver these value additions to the existing asset management model at lower expenses than in-house development & operations.

The path for entry into this market for challengers is essentially the same. Cloud-based service providers have helped lower barriers to entry across many industries by reducing operational costs and seed capital needed to start a business. Those who are ready to embrace the Fintech disruption could go a step further and become first-movers in incorporating broader and multi-source data sets and forming a more holistic view of the customers. Innovative business models, such as marketplaces and investor networks, are changing the way investments are made.

There is a need to disrupt oneself or run the risk of disruptors doing it for you. Customer-obsessed incumbent Vanguard is willing to undercut its own offerings: as digital investment managers like Wealthfront gain momentum with diversified portfolios built largely with Vanguard ETFs, Vanguard is rolling out Vanguard Personal Advisor Services, which offers a managed account plus access to an advisor for an annual fee of 0.30% of assets under management — a price in range of the digital investment managers, and less than half that of an existing Vanguard service with the same features.

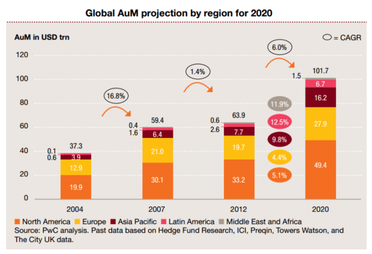

A recent PWC survey quoted an asset manager “The organization is not quite sure what to make of Fintech yet.” On the other hand, Fintechs and challengers have evaluate their potential impact for the AWM space extensively and would be looking to either collaborate or disrupt the current ecosystem, which shows increasing amount of assets under management as technology enables greater access and democratization. Crowd Valley’s infrastructure can support both challengers and incumbents embrace the capabilities of financial technology to provide quality digital user interfaces that are robust and accommodate a range of asset and wealth management functions. Feel free to evaluate our offering at www.crowdvalley.com and drop us a message.

Sources:

Fintech Analyst Report Part 3: Asset Management (Pitchbook)

Digital Transformation: The Central Challenge for Asset Management Firms (Accenture)

Digital Disruption Threatens Wealth And Asset Management (Forrester Research)

Digital disruption in Asset and Wealth Management (Capgemini Consulting)

Beyond automated advice: How Fintech is shaping asset & wealth management (PWC)

About the Author: Adit Vaddi

Adit Vaddi is a business development associate with a Bachelor of Arts in Economics from Vassar College, New York. He has a background in Economics, Accounting, Political Science and Operations (Event Management). He is from Hyderabad, India. Prior to Crowd Valley, Adit has worked as a research analyst for Baring's Private Equity Partners in Mumbai and for the IdeaSpace Foundation in Manila as well as a risk analyst for Fincare in Bangalore. On the operations side, Adit has organized and run over 30 large scale events that cater primarily to a college community. He is currently based in New York City.

Adit Vaddi is a business development associate with a Bachelor of Arts in Economics from Vassar College, New York. He has a background in Economics, Accounting, Political Science and Operations (Event Management). He is from Hyderabad, India. Prior to Crowd Valley, Adit has worked as a research analyst for Baring's Private Equity Partners in Mumbai and for the IdeaSpace Foundation in Manila as well as a risk analyst for Fincare in Bangalore. On the operations side, Adit has organized and run over 30 large scale events that cater primarily to a college community. He is currently based in New York City.

RSS Feed

RSS Feed