Recently, it is not rare to read about the so called “crowdfunding fatigue”, which indicates the feeling of some people, annoyed by too many requests for participating into crowdfunding campaigns. But does such a thing as crowdfunding fatigue actually exist?

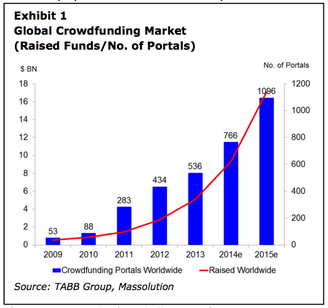

Considering that a three-percent return on common bonds is seen as high, there is no reason to doubt why individual investors are flooding to seven-percent return rates provided by mini-bonds. A rapidly growing number of well-established companies in the UK that are raising growth capital are looking to the public for sources of finance, and skipping the banks. Within a matter of a few weeks, companies have been able to borrow millions, at a rate much less than that offered by banks. However, due to the nature of the mini-bonds, many questions are starting to arise with this new ‘hot’ form of ‘easy’ financing. Is the high risk worth the high return? Is the individual investor protected enough?  Crowdfunding is quickly changing the way we are investing, but unfortunately, the online payment processing industry has been rather slow to update, causing roadblocks and mistrust for investors as well as for companies seeking financing. PayPal is paving the way to embracing crowdfunding as they adjust company policies.  A vast branch of the academic research focuses on gender differences in entrepreneurial initiatives and access to finance. Women have been identified as a large untapped pool of entrepreneurial talent. In fact, worldwide, the number of female entrepreneurs is considerably lower than men. Just by looking at the UK, for example, the number of women-owned businesses is only 15%, while 35% is co-owned by men and women. Doing the math, the remaining 50% is owned by men.  Throughout the past fourteen years I've handled PR launches for countless products, services and companies. Eventually I sat in the position of being an entrepreneur myself. When Grow VC launched in 2008, the founders (of which I was lucky to be a member) had a great idea and even greater ambition, and the group has flourished in the six years since. This short article will cover some of the PR challenges and opportunities we faced with that launch. Every startup is different; however, every launch shares some basic elements. This common ground can provide fruitful learning opportunities, as we can all draw insights from shared experiences. I'll go through the following in order: Press Relationships; Importance of Timing; Key Messaging and Taglines; Keeping Communications Appropriate; Growth After Launch.  Almost five months have passed since the beginning of the year and it is quite natural to ask: how is the market evolving this year? A recent report published by research firm, TABB Group shows that the hockey stick growth of the global crowdfunding market continues, with the number of online platforms multiplying and the amount of raised funds growing at fast pace.  Since the early days of crowd investing, which for us mean 2008 and 2009, we have seen the need for a connected ecosystem, rather than isolated silos. This is today more true than ever, and the crowd investing market has developed to included many different dimensions to consider.  Having a global vantage point and developed operations in this market for several years now, we’ve been paying attention to several developments. One of those, has been the evolution of crowd investing applications to more professional investor audiences and sophisticated systems.  In October 2013, Crowd Valley published the first Crowdfunding Market Report, which translated the company's overview on the international crowdfunding market into facts and figures presented at UC Berkeley. Since then, a few important milestones have been achieved by the crowdfunding industry.  Intrapreneurship is a hot topic among big corporations. Many large firms are trying to encourage an entrepreneurial attitude among their employees, in order to foster innovation. Crowdfunding is also another hot trend at the moment. The market is growing fast, touching every day upon different sectors and applications, as also Crowd Valley has been observing in the last 12 months. Now, imagine if the the two phenomena would merge. What the result would be? A neologism and a new crowdfunding application: intra-crowdfunding or enterprise crowdfunding. |

Categories

All

|

RSS Feed

RSS Feed