On February 16, 2016, the SEC’s Office of Investor Education and Advocacy issued an Investor Bulletin to educate investors about the opportunities that will arise for investors through securities-based crowdfunding (also known as equity crowdfunding, and digital investing), when the new rules will be enacted on May 16, 2016. Starting from that date, registered platforms will be able to offer securities under Title III of the JOBS Act, and companies to use crowdfunding to offer and sell securities to the investing public.

We return to discuss US crowdfunding rules, after we covered it extensively in this article by Crowd Valley’s legal counsel, when the SEC adopted the final rules and forms on October 30, 2015, implementing the new Section 4(a)(6) of the Securities Act of 1933, as amended (the “Securities Act”), allowing issuers to sell securities to the public under certain circumstances without registering such securities with the SEC.

The original investor bulletin published by the SEC, is a thorough document explaining what these new rules will mean for small investors. We try to summarize the main points below:

Who can make a crowdfunding investment?

Virtually anyone can do that, but since of the risks involved by investing in startups and in early stage companies, there is a transaction limit which depends on your net worth and annual income.

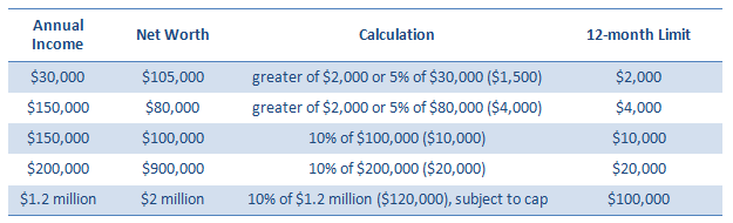

- If either your net worth or your annual income is < than $100,000, then you can invest, in any 12 month period, up to the greater of either $2,000 or 5% of the lesser of your annual income or net worth.

- If both your annual income and your net worth are = or > than $100,000, then you can invest, in any 12 month period, up to 10% of annual income or net worth, whichever is lesser. In any case you can’t exceed $100,000 invested per year.

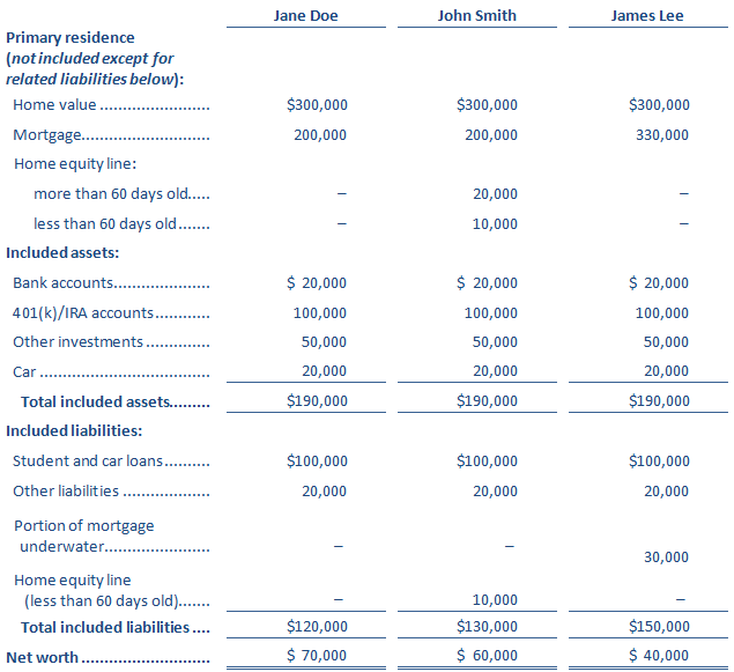

In order to calculate your net worth you should add all your assets and subtract all your liabilities. If you calculate your income or assets jointly with your spouse, each of your investments together cannot exceed the limit that would apply to an individual investor. For this purpose, the value of your residence is not included in the calculation. More information about this, in particular about what to do with mortgages, are well explained in the original investor bulletin.

Few examples of net worth calculations, in order to determine crowdfunding investment limits, are showed in the following table:

Few examples of net worth calculations, in order to determine crowdfunding investment limits, are showed in the following table:

In practice, how can you make a crowdfunding investment?

You can invest in a crowdfunding offering through the online platform of a broker-dealer or a funding portal, that should be registered with the SEC and be a member of the Financial Industry Regulatory Authority (FINRA).

You will have to open an account with the crowdfunding intermediary — the broker-dealer or funding portal — in order to make an investment.

Is it risky to invest in early stage ventures? Which are the main risks?

It’s a big opportunity to invest early on in a promising startup, but you should always do your own research about any opportunity and there are various different risks that you have to consider

- It’s a speculative investment, and you you should be able to afford to lose your entire investment.

- It’s an illiquid investment, as you will be limited in your ability to resell your investment for the first year. You may have to locate an interested buyer in order to resell your crowdfunded investment.

- There are cancellation restrictions, but you have up to 48 hours prior to the end of the offer period to cancel your investment commitment for any reason.

- The valuation of private companies, is particularly difficult, and there is the the risk to overpay the % of equity that you receive.

- A part of of your investment may be used as compensation of the company’s employees, including its management. You should review any disclosure regarding the company’s use of proceeds.

- As it happens with other investments, there is no guarantee that crowdfunding investments will be immune from fraud.

- No early-stage investors, as for example angel investors and venture capital firms, can translate in lack of professional guidance.

- The required financial disclosure is limited compared to public listed companies.

- $100,000 or less — financial statements and specific line items from income tax returns (certified by the principal executive officer of the company).

- $100,000.01 to $500,000 — financial statements reviewed by an independent public accountant and the accountant’s review report.

- $500,000.01 to $1 million — if first time crowdfunding, then financial statements reviewed by an independent public accountant and the accountant’s review report, otherwise financial statements audited by an independent public accountant and the accountant’s audit report.

What are the main difference between a crowdfunding investor and a shareholder in public listed company?

1. The main two differences are: the limited disclosure required for a private company compared to publicly listed company, that is generally required to disclose information about their performances at least on a quarterly basis (while crowdfunding companies are required to disclose annually their results of operations and financial statements). To help in that sense, and provide greater disclosure, all the persons representing the company must identify themselves. In addition, Broker-dealers and funding portals are required to have communication channels transparent to the public on their crowdfunding platforms. In this way the investors can discuss about the pros and cons of an investment opportunity, and ask questions directly to the management of the company that is raising money on the platform.

2. The second main difference is the illiquidity of the shares you buy. As explained before, you cannot resell your shares for the first year, unless the shares are transferred:

- to the company that issued the securities;

- to an accredited investor;

- to a family member;

- in connection with your death or divorce or other similar circumstance;

- to a trust controlled by you or a trust created for the benefit of a family member;

- as part of an offering registered with the SEC.

For more information you can check the original investor bulletin available on the SEC website at: https://www.sec.gov/oiea/investor-alerts-bulletins/ib_crowdfunding-.html

Image credit: the computer Icon has been created by Wilson Joseph from Noun Project.

About the author - Alessandro Ravanetti

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

Alessandro is Co-founder & CMO of Crowd Valley. He has worked in the fintech industry, with marketplace investing and lending, since 2011. Has built and managed digital companies with distributed teams and international partners, and gained experience with both startups and large corporations, having worked with British Telecom, Bloomberg and the Grow VC Group.

Alessandro grew up in Italy, where he graduated with a B.A. in Economics at University of Parma, before to obtain a M.S. in Finance at Regent’s University London. He studied and worked in many different cities, including Munich, Geneva, London, Barcelona and Valencia. Genuinely passionate about financial technology and innovation, he loves to spend his spare time traveling and discovering new cultures. You can find him on Twitter at @aleravanetti.

RSS Feed

RSS Feed